Zen Technologies Ltd is an Indian company that specializes in providing defense training and simulation solutions. On this page, you will find Zen Technologies Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Zen Pharma Share Price Today, Zen Technologies share price target Tomorrow, Zen Technologies share price Target 2040, Zen Technologies Latest News, Zen Technologies Share Price target 2025 moneycontrol, and more Information.

Zen Technologies Ltd Company Details

Zen Technologies Ltd is an Indian company that specializes in providing defense training and simulation solutions. Founded in 1993, the company designs, develops, and manufactures a wide range of high-tech training equipment for military, law enforcement, and other security organizations.

With a strong focus on innovation, Zen Technologies aims to enhance the effectiveness and efficiency of defense forces through its advanced simulators and training systems. The company’s commitment to quality and customer satisfaction has helped it establish a solid reputation in the defense industry, both in India and internationally.

| Official Website | zentechnologies.com |

| Founded | 1993 |

| Headquarters | Hyderabad |

| Number of employees | 342 (2024) |

| Category | Share Price |

Current Market Overview Of Zen Technologies Share Price

- Open: INR 1,799.00

- High: INR 1,799.00

- Low: INR 1,734.15

- Market Cap: INR 14.53K Cr

- P/E Ratio: 91.91

- Dividend Yield: 0.058%

- 52-Week High: INR 1,970.00

- 52-Week Low: INR 650.00

- Current Price: INR 1,734.15

Zen Technologies Share Price Recent Graph

Read Also:- HCC Share Price Target 2024, 2025, 2026 To 2030 Prediction

Zen Technologies Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Zen Technologies for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Zen Technologies Share Price Target Years | SHARE PRICE TARGET |

| 1 | Zen Technologies Share Price Target 2024 | ₹1960 |

| 2 | Zen Technologies Share Price Target 2025 | ₹2645 |

| 3 | Zen Technologies Share Price Target 2026 | ₹3270 |

| 4 | Zen Technologies Share Price Target 2027 | ₹3890 |

| 5 | Zen Technologies Share Price Target 2028 | ₹4450 |

| 6 | Zen Technologies Share Price Target 2029 | ₹5015 |

| 7 | Zen Technologies Share Price Target 2030 | ₹6140 |

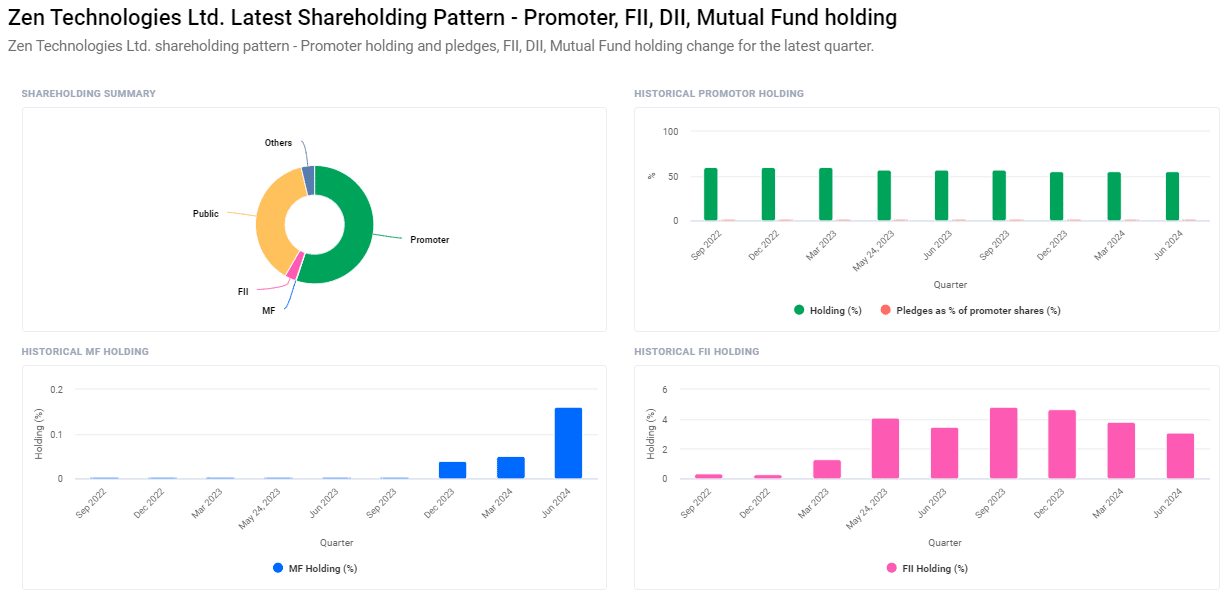

Shareholding Pattern For Zen Technologies Share Price

- Promoters: 55.07%

- Retail and Others: 38.47%

- Other Domestic Institutions: 3.21%

- Foreign Institutions: 3.08%

- Mutual Funds: 0.16%

Zen Technologies Ltd Financials 2023

| Revenue | 2.19 Billion INR | ⬆ 213.75% YOY |

| Operating expense | 860.56 Million INR | ⬆ 62.89% YOY |

| Net Income | 427.38 Million INR | ⬆ 2,052.94% YOY |

| Net Profit Margin | 19.53 | ⬆ 585.26% YOY |

| Earnings Per Share |

|

|

| EBITDA | 720.84 Million INR | ⬆ 1,509.66% YOY |

| Effective Tax Rate | 30.34% |

|

| Total Assets | 4.74 Billion INR | ⬆ 28.39% YOY |

| Total Liabilities | 1.43 Billion INR | ⬆ 81.40% YOY |

| Total Equity | 3.30 Billion INR |

|

| Return on assets | 9.87% | |

| Return on Capital | 12.96% | |

| P/E Ratio | 76.28 | |

| Dividend Yield | 0.019% |

Read Also:- Balrampur Chini Share Price Target 2024, 2025 To 2030 Prediction

Risks and Challenges For Zen Technologies Share Price

-

Market Competition: Zen Technologies operates in a highly competitive market. With many other companies offering similar defense training and simulation solutions, standing out and capturing market share can be challenging.

- Dependence on Government Contracts: Much of Zen Technologies’ business comes from government contracts. Any changes in government policies, budget cuts, or delays in contract approvals can directly impact the company’s revenue and share price.

- Technological Advancements: The defense sector constantly evolves with new technologies. Zen Technologies needs to invest in research and development to stay ahead. Failure to innovate could result in the company losing its competitive edge.

- Economic Uncertainty: Fluctuations in the global and domestic economy can impact defense budgets and spending. Economic downturns may reduce defense budgets, affecting Zen Technologies’ sales and profitability.

-

Regulatory Risks: Changes in regulations, both domestically and internationally, can pose risks. Compliance with various defense and security regulations is essential, and any non-compliance could lead to fines, penalties, or loss of contracts.

Major Factors Affecting Zen Technologies Share Price Share Price

-

Government Contracts: Zen Technologies relies heavily on contracts from government agencies, particularly in the defense sector. The company’s share price is significantly impacted by the volume and value of these contracts. Winning new contracts or renewing existing ones can boost the share price, while losing them could have the opposite effect.

- Technological Innovations: The ability of Zen Technologies to innovate and introduce new products plays a crucial role in its market positioning. Cutting-edge solutions in defense training and simulation attract more clients and drive revenue growth, positively influencing the share price.

- Economic Conditions: The overall economic environment, both in India and globally, affects defense budgets. Economic downturns or reduced defense spending can lead to lower demand for Zen Technologies’ products, which may result in a decline in share price.

- Competition in the Industry: Other companies offering similar defense solutions create a competitive landscape. If competitors introduce superior technology or more cost-effective solutions, Zen Technologies might face challenges in maintaining its market share, potentially affecting its share price.

-

Global Security and Defense Needs: Changes in global security dynamics, such as increased defense spending due to rising geopolitical tensions, can positively impact Zen Technologies. Higher demand for defense solutions in such scenarios can lead to increased sales and a boost in the company’s share price.

Read Also:-

- Swaraj Engines Share Price Target

- Radico Khaitan Share Price Target

- Bajaj Auto Share Price Target

- Igarashi Motors Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.