Hello friends, Do you want to know about the future value of Waaree Renewable share price target? So you have come to the right page. Waaree Renewable Share Price on NSE as of 3 September 2024 is 1,492.90 INR. On this page, you will find Waaree Renewable Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Waaree solar share price chart, Waaree solar share price NSE today, Waaree solar share price today, Waaree Renewables share price target tomorrow, Waaree Renewables share price target 2030, and more Information.

Waaree Renewable Technologies Ltd Company Details

Waaree Renewable Technologies Ltd is an Indian company specializing in the renewable energy sector. Based in Mumbai, it focuses on providing sustainable energy solutions, particularly through the manufacture and supply of solar panels and related technologies. Waaree Renewable Technologies aims to contribute to the growing demand for clean energy by offering innovative and efficient solar solutions for residential, commercial, and industrial applications. With a commitment to environmental sustainability, the company plays a key role in advancing India’s renewable energy landscape.

| Official Website | waareertl.com |

| Headquarters | India |

| Number of employees | 192 (2024) |

| Parent organization | Waaree Energies Limited |

| Category | Share Price |

Current Market Overview Of Waaree Renewables Share Price

- Open Price: INR 1,529.85

- High Price: INR 1,534.80

- Low Price: INR 1,484.55

- Current Price: INR 1,492.90

- Market Capitalization: INR 15.99K Crore

- P/E Ratio: N/A

- Dividend Yield: N/A

- 52-Week High: INR 3,037.75

- 52-Week Low: INR 227.20

Waaree Renewables Share Price Recent Graph

Read Also:- Anant Raj Share Price Target 2024, 2025 to 2030 and More Details

Waaree Renewables Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of Waaree Renewables for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Waaree Renewables Share Price Target Years | SHARE PRICE TARGET |

| 1 | Waaree Renewables Share Price Target 2024 | ₹2131 |

| 2 | Waaree Renewables Share Price Target 2025 | ₹3449 |

| 3 | Waaree Renewables Share Price Target 2026 | ₹4644 |

| 4 | Waaree Renewables Share Price Target 2027 | ₹5808 |

| 5 | Waaree Renewables Share Price Target 2028 | ₹7085 |

| 6 | Waaree Renewables Share Price Target 2029 | ₹8290 |

| 7 | Waaree Renewables Share Price Target 2030 | ₹9495 |

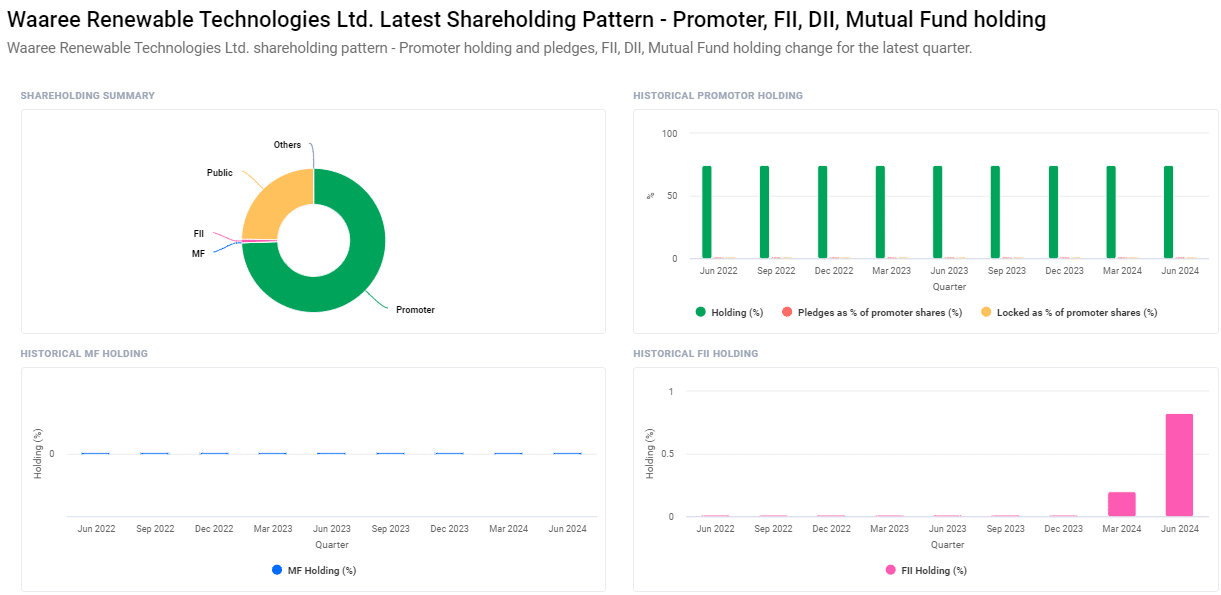

Shareholding Pattern For Waaree Renewables

- Promoters: 74.46%

- Retail and Others: 24.70%

- Foreign Institutions (FII/FPI): 0.83%

- Other Domestic Institutions: 0.01%

Risks and Challenges to Waaree Renewables Share Price

-

Market Fluctuations: Waaree Renewables’ share price can be affected by fluctuations in the renewable energy market, which are often influenced by changes in government policies, technological advancements, and market demand.

- Regulatory Changes: As the renewable energy sector is heavily regulated, any changes in government policies or incentives related to solar energy can impact Waaree’s business operations and, consequently, its share price.

- Raw Material Costs: The cost of raw materials, such as silicon for solar panels, can fluctuate due to market conditions. Increases in these costs can affect the company’s profit margins and impact its share price.

- Technological Advancements: Rapid changes in technology and innovation in the renewable energy sector can pose a risk if Waaree does not keep up with the latest developments, potentially affecting its competitive position and share price.

- Economic Conditions: Economic downturns or slowdowns can reduce investment in renewable energy projects, affecting Waaree Renewables’ revenue and share price. Economic instability can also impact consumer and business spending on renewable energy solutions.

-

Competition: Intense competition in the renewable energy sector, both from established players and new entrants, can impact Waaree Renewables’ market share and profitability, which may lead to fluctuations in its share price.

Read Also:-

- Shree Renuka Sugars Share Price Target

- Olectra Greentech Share Price Target

- Aarti Drugs Share Price Target

- Integra Essentia Ltd. Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.