VST Industries is a properly – established Indian organization engaged in the manufacture and sale of cigarettes and amazing tobacco products. With its headquarters in Hyderabad, VST Industries has been a large player within the tobacco organization for a long time. The enterprise employer is understood to generate well-known producers like Charms, Total, and Editions, which have a sturdy marketplace presence. The regular call for its products, mixed with its robust monetary basis, makes VST Industries an exciting opportunity for investors.

VST Industries Share Price Performance Overview

As of the extreme – modern factories are shopping for and selling at 380.20, reflecting a 17.53 % boom during the last year. The company’s stock has confined regular increase over time, with a 52-week excessive of 486.15 and 52 52-week low of 287.18. The VST industry’s Share price volatility indicates the resilience of the economics agency and the effect of outdoor market conditions.

- Open: 391.60

- High: 392.95

- Low: 397.35

- Current Share Price: 348.90

- P / E Ratio: 8.00

- Dividend Yield: 3.59 %

- 52 Week High: 486.15

- 52 Week Low: 287.18

VST Industries Share Price Current Graph

VST Industries Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 514 |

| 2025 | 568 |

| 2026 | 624 |

| 2027 | 686 |

| 2028 | 745 |

| 2029 | 802 |

| 2030 | 865 |

Shareholding Pattern For VST Industries Share Price

- Promotors: 32.16 %

- Foreign Institutional: 1.95 %

- Mutual Funds: 7.79 %

- Other Domestic Institutions 1.61 %

- Retail and other: 56.50 %

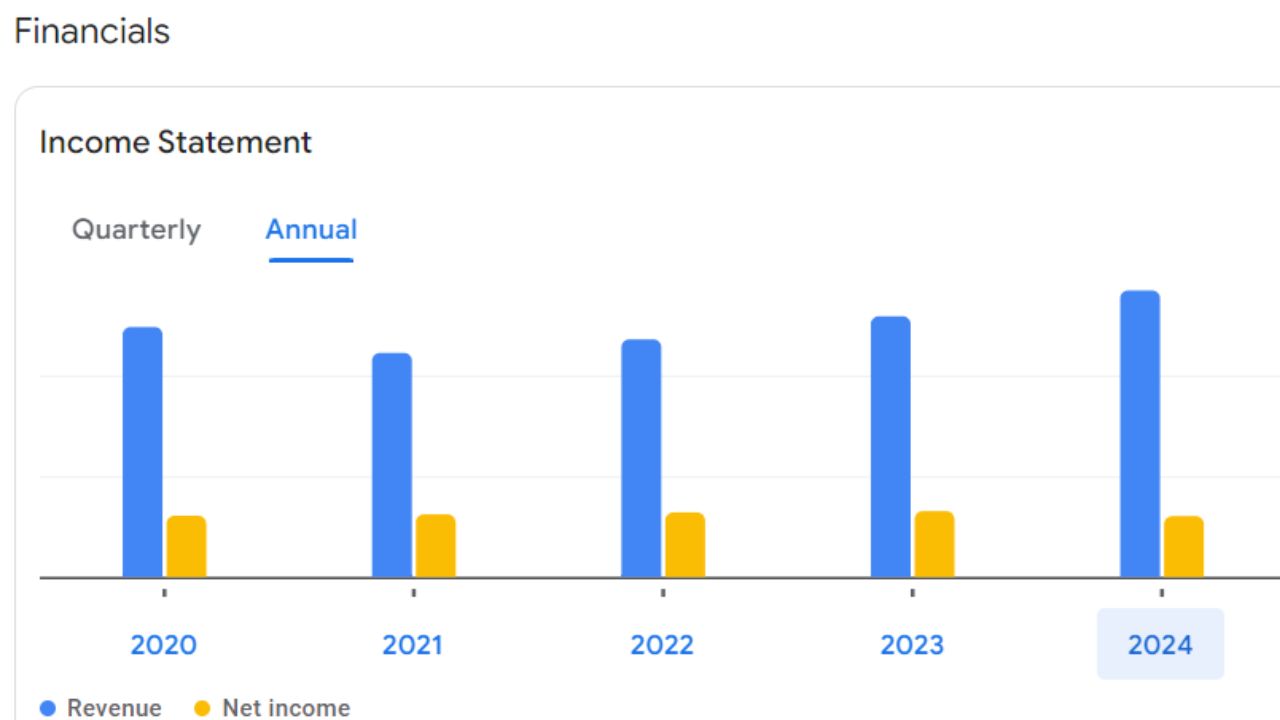

VST Industries Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 3.21 B | -3.59 % |

| Operating Expenses | 899.30 M | +18.03 % |

| Net Income | 353.80 M | -35.99 % |

| Net Profit Margin | 16.67 | -33.61 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 727.28 M | -30.62% |

| Effective Tax Rate | 25.87 % | N/A |

Factors Influencing VST Industries Share Price

- Technological Advancements: Technological Advancements: Broadcom’s reputation on innovation and its potential to increase modern-day semiconductor answers play a splendid characteristic in the usage of its percentage charge.

- Strategic Acquisitions : Broadcom;s facts of strategic acquisition have bolstered its product portfolio and market presence, contributing to sales increase.

- Market Demand : Demand for semiconductors in prevent markets which consists of factories, facilities, networking, and wireless conversation appreciably affects Broadcom;s economics well – known regular generic general overall performance.

- Global Economics Conditions : Economics health, alongside element factors which incorporate GDP boom, interest expenses, and client spending, need to have an effect on Broadcom;s fashionable not unusual performance.

- Competition : The semiconductor organization is pretty competitive, with several key gamers vying for marketplace percent. Broadcom’s aggressive positioning and capacity to innovate are vital.