Voltas is an Indian multinational company that specializes in air conditioning and engineering solutions. Voltas Share Price on NSE as of 9 September 2024 is 1,788.65 INR. On this page, you will find Voltas Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Voltas share price target tomorrow, Voltas share buy or sell, Voltas Share Price Target 2030, and more Information.

Voltas Ltd. Company Details

Voltas Ltd is an Indian multinational company that specializes in air conditioning and engineering solutions. It is part of the Tata Group, one of India’s largest and most trusted business conglomerates. Founded in 1954, Voltas is well known for manufacturing and selling air conditioners, refrigerators, and cooling appliances, making it a leader in the Indian home appliances market.

Apart from home products, Voltas also provides engineering services, such as designing and installing heating, ventilation, and air conditioning (HVAC) systems for large commercial buildings. With a strong reputation for quality and innovation, Voltas has become a popular choice among Indian consumers, contributing to its steady growth in the market.

| Official Website | voltas.com |

| CEO | Pradeep Bakshi (10 Feb 2018–) |

| Chairman | Noel Tata |

| Headquarters | Mumbai, Maharashtra, India |

| Number of employees | 1,938 (2024) |

| Parent organization | Tata Group |

| Category | Share Price |

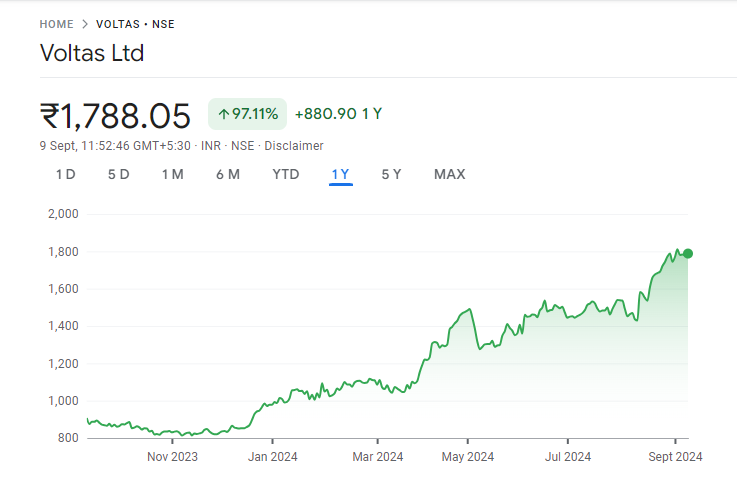

Current Market Overview Of Voltas Share Price

- Open Price: ₹1,786.00

- High Price: ₹1,799.80

- Low Price: ₹1,770.00

- Market Capitalization: ₹59.19K Crores

- P/E Ratio: 129.60

- Dividend Yield: 0.31%

- 52-Week High: ₹1,828.75

- 52-Week Low: ₹806.70

- Current Price: ₹1,788.65

Voltas Share Price Today Chart

Read Also:- Aadhar Housing Finance Share Price Target 2024, 2025, 2026 To 2030

Voltas Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Voltas for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Voltas Share Price Target Years | SHARE PRICE TARGET |

| 1 | Voltas Share Price Target 2024 | ₹1935 |

| 2 | Voltas Share Price Target 2025 | ₹2785 |

| 3 | Voltas Share Price Target 2026 | ₹3650 |

| 4 | Voltas Share Price Target 2027 | ₹4585 |

| 5 | Voltas Share Price Target 2028 | ₹5575 |

| 6 | Voltas Share Price Target 2029 | ₹6482 |

| 7 | Voltas Share Price Target 2030 | ₹7250 |

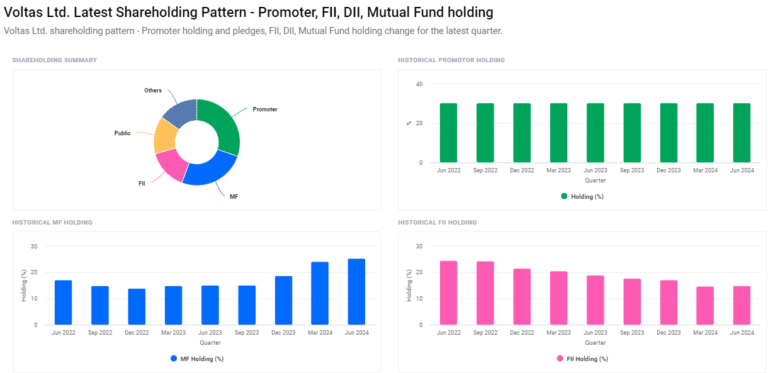

Voltas Ltd. Shareholding Pattern

- Promoters: 30.30% (Unchanged from the preceding location)

- Mutual Funds: 25.34% (Increased from 24.17%)

- Foreign Institutional Investors (FII/FPI): 15.08% (Increased from 14.71%)

- Other Domestic Institutions: 15.07%

- Retail and Others: 14.21%

Risks and Challenges to Voltas Share Price

Here are seven risks and challenges that could affect Voltas’ share price:

- Economic Slowdowns: A weak economy can lead to reduced consumer spending on non-essential goods like air conditioners and refrigerators. This could impact Voltas’ sales and, in turn, lower its share price.

- Rising Competition: The home appliances market is highly competitive, with both domestic and global brands competing for market share. Increased competition can pressure Voltas’ pricing and market position, potentially affecting its profitability and stock price.

- Raw Material Costs: If the prices of raw materials like metals or electronic components rise, Voltas may face higher production costs. If the company cannot pass these costs to consumers, its profit margins could shrink, leading to a possible decline in its share price.

- Seasonal Dependency: Voltas’ sales are often higher during the summer months when demand for cooling products increases. Poor weather or unexpected changes in seasonal patterns could impact sales, causing fluctuations in its financial performance and stock price.

- Supply Chain Disruptions: Delays or disruptions in the supply chain, whether due to global events or logistical issues, can affect Voltas’ ability to manufacture and deliver products on time. This could impact revenues and investor confidence, potentially lowering the share price.

- Foreign Exchange Fluctuations: Since Voltas operates internationally and sources some materials from abroad, changes in foreign exchange rates can affect its costs and profits. Currency fluctuations might reduce earnings, influencing the stock’s performance.

-

Regulatory and Policy Changes: Government regulations on energy efficiency, environmental standards, or taxes on imported goods can impact Voltas’ costs or product offerings. Adapting to such changes could increase expenses or reduce demand, which may negatively impact the company’s share price.

Read Also:-

- Mangalam Cement Share Price Target

- Nestle India Share Price Target

- GMR Power Share Price Target

- Axita Cotton Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.