Ujaas Energy Ltd is an Indian company focused on renewable energy solutions, particularly solar power. Ujaas Energy Share Price on NSE as of 24 September 2024 is 480.00 INR. On this page, you will find Ujaas Energy Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Ujaas Energy latest News, Ujaas Energy share price target tomorrow, Ujaas Energy share price target Motilal Oswal, Ujaas Energy share Price target 2030, and more Information.

Ujaas Energy Ltd Company Details

Ujaas Energy Ltd is an Indian company focused on renewable energy solutions, particularly solar power. Established to promote sustainable energy, Ujaas Energy designs develops, and operates solar power plants across the country. The company aims to contribute to India’s growing energy needs while minimizing environmental impact. With a commitment to innovation and efficiency, Ujaas Energy is playing a vital role in the transition towards cleaner energy sources. Its dedication to renewable energy makes it a key player in the Indian green energy sector.

| Official Website | ujaas.com |

| Headquarters | India |

| Number of employees | 85 (2024) |

| Subsidiary | Ujaas Energy HK Limited |

| Category | Share Price |

Ujaas Energy Share Price Today Chart

Current Market Overview Of Ujaas Energy Share Price

- Open Price: ₹480.00

- High Price: ₹480.00

- Low Price: ₹480.00

- Current Price: ₹480.00

- Mkt cap: ₹5.12KCr

- P/E ratio: 0.29

- Div yield: NA

- 52-wk high: ₹480.00

- 52-wk low: ₹20.68

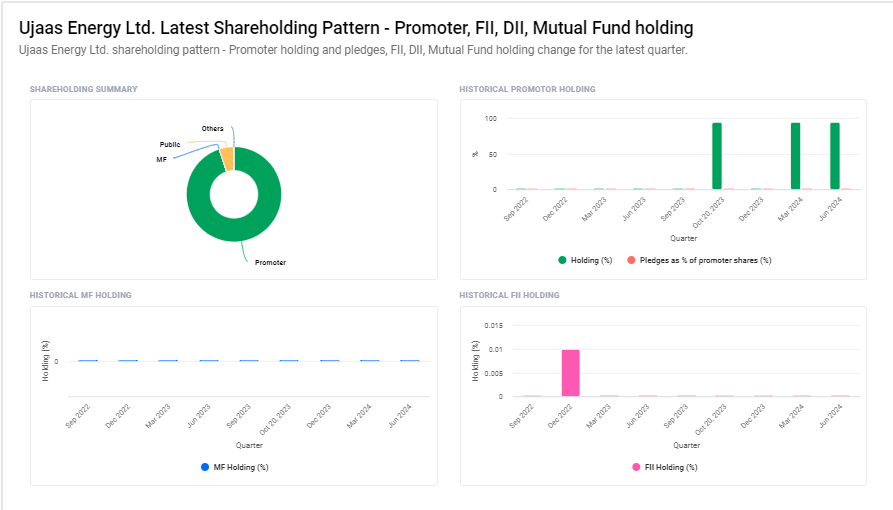

Ujaas Energy Ltd Shareholding Pattern

- Promoter: 95%

- Public: 5%

Ujaas Energy Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Ujaas Energy for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Ujaas Energy Share Price Target Years | Share Price Target |

| 1 | Ujaas Energy Share Price Target 2024 | ₹560 |

| 2 | Ujaas Energy Share Price Target 2025 | ₹657 |

| 3 | Ujaas Energy Share Price Target 2026 | ₹740 |

| 4 | Ujaas Energy Share Price Target 2027 | ₹810 |

| 5 | Ujaas Energy Share Price Target 2028 | ₹895 |

| 6 | Ujaas Energy Share Price Target 2029 | ₹982 |

| 7 | Ujaas Energy Share Price Target 2030 | ₹1054 |

Read Also:- Bharti Airtel Share Price Target 2024, 2025 To 2030 Prediction

Ujaas Energy Share Price Target 2024

| First Target Price | ₹510 |

| Second Target Price | ₹560 |

Ujaas Energy Share Price Target 2025

| First Target Price | ₹630 |

| Second Target Price | ₹657 |

Ujaas Energy Share Price Target 2030

| First Target Price | ₹1000 |

| Second Target Price | ₹1054 |

Key Factors Affecting Ujaas Energy Share Price Growth

Here are four key factors that can influence the growth of Ujaas Energy Ltd’s share price:

- Growth in Renewable Energy Demand: As the world shifts towards cleaner energy sources, the increasing demand for solar power can benefit Ujaas Energy. A higher demand for renewable energy solutions can lead to more projects and revenue, positively impacting the share price.

- Government Policies and Incentives: Supportive government policies and incentives for renewable energy can enhance Ujaas Energy’s business opportunities. Initiatives like subsidies or tax breaks for solar energy projects can encourage investment and growth, which in turn can boost the company’s share value.

- Technological Advancements: Innovations in solar technology can improve the efficiency and cost-effectiveness of Ujaas Energy’s projects. Adopting the latest technologies can enhance profitability, making the company more attractive to investors and contributing to share price growth.

-

Project Development Pipeline: The ability of Ujaas Energy to successfully execute and complete solar projects is crucial. A strong pipeline of upcoming projects can signal growth potential to investors, leading to increased confidence and a rise in share price.

Ujaas Energy Ltd Financials

| Market Capitalization Value | 3192.73 crores |

| Total Share Capital | 10.53 crores |

| Total Borrowings | 18.51 crores |

| Trade Payables | 0.93 crores |

| Trade Receivables | 26.71 crores |

| Total Inventories | 9.56 crores |

| Total Investments | 11.26 crores |

| Total Assets | 110.60 crores |

| Total Contingent liabilities | 4.04 crores |

| Total Revenue | 52.87 crores |

| Total Expenses | 44.78 crores |

| Asset Turnover ratio | 0.13 percent |

| Inventory Turnover ratio | 0.57 percent |

| Return on Equity | 32.48 percent |

| Return on Capital Employed | 20.71 percent |

| Price-to-earnings ratio | 27.20 percent |

| Price-to-Book Value ratio | 0.10 percent |

| Debt to Equity ratio | 0.21 percent |

| Earnings Yield ratio | 1.23 percent |

| Dividend Yield ratio | 0.01 percent |

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.