Tejas Networks Ltd is an Indian company that designs and manufactures telecommunications equipment. Tejas Networks Share Price on NSE as of 18 September 2024 is 1,220.00 INR. On this page, you will find Tejas Networks Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Tejas Networks News today, Why Tejas Networks share price today, Tejas Networks share price target long-term, Why Tejas Networks share falling today, Tejas networks share price target tomorrow, Tejas Networks Share Price target 2030, and more Information.

Tejas Networks Ltd Company Details

Tejas Networks Ltd is an Indian company that designs and manufactures telecommunications equipment. It provides high-performance networking products for telecommunications service providers, internet service providers, and government entities. The company specializes in optical and data networking solutions, helping build high-speed networks for broadband internet, mobile communication, and other critical infrastructure. With a focus on innovation and technology, Tejas Networks plays an important role in India’s digital transformation and expanding global connectivity.

| Official Website | tejasnetworks.com |

| Founded | 2000 |

| Headquarters |

Bangalore, Karnataka, India

|

| Founders | Sanjay Nayak, Kumar N. Sivarajan, Arnob Roy |

| Number of employees | 1,843 (2024) |

| Category | Share Price |

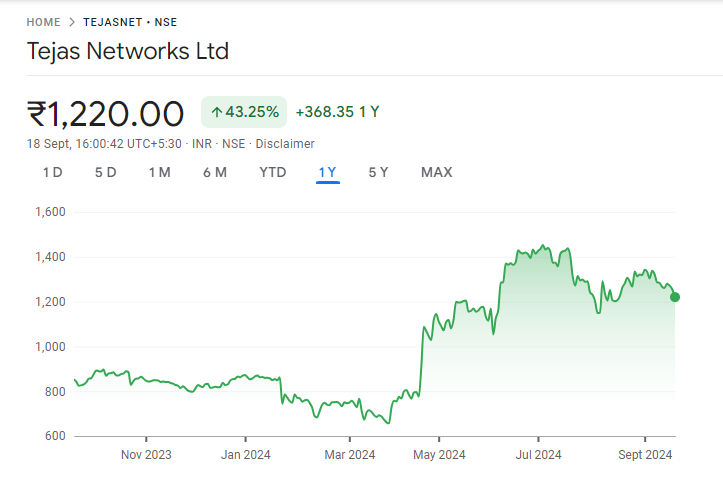

Current Market Overview of Tejas Networks Share Price

- Open Price: ₹1,250.45

- High Price: ₹1,262.95

- Low Price: ₹1,213.00

- Current Price: ₹

- Market Capitalization: ₹21.09K crore

- P/E Ratio: 133.77

- Div Yield: NA

- 52-Week High: ₹1,495.00

- 52-Week Low: ₹651.25

Tejas Networks Share Price Today Chart

Tejas Networks Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Tejas Networks for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Tejas Networks Share Price Target Years | Share Price Target |

| 1 | Tejas Networks Share Price Target 2024 | ₹1,522 |

| 2 | Tejas Networks Share Price Target 2025 | ₹1,975 |

| 3 | Tejas Networks Share Price Target 2026 | ₹2,456 |

| 4 | Tejas Networks Share Price Target 2027 | ₹2,925 |

| 5 | Tejas Networks Share Price Target 2028 | ₹3,378 |

| 6 | Tejas Networks Share Price Target 2029 | ₹3,850 |

| 7 | Tejas Networks Share Price Target 2030 | ₹4,453 |

Read Also:- Gujarat Gas Share Price Target 2024, 2025 to 2030 and More Details

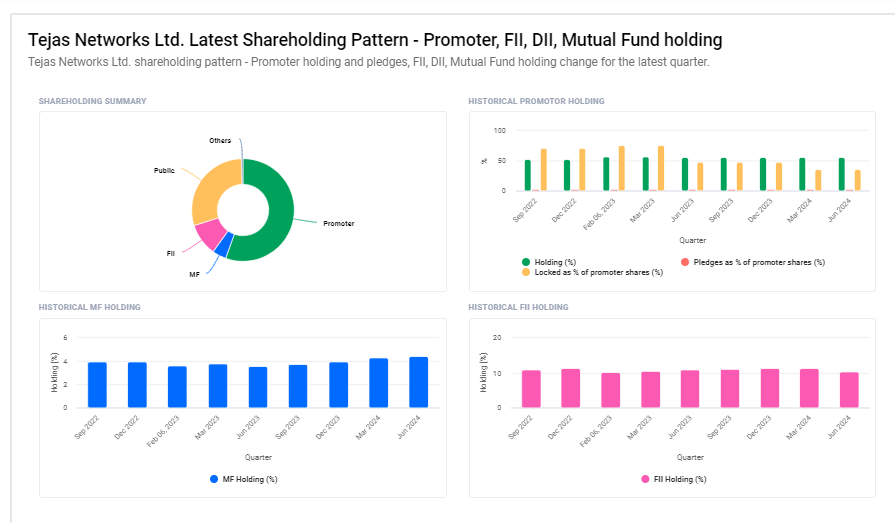

Tejas Networks Ltd Shareholding Pattern

- Promoters: 55.50%

- Retail and Others: 29.40%

- Foreign Institutions: 10.19%

- Mutual Funds: 4.41%

- Other Domestic Institutions: 0.50%

Key Factors Affecting Tejas Networks Share Price Growth

Here are four key factors affecting Tejas Networks’ share price growth:

- Demand for Telecommunications Infrastructure: The growth of data consumption and the expansion of high-speed internet and 5G networks drive demand for Tejas Networks’ products. Increased investments in telecommunications infrastructure can boost the company’s revenue and positively influence its share price.

- Technological Innovation: Tejas Networks’ ability to innovate and develop cutting-edge technology in optical and data networking solutions is crucial. Successful product advancements and new technology offerings can enhance competitiveness and attract investor interest, supporting share price growth.

- Government Policies and Investments: Government initiatives and policies promoting digital infrastructure, such as funding for broadband expansion and 5G rollout, can benefit Tejas Networks. Positive regulatory environments and public sector projects can lead to increased business opportunities and impact the share price.

-

Global Market Expansion: Tejas Networks’ efforts to expand into international markets can provide significant growth opportunities. Success in securing contracts and partnerships abroad can contribute to revenue growth and positively affect the share price.

Risks and Challenges to Tejas Networks Share Price

Here are four risks and challenges that could affect Tejas Networks’ share price:

- Intense Competition: The telecommunications equipment market is highly competitive, with numerous global and local players. Intense competition can put pressure on pricing and margins, potentially affecting profitability and share price.

- Technological Changes: Rapid advancements in technology mean that Tejas Networks must continually innovate to stay relevant. Failure to keep up with technological changes or delays in product development could impact market position and investor confidence.

- Economic Downturns: Economic slowdowns can lead to reduced investments in telecommunications infrastructure. Lower spending by businesses and governments during tough economic times can affect Tejas Networks’ sales and revenue, which may negatively impact its share price.

-

Regulatory Challenges: Changes in government regulations or trade policies can pose risks to Tejas Networks. Regulatory hurdles, tariffs, or compliance issues in different markets can impact operational efficiency and cost structures, affecting the company’s financial performance and share price.

Read Also:-

- Mangalam Cement Share Price Target

- Bajaj Hindusthan Sugar Share Price Target

- Kalyan Jewellers Share Price Target

- Waaree Renewables Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.