Consultancy Services (TCS) is one of the most important and most properly set up IT offerings companies globally, famed for its whole type of services and answers. The organization, part of the Tata Group, has a strong presence inside the technology and consulting sectors and keeps demonstrating robust financial overall performance and boom capability. This superb evaluation affords an in-intensity test of TCS’s percent charge goals from 2024 to 2030, thinking about its current normal universal overall performance, market conditions, and future increase possibilities.

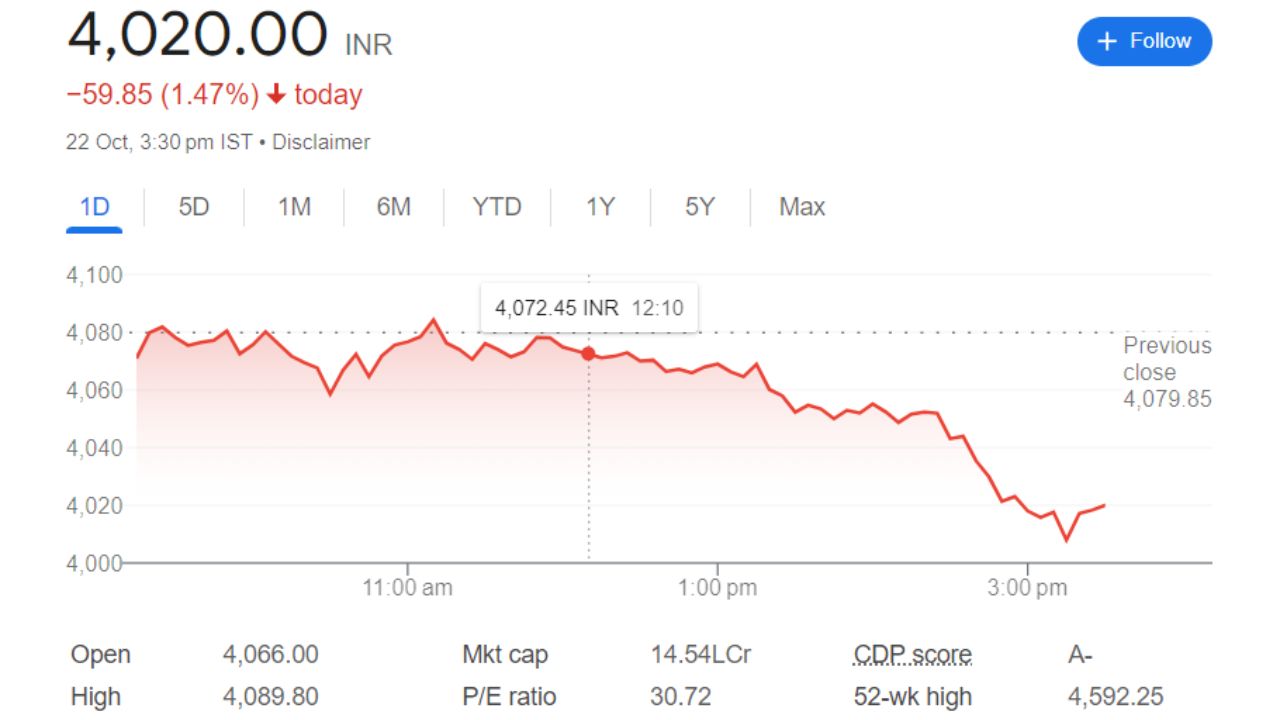

Overview Of TCS Share Price

- Open Price: ₹4,576.00

- High Price: ₹4,588.00

- Low Price: ₹4,530.35

- Market Capitalization: ₹16.40 Lakh Crores

- P/E Ratio: 35.16

- Dividend Yield: 1.24%

- CDP Score: A-

- 52-Week High: ₹4,588.00

- 52-Week Low: ₹3,311.00

- Current Price: ₹4020.00

TCS Share Price Current Graph

Shareholding Pattern For TCS Share Price

The shareholding pattern of TCS as of June 2024 is as follows:

- Promoters: 71.77%

- Foreign Institutions: 12.36%

- Other Domestic Institutions: 6.81%

- Retail and Others: 4.80%

- Mutual Funds: 4.25%

TCS Share Price Targets 2024 To 2030

| YEAR | SHARE PRICE TARGET |

| 2024 | 4738 |

| 2025 | 5423 |

| 2026 | 6206 |

| 2027 | 7103 |

| 2028 | 8127 |

| 2029 | 9301 |

| 2030 | 10646 |

Shareholding Pattern For Tcs Share Price

- Promoters: 71.77%

- Foreign Institutions: 12.36%

- Other Domestic Institutions: 6.81%

- Retail and Others: 4.80%

- Mutual Funds: 4.25%

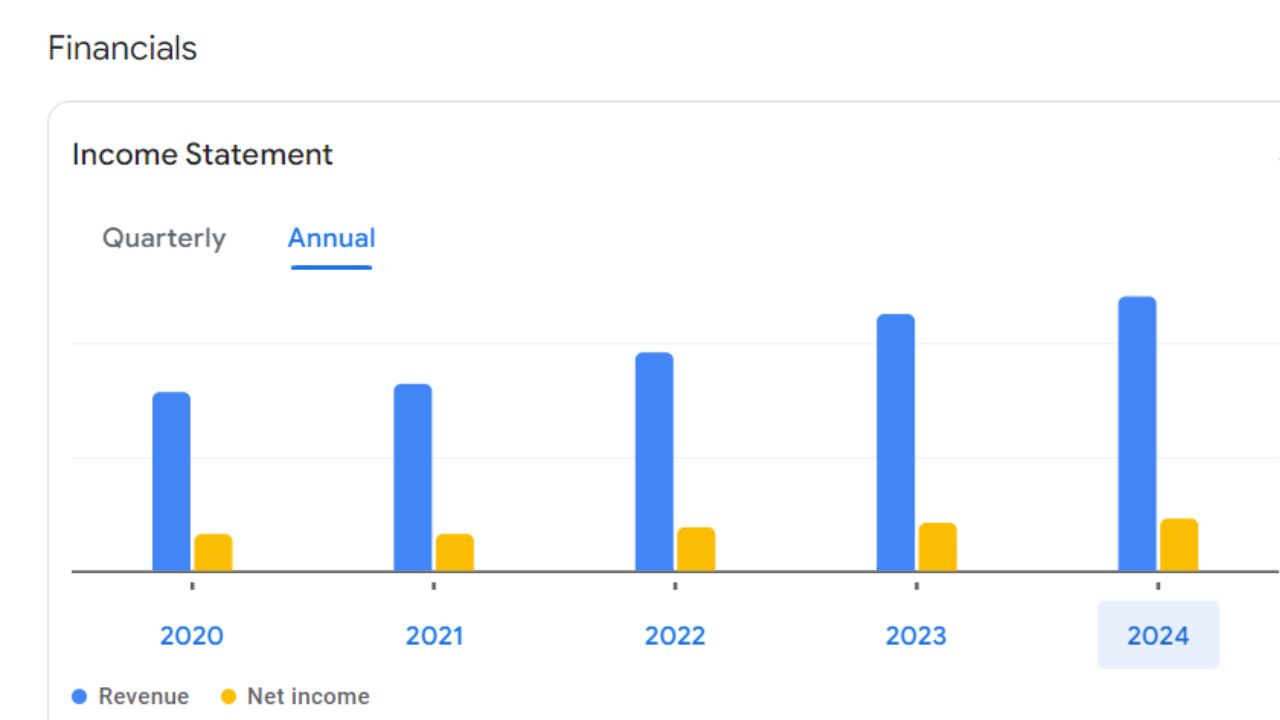

TCS Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 642.59 B | 7.65 % |

| Operating Expenses | 89.10 B | -7.42 % |

| Net Income | 119.09 B | +5.00 % |

| Net Profit Margin | 18.53 | -7.42 % |

| Earning Per Share | 32.92 | +6.19 % |

| EBITDA | 162.68 B | +6.28 % |

| Effective Tax Rate | 25.43 % | N/A |

Advantages and Disadvantage Of TCS Share Price

Advantage

- Strong worldwide presence with a numerous patron base.

- Consistent sales increase and profitability.

Disadvantage

- Exposure to international financial volatility.

- Intense opposition in the IT services area.