TCS is a leading global IT services, consulting, and business solutions company. TCS Share Price on NSE as of 4 September 2024 is 4,484.00 INR. On this page, you will find TCS Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as TCS share price target next Week, Will TCS share price increase tomorrow, TCS share price target tomorrow, Tcs share price target motilal oswal, TCS share price in 2030, and more Information.

Tata Consultancy Services Ltd Company Details

Tata Consultancy Services Ltd (TCS) is a leading global IT services, consulting, and business solutions company based in India. As part of the Tata Group, TCS offers a wide range of services, including software development, IT infrastructure management, and digital transformation solutions. Renowned for its innovation and customer-centric approach, TCS serves clients across various industries worldwide, helping them achieve their business goals with cutting-edge technology and expertise.

| Official Website | tcs.com |

| CEO | K. Krithivasan (1 Jun 2023–) |

| Founded | 1 April 1968 |

| Founders | J. R. D. Tata, Faquir Chand Kohli |

| Headquarters | Mumbai, India |

| Chairman | Natarajan Chandrasekaran |

| Number of employees | 6,06,998 (2024) |

| Parent organizations | Tata Group, Tata Sons |

| Category | Share Price |

Current Market Overview Of TCS Share Price

- Open Price: ₹4,476.95

- High Price: ₹4,487.00

- Low Price: ₹4,436.70

- Market Capitalization: ₹16.21 Lakh Crores

- P/E Ratio: 34.78

- Dividend Yield: 1.25%

- CDP Score: A-

- 52-Week High: ₹4,592.25

- 52-Week Low: ₹3,311.00

TCS Share Price Today Chart

Read Also:- HUDCO Share Price Target 2024, 2025, 2026 to 2030 and More Details

TCS Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of TCS for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | TCS Share Price Target Years | SHARE PRICE TARGET |

| 1 | TCS Share Price Target 2024 | ₹4738 |

| 2 | TCS Share Price Target 2025 | ₹5423 |

| 3 | TCS Share Price Target 2026 | ₹6206 |

| 4 | TCS Share Price Target 2027 | ₹7103 |

| 5 | TCS Share Price Target 2028 | ₹8127 |

| 6 | TCS Share Price Target 2029 | ₹9301 |

| 7 | TCS Share Price Target 2030 | ₹10646 |

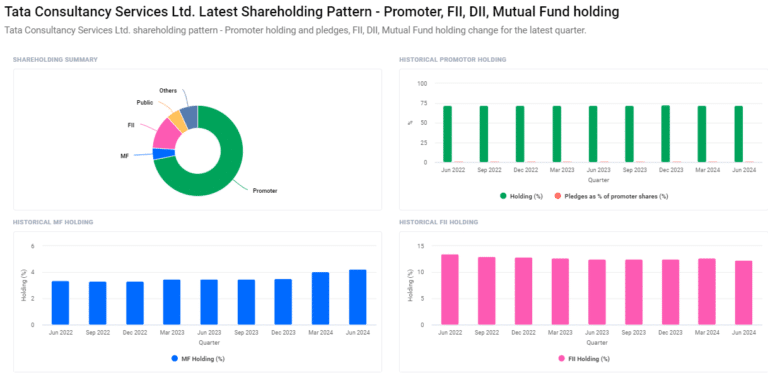

Tata Consultancy Services Ltd Shareholding Pattern

- Promoters: 71.77%

- Foreign Institutions: 12.36%

- Other Domestic Institutions: 6.81%

- Retail and Others: 4.80%

- Mutual Funds: 4.25%

Risks and Challenges to TCS Share Price

-

Global Economic Slowdowns: TCS is heavily reliant on international markets, especially in the U.S. and Europe. Any economic downturn in these regions could lead to reduced IT spending, impacting TCS’s revenue and share price.

- Currency Fluctuations: As TCS earns a significant portion of its revenue in foreign currencies, fluctuations in exchange rates, particularly a strengthening rupee, can negatively affect its profitability.

- Intense Competition: The IT services sector is highly competitive, with global and domestic players vying for market share. Increased competition can pressure TCS’s margins and affect its share price.

- Regulatory Changes: Changes in data protection laws, immigration policies, or other regulations in key markets could increase operational costs or limit TCS’s ability to deploy its workforce effectively, impacting profitability.

-

Technological Disruptions: The rapid pace of technological change requires continuous innovation. If TCS fails to keep up with emerging technologies or shifts in customer demands, it risks losing market relevance, which could adversely affect its share price.

Major Factors Affecting TCS Share Price Growth

-

Strong Financial Performance: Consistent revenue growth and robust profit margins are key drivers of TCS’s share price. Strong quarterly earnings reports can boost investor confidence, leading to share price appreciation.

- Global Market Expansion: TCS’s ability to penetrate new international markets and expand its global footprint plays a significant role in its share price growth. Success in securing large deals in new regions can positively influence the stock.

- Innovation and Technology Adoption: TCS’s focus on adopting cutting-edge technologies like artificial intelligence, cloud computing, and cybersecurity solutions can attract new clients and drive long-term growth, positively impacting its share price.

- Strategic Acquisitions: Acquiring complementary businesses can enhance TCS’s service offerings and market position, leading to increased revenue streams and share price growth. Investors often view such strategic acquisitions as a positive sign.

-

Favorable Economic Conditions: A stable and growing global economy increases IT spending by businesses, which directly benefits TCS. Favorable economic conditions in key markets can lead to more business opportunities, driving the company’s share price upward.

Read Also:-

- Syncom Formulations Share Price Target

- IndusInd Bank Share Price Target

- CG Power Share Price Target

- Orient Green Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.