Tata Teleservices company provides a range of telecommunications services, including mobile and fixed-line voice services, data services, and enterprise solutions. Tata Teleservices Share Price on NSE as of 19 September 2024 is 87.35 INR. On this page, you will find Tata Teleservices Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as TTML share price target Motilal Oswal, Tata Teleservices (Maharashtra), Why Tata Teleservices share is increasing, Tata Teleservices News, TTML share price target 2025, Tata Teleservices share price target tomorrow, Tata Teleservices Share Price Target 2030, and more Information.

Tata Teleservices Ltd Company Details

Tata Teleservices Ltd is a part of the Tata Group, one of India’s largest and most respected business conglomerates. The company provides a range of telecommunications services, including mobile and fixed-line voice services, data services, and enterprise solutions. It operates under various brands, including Tata Docomo and Tata Indicom.

Founded in the early 1990s, Tata Teleservices has played a significant role in enhancing connectivity across India. The company focuses on delivering high-quality services and innovative solutions to meet the growing demands of its customers.

| Official Website | tatatelebusiness.com |

| Founded | 1996 |

| Founder | Tata Sons |

| Headquarters | Mumbai, Maharashtra, India |

| MD | Harjit Singh |

| Number of employees | 385 (2024) |

| Category | Share Price |

Current Market Overview Of Tata Teleservices Share Price

- Current Price: ₹87.35

- Open Price: ₹88.93

- High Price: ₹89.97

- Low Price: ₹85.22

- Market Capitalization: ₹17.03K crore

- P/E Ratio: N/A (currently not available because of lack of income)

- Dividend Yield: N/A (the organization employer is not presently paying dividends)

- 52-Week High: ₹111.40

- 52-Week Low: ₹65.05

Tata Teleservices Share Price Today Chart

Tata Teleservices Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Tata Teleservices for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Tata Teleservices Share Price Target Years | SHARE PRICE TARGET |

| 1 | Tata Teleservices Share Price Target 2024 | ₹115 |

| 2 | Tata Teleservices Share Price Target 2025 | ₹150 |

| 3 | Tata Teleservices Share Price Target 2026 | ₹172 |

| 4 | Tata Teleservices Share Price Target 2027 | ₹198 |

| 5 | Tata Teleservices Share Price Target 2028 | ₹225 |

| 6 | Tata Teleservices Share Price Target 2029 | ₹269 |

| 7 | Tata Teleservices Share Price Target 2030 | ₹310 |

Read Also:- CG Power Share Price Target 2024, 2025, 2026 to 2030 Prediction

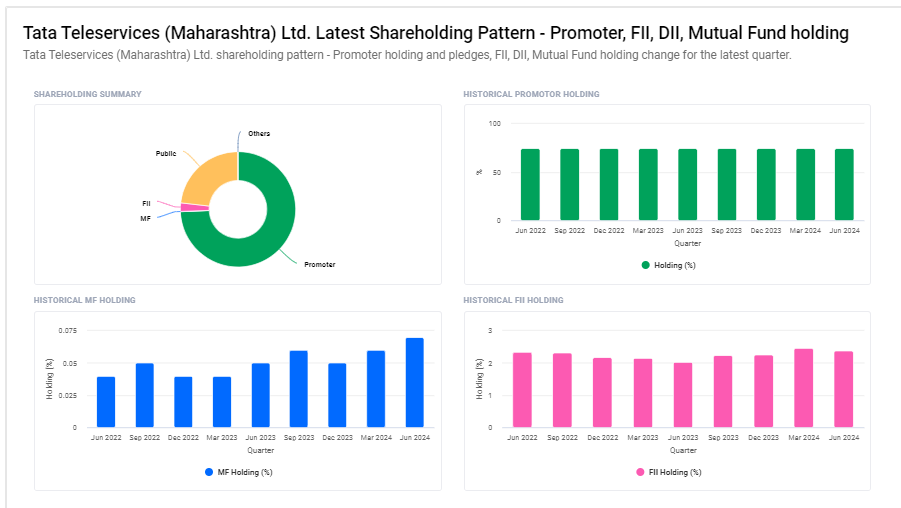

Tata Teleservices Ltd Shareholding Pattern

- Promoters: 74.36%

- Retail and Others: 23.19%

- Foreign Institutions: 2.38%

- Mutual Funds: 0.07%

- Other Domestic Institutions: 0.01%

Key Factors Affecting Tata Teleservices Share Price Growth

Here are six major factors that can influence Tata Teleservices’ share price:

- Telecom Market Competition: The telecom sector is highly competitive, with several major players. Tata Teleservices’ ability to compete effectively, particularly in pricing and service quality, can directly impact its market share and share price.

- Technological Advancements: The telecom industry is rapidly evolving with new technologies like 5G and IoT. Tata Teleservices’ ability to adopt and integrate these technologies into its services can influence its growth prospects and stock performance.

- Regulatory Changes: Government regulations and policies, such as spectrum allocation, telecom licenses, or changes in tariffs, can have a significant impact on Tata Teleservices. Favorable regulations can support growth, while restrictive ones might create challenges.

- Customer Base and Retention: The size and loyalty of Tata Teleservices’ customer base play a crucial role in its financial performance. An expanding customer base and high retention rates can lead to increased revenue, positively affecting the share price.

- Financial Health and Debt Levels: The company’s financial performance, including revenue growth, profitability, and debt management, is key to investor confidence. A strong financial position with manageable debt levels can support share price stability and growth.

-

Partnerships and Collaborations: Strategic partnerships with technology providers, content creators, or other telecom companies can enhance Tata Teleservices’ service offerings. Successful collaborations can open new revenue streams and drive share price growth.

Read Also:-

- KEC International Share Price Target

- Motisons Jewellers Share Price Target

- Orient Green Power Share Price Target

- IndusInd Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.