Tata Motors Limited is a renowned automotive manufacturer from India, known for its diverse range of vehicles, from compact cars to heavy-duty trucks. With a commitment to innovation and quality, Tata Motors has become a trusted name both domestically and globally. Their focus on sustainability and advanced technology makes them a leader in the automotive industry. Tata Motors Share Price on NSE as of 13 September 2024 is 991.85 INR. This article will provide more details on Tata Motors Share Price Target 2024, 2025, to 2030.

Tata Motors Share Price Target Tomorrow 2024, 2025, 2026 To 2030 Forecast

Tata Motors share prices are expected to show steady growth in the coming years. In 2023, the share price is projected to be ₹1059.02, remaining the same in 2024. By 2025, it is expected to rise to ₹1096.50, then to ₹1144.50 in 2026, and ₹1171.50 in 2027. The share price is anticipated to reach ₹1316.50 in 2028, and by 2030, it is projected to climb significantly to ₹1721.50.

Tata Motors Company Full Details

Tata Motors is one of India’s largest automotive manufacturers. Founded in 1945, the company has grown to become a global player in the automotive industry. Tata Motors produces a wide variety of vehicles, including cars, trucks, buses, and even military vehicles.

The company stands out for its pioneering spirit and unwavering dedication to excellence. Over the years, Tata Motors has introduced several groundbreaking models, such as the Tata Nano, which was once the world’s cheapest car, and the Tata Nexon, a popular compact SUV.

Tata Motors is also focused on sustainability and eco-friendly technologies. They are actively developing electric vehicles and investing in green technology to reduce their environmental impact. With a strong presence in over 125 countries, Tata Motors continues to expand its reach and influence in the global market.

|

The company’s industry |

|

|

Established |

September 1945 |

|

Founder |

J. R. D. Tata |

|

Headquarters |

Mumbai, Maharashtra, India |

|

Net Income |

₹2,414.29Cr |

|

Market Cap |

₹3,74,108 Cr |

|

P/E Ratio |

18.6 |

|

ROE |

5.95% |

|

Profit before Tax 2023 |

₹3,057.55 |

|

Net Worth |

₹52,600 Cr |

|

52 Week High |

₹1027 |

| Category | Share Price |

Tata Motors Fundamental Analysis

| Promoters Hold | 46.36% |

| Foreign Institutions Hold | 19.20% |

| Retail | 18.36% |

| Mutual Funds | 9.5% |

| Other Domestic Institutions Hold | 6.58% |

Read Also:- SEL Manufacturing Share Price Target 2024, 2025, to 2030 and More Details

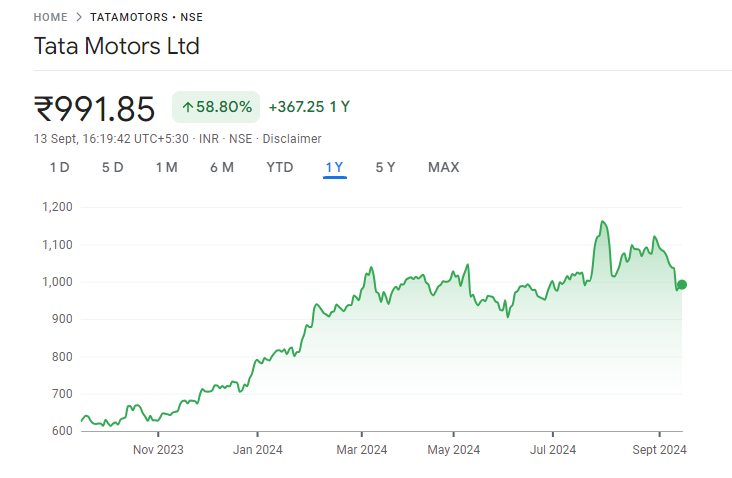

Current Market Overview Of Tata Motors Share Price

- MARKET CAP: ₹3.65LCr

- OPEN: ₹994.90

- HIGH: ₹1,006.00

- Low: ₹988.00

- Current: ₹991.85

- P/E RATIO: 8.54

- DIVIDEND YIELD: 0.30%

- 52 WEEK HIGH: ₹1179.00

- 52 WEEK LOW: ₹608.30

Tata Motors Share Price Chart

Tata Motors Share Price Target Tomorrow From 2024 To 2030

| S. No. | Tata Motors Share Price Target Years | SHARE PRICE TARGET |

| 1 | Tata Motors Share Price Target 2024 | ₹1189.02 |

| 2 | Tata Motors Share Price Target 2025 | ₹1296.50 |

| 3 | Tata Motors Share Price Target 2026 | ₹1344.50 |

| 4 | Tata Motors Share Price Target 2027 | ₹1471.50 |

| 5 | Tata Motors Share Price Target 2028 | ₹1516.50 |

| 6 | Tata Motors Share Price Target 2029 | ₹1628.50 |

| 7 | Tata Motors Share Price Target 2030 | ₹1721.50 |

Read Also:-

IDFC First Bank Share Price Target

Key Factors Affecting Tata Motors Share Price Growth

Here are six key factors that can affect the share price growth of Tata Motors:

- Global Automotive Market Trends: Tata Motors, with its international presence, including its luxury brand Jaguar Land Rover (JLR), is significantly influenced by global automotive market trends. Factors like increasing demand for electric vehicles (EVs), changing consumer preferences, and overall market conditions in regions like Europe, China, and the U.S. impact Tata Motors’ revenue. A rise in demand, especially for EVs, could drive revenue growth, positively influencing the share price.

- Electric Vehicle (EV) Development and Adoption: Tata Motors’ push toward electric mobility, particularly with its Tata Nexon EV, is a key growth driver. As governments worldwide encourage the transition to EVs through subsidies and supportive policies, Tata Motors’ strong EV portfolio positions it for growth in this emerging market. Increased adoption of EVs in India and abroad can boost Tata Motors’ revenue and result in a higher share price.

- Jaguar Land Rover (JLR) Performance: The performance of Jaguar Land Rover, Tata Motors’ luxury vehicle division, is a significant factor in determining the company’s overall financial health. JLR’s sales performance in key markets, such as China, the U.S., and Europe, and its ability to innovate with new models, including electric versions, directly impact Tata Motors’ earnings. Strong sales and profitability in JLR contribute to share price growth.

- Raw Material Costs and Supply Chain Management: The cost of raw materials, such as steel, aluminum, and semiconductors, plays a crucial role in Tata Motors’ production costs. Rising raw material prices or supply chain disruptions, as seen during the global semiconductor shortage, can increase production costs and affect the company’s profit margins. Efficient supply chain management and stable raw material prices will help protect profits, positively influencing the stock price.

- Regulatory Policies and Environmental Norms: As a global automotive player, Tata Motors must comply with various environmental and regulatory standards in different markets. Stricter emission norms and safety regulations can increase compliance costs, but they also push the company to innovate, especially in the electric vehicle space. Positive regulatory developments, such as incentives for clean energy vehicles, could help boost Tata Motors’ growth prospects and share price.

-

Macroeconomic Conditions and Consumer Sentiment: The automotive industry is sensitive to macroeconomic conditions, such as inflation, interest rates, and consumer spending patterns. A strong economy encourages vehicle purchases, while economic slowdowns or high inflation reduce demand. In markets like India, where Tata Motors has a significant presence, strong economic growth and favorable consumer sentiment can drive sales, boosting the company’s revenue and share price.

Read Also:-

Jio Finance Share Price Target

FAQ

Q1. What is the share price target of Tata Motors in 2024?

Ans. The target price of Tata Motors in 2024 is ₹₹1059.02.

Q2. What is the share price target of Tata Motors in 2025?

Ans. The target price of Tata Motors in 2025 is ₹1096.50.

Q3. What is the share price target of Tata Motors in 2030?

Ans. The target price of Tata Motors in 2030 is ₹1721.50.

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.