Tata Consumer Products Limited (TCPL), a part of the Tata Group, is a first-rate participant in India’s fast-transferring consumer goods (FMCG) region. The enterprise operates in every beverage and meal segment, retaining massive marketplace shares in products that incorporate tea, espresso, water, salt, and packaged food. Over the past few years, Tata Consumer has been evolving its organization, emphasizing innovation, expanding its product variety, and enhancing its market penetration.

In this article, we are able to look at Tata Consumer Share Price’s ordinary overall performance from 2024 to 2030, along with key factors influencing its charge movements. We might also offer an in-depth forecast of the business agency’s inventory rate, primarily based on its monetary health, market developments, and institutional investor hobby.

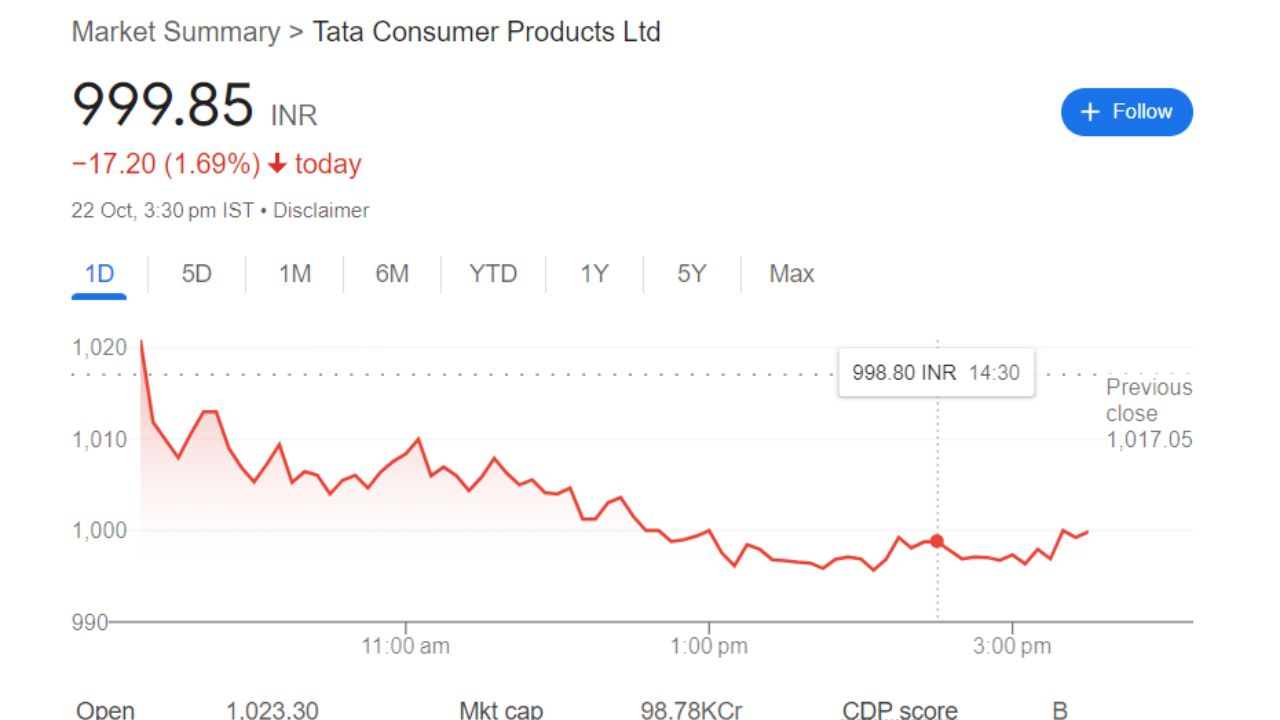

Overview Of Tata Consumer Share Price

As of October 2024, Tata Consumer Share Price is well-known and shows sturdy basics with terrific boom capacity. Below are the critical elements of financial metrics:

- Open Price: ₹1,047.00

- High Price: ₹1,059.45

- Low Price: ₹986.35

- Market Capitalization: 99.87KCrore

- P/E Ratio: 85.36

- Dividend Yield: 0.76%

- 52-Week High: ₹1,253.69

- 52-Week Low: ₹861.48

- Current Price: ₹999.85

- 1-Year Price Change: +126.25

Tata Consumer Share Price Current Graph

Tata Consumer Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 1320 |

| 2025 | 1570 |

| 2026 | 1820 |

| 2027 | 2085 |

| 2028 | 2354 |

| 2029 | 2675 |

| 2030 | 2964 |

Shareholding Pattern For Tata Consumer Share Price

- Promoters: 33.84%

- Foreign Institutions (FII/FPI): 24.06%

- Retail and Others: 23.14%

- Other Domestic Institutions: 11.71%

- Mutual Funds: 7.25%

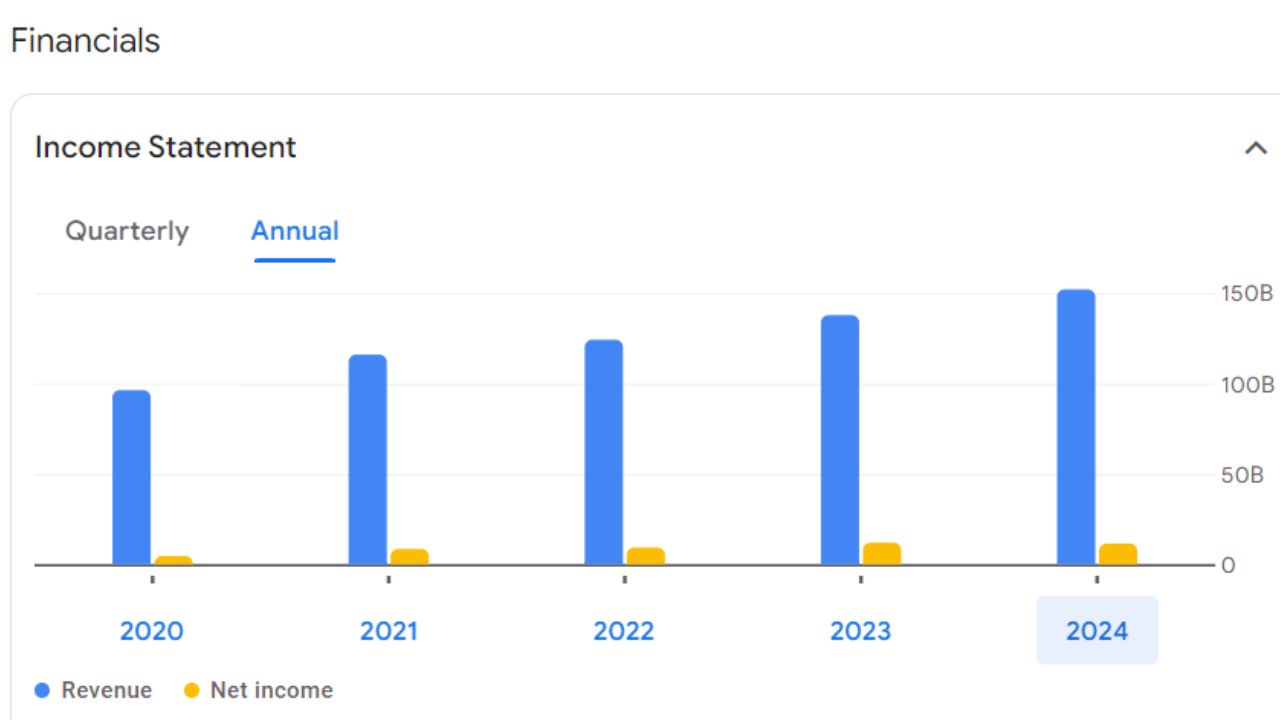

Tata Consumer Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 42.14 B | +12.87 % |

| Operating Expenses | 13.61 B | +18.96 % |

| Net Income | 3.64 B | +7.74 % |

| Net Profit Margin | 8.65 | –4.53 % |

| Earning Per Share | 4.04 | +7.44 % |

| EBITDA | 6.26 B | +17.80 % |

| Effective Tax Rate | 9.32 % | N/A |

Advantages And Disadvantages Of Tata Consumer Share Price

Advantage

- Strong worldwide presence with a numerous patron base.

- Consistent sales increase and profitability.

Disadvantage

- Exposure to international financial volatility.

- Intense opposition in the IT services area.