Subex Ltd is a well-known Indian enterprise software company. Subex Share Price on NSE as of 13 September 2024 is 28.87 INR. On this page, you will find Subex Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Subex takeover News, Subex share news, Subex share price target tomorrow, Subex Share Price Target 2025 in Hindi, Subex Share Price Target 2030, and more Information.

Subex Ltd Company Details

Subex Ltd is an Indian technology company specializing in software solutions for telecommunications, utilities, and other industries. Founded in 1992, Subex offers a range of services including revenue assurance, fraud management, and network operations. The company is known for its expertise in providing tools that help businesses manage their operational efficiency and protect against financial losses. Subex’s solutions are designed to enhance the performance and security of its clients’ systems, making it a key player in the technology sector.

| Official Website | subex.com |

| Founded | 1992 |

| Founders | Subash Menon Alex Puthenchira |

| CEO | Nisha Dutt (2023–) |

| Headquarters | Bangalore, Karnataka, India |

| Number of employees | 828 (2024) |

| Category | Share Price |

Current Market Overview Of Subex Share Price

- Open Price: ₹28.59

- High Price: ₹29.34

- Low Price: ₹28.59

- Current Price: ₹28.87

- Mkt cap: ₹1.60KCr

- P/E ratio: NA

- Div yield: NA

- 52-wk high: ₹45.80

- 52-wk low: ₹22.50

Subex Share Price Today Chart

Read Also:- Raymond Share Price Target 2024, 2025, 2026 To 2030

Subex Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Subex for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Subex Share Price Target Years | SHARE PRICE TARGET |

| 1 | Subex Share Price Target 2024 | ₹38 |

| 2 | Subex Share Price Target 2025 | ₹51 |

| 3 | Subex Share Price Target 2026 | ₹60 |

| 4 | Subex Share Price Target 2027 | ₹68 |

| 5 | Subex Share Price Target 2028 | ₹75 |

| 6 | Subex Share Price Target 2029 | ₹87 |

| 7 | Subex Share Price Target 2030 | ₹101 |

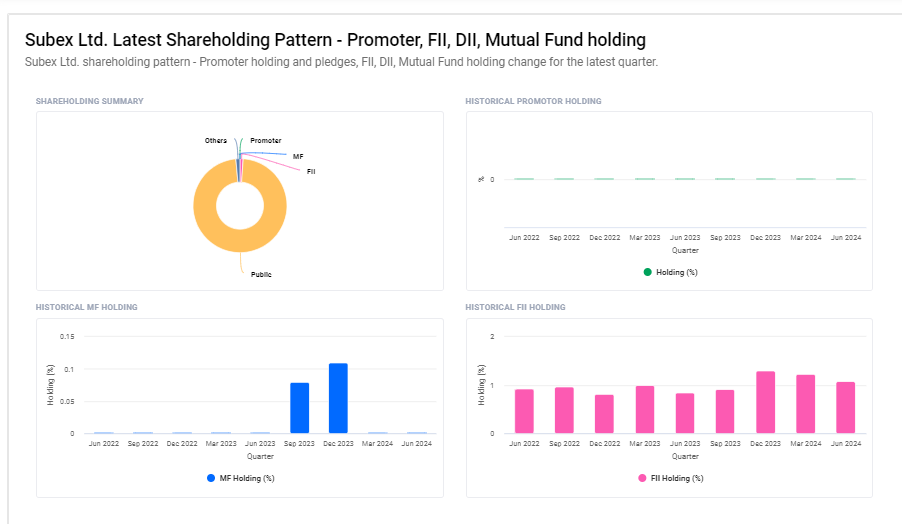

Subex ltd Shareholding Pattern

- Retail and Others: 98.91%

- Foreign Institutions: 1.07%

- Other Domestic Institutions: 0.01%

Key Factors Affecting Subex Share Price Growth

Here are seven key factors that can deeply affect Subex Ltd’s share price growth:

- Demand for Telecommunications Software: Subex provides specialized software solutions for telecom companies, including fraud management and revenue assurance. As the telecommunications industry grows and evolves, the demand for these advanced software solutions increases. Strong demand for such services can lead to higher revenue for Subex, which may positively influence its share price.

- Technological Advancements: The technology sector is characterized by rapid advancements. Subex’s ability to stay at the forefront of technology, by continuously developing and upgrading its software solutions, is crucial. If Subex successfully integrates emerging technologies like artificial intelligence and machine learning into its offerings, it can attract more clients and drive growth, boosting its share price.

- Client Acquisition and Retention: Subex’s financial performance is closely linked to its client base. Securing new contracts with major telecom operators and retaining existing clients are vital for steady revenue growth. Strong client relationships and successful project implementations can enhance investor confidence and lead to an increase in share price.

- Global Market Expansion: Expanding into new geographical markets can provide Subex with additional revenue streams. By tapping into emerging markets where telecommunications infrastructure is growing, Subex can increase its global footprint. Successful international expansion can drive revenue growth and positively impact the company’s stock price.

- Financial Performance and Stability: Investors closely monitor Subex’s financial performance, including revenue growth, profit margins, and overall profitability. Strong and consistent financial results signal a healthy business, which can attract more investors and contribute to share price growth. Conversely, any financial instability or disappointing earnings can negatively affect the stock.

- Industry Trends and Regulatory Changes: The telecommunications industry is subject to various regulations and industry trends. Changes in regulations, such as data protection laws or new industry standards, can impact Subex’s operations. Adapting to these changes effectively can help the company maintain its market position and capitalize on new opportunities, influencing its share price positively.

-

Competitive Landscape: Subex operates in a competitive market with other technology and software providers. The company’s ability to differentiate itself through innovation, customer service, and pricing strategies is crucial. If Subex can outperform its competitors and capture a larger market share, it can enhance its financial performance and positively impact its share price.

Read Also:-

- MosChip Share Price Target

- NYKAA Share Price Target

- NALCO Share Price Target

- Deep Diamond India Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.