Sri Adhikari Brothers Television Network Ltd is an Indian media company that produces and broadcasts television content. Sri Adhikari Brothers Share Price on NSE as of 20 September 2024 is 762.75 INR. On this page, you will find Sri Adhikari Brothers Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Sri Adhikari Brothers share price News, Sri Adhikari Brothers Share Price target 2025 Moneycontrol today, Sri Adhikari brothers share price target tomorrow, Sri Adhikari brothers share price target Motilal Oswal, Sri Adhikari brothers share price target 2030, and more Information.

Sri Adhikari Brothers Televisn Ntwrk Ltd Company Details

Sri Adhikari Brothers Television Network Ltd is an Indian media company that produces and broadcasts television content. Established as a pioneer in the TV industry, the company creates a variety of shows, including entertainment, drama, and comedy programs. With a strong presence in the Indian television market, Sri Adhikari Brothers has built a reputation for delivering popular content that resonates with audiences nationwide.

| Official Website | adhikaribrothers.com |

| Headquarters | India |

| Number of employees | 1 (2024) |

| Category | Share Price |

Sri Adhikari Brothers Share Price Today Chart

Current Market Overview Of Sri Adhikari Brothers Share Price

- Current Price: ₹762.75

- Open Price: ₹762.75

- High Price: ₹762.75

- Low Price: ₹762.75

- Mkt cap: ₹272.78LCr

- P/E ratio: NA

- Div yield: NA

- 52-wk high: ₹762.75

- 52-wk low: ₹41.25

Sri Adhikari Brothers Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Sri Adhikari Brothers for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Sri Adhikari Brothers Share Price Target Years | SHARE PRICE TARGET |

| 1 | Sri Adhikari Brothers Share Price Target 2024 | ₹826 |

| 2 | Sri Adhikari Brothers Share Price Target 2025 | ₹1420 |

| 3 | Sri Adhikari Brothers Share Price Target 2026 | ₹2120 |

| 4 | Sri Adhikari Brothers Share Price Target 2027 | ₹2785 |

| 5 | Sri Adhikari Brothers Share Price Target 2028 | ₹3354 |

| 6 | Sri Adhikari Brothers Share Price Target 2029 | ₹3978 |

| 7 | Sri Adhikari Brothers Share Price Target 2030 | ₹4652 |

Read Also:- PCBL Share Price Target 2024, 2025 To 2030 and More Information

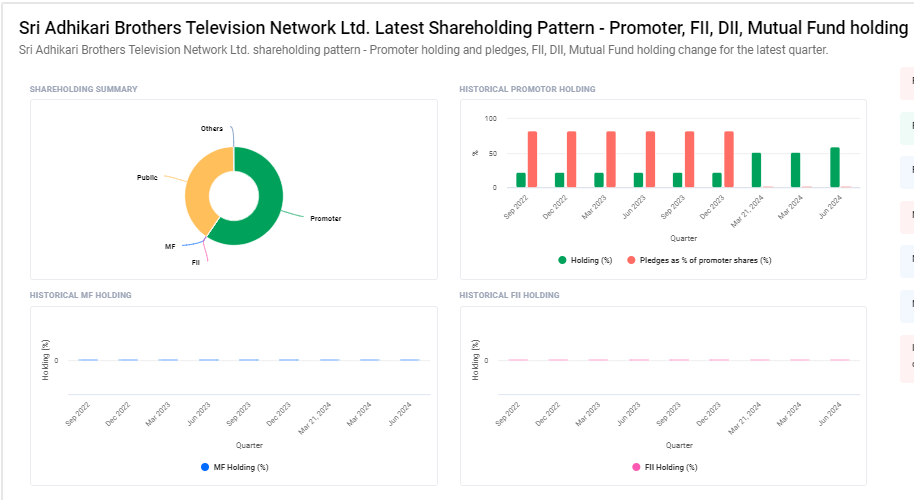

Sri Adhikari Brothers Televisn Ntwrk Ltd Shareholding Pattern

- Promoters: 59.42%

- Retail and Others: 40.26%

- Other Domestic Institutions: 0.23%

Key Factors Affecting Sri Adhikari Brothers Share Price Growth

Here are four key factors that can influence the growth of Sri Adhikari Brothers’ share price:

- Content Popularity: The success of Sri Adhikari Brothers’ television shows plays a crucial role in attracting viewers and advertisers. High viewership and popular content can lead to increased advertising revenue, positively affecting the company’s share price.

- Advertising Revenue: The company’s financial health largely depends on advertising income. If Sri Adhikari Brothers secure strong advertising deals or experiences growth in ad rates, it can boost revenue and support share price growth.

- Expansion of Distribution Channels: Expanding the distribution of content through various platforms, such as digital streaming services, can help the company reach a larger audience. This broader reach can drive revenue growth and improve investor confidence, leading to a higher share price.

-

Industry Competition: The media industry is highly competitive, with numerous players vying for audience attention. Sri Adhikari Brothers’ ability to stay competitive by producing high-quality content and retaining viewership will influence its market position and share price growth.

Risks and Challenges to Sri Adhikari Brothers Share Price

Here are four risks and challenges that could impact Sri Adhikari Brothers’ share price:

- Content Quality and Audience Retention: The company’s success heavily relies on producing engaging content. If shows fail to attract or retain viewers, advertising revenue could decline, negatively affecting the share price.

- Competitive Pressure: The media industry is highly competitive, with numerous channels and digital platforms vying for viewers. Intense competition can make it challenging for Sri Adhikari Brothers to maintain its market share, which could impact its financial performance and share price.

- Advertising Market Fluctuations: The company’s revenue is closely tied to the advertising market. Economic downturns or shifts in advertising spending patterns could lead to lower ad revenue, posing a risk to the share price.

-

Regulatory Changes: Changes in media regulations or government policies, such as those affecting content licensing or advertising, could increase operational costs or limit opportunities for growth, potentially impacting the share price.

Read Also:-

- Deep Diamond India Share Price Target

- NIIT Ltd Share Price Target

- Franklin Industries Share Price Target

- Cressanda Solutions Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.