SpiceJet Ltd is one of India’s leading low-cost airlines. SpiceJet Share Price on NSE as of 20 September 2024 is 66.16 INR. On this page, you will find SpiceJet Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as SpiceJet share News, NSE SpiceJet share price target, Spicejet share price target long term, SpiceJet share price Target tomorrow, Spicejet Share Price Target 2030, and more Information.

Spicejet Ltd Company Details

SpiceJet Ltd is one of India’s leading low-cost airlines, known for offering affordable flights to a wide range of domestic and international destinations. The airline focuses on providing value-for-money services, making air travel accessible to a large number of people. With a strong network and a commitment to customer satisfaction, SpiceJet has become a popular choice for travelers across the country.

| Official Website | spicejet.com |

| Founded | 9 February 1984 |

| Founders | Ajay Singh, Bhupendra S. Kansagra |

| Headquarters | Gurgaon, Haryana, India |

| Number of employees | 7,131 (2023) |

| Category | Share Price |

Spicejet Share Price Today Chart

Current Market Overview Of Spicejet Share Price

- Open Price: ₹68.95

- Day’s High: ₹70.40

- Day’s Low: ₹65.51

- Market Capitalization: ₹5.25K Crore

- P/E Ratio: Not applicable (because of awful earnings)

- Dividend Yield: Not relevant

- 52-Week High: ₹79.90

- 52-Week Low: ₹34.00

- Current Price: ₹66.16

Read Also:- LT Foods Share Price Target 2024, 2025 To 2030 and More Details

Spicejet Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Spicejet for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Spicejet Share Price Target Years | Share Price Target |

| 1 | Spicejet Share Price Target 2024 | ₹80 |

| 2 | Spicejet Share Price Target 2025 | ₹116 |

| 3 | Spicejet Share Price Target 2026 | ₹148 |

| 4 | Spicejet Share Price Target 2027 | ₹185 |

| 5 | Spicejet Share Price Target 2028 | ₹219 |

| 6 | Spicejet Share Price Target 2029 | ₹247 |

| 7 | Spicejet Share Price Target 2030 | ₹283 |

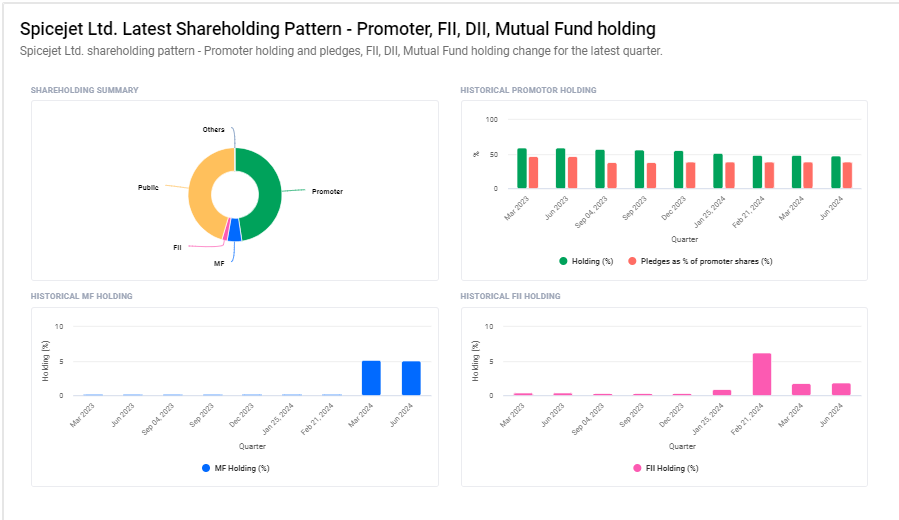

Spicejet Ltd Shareholding Pattern

- Promoters: 47.66%

- Retail and Others: 45.37%

- Mutual Funds: 5.05%

- Foreign Institutions: 1.81%

- Other Domestic Institutions: 0.11%

Key Factors Affecting SpiceJet Share Price Growth

Here are seven key factors that can influence the growth of SpiceJet’s share price:

- Fuel Prices: Jet fuel is a significant cost for airlines. Fluctuations in global oil prices directly impact SpiceJet’s operating expenses. Lower fuel prices can boost profitability, while higher prices may squeeze margins and affect the share price.

- Passenger Demand: The number of passengers flying with SpiceJet plays a crucial role in its revenue. Higher demand for air travel, especially in key domestic and international routes, can lead to increased ticket sales and positively impact the share price.

- Competition in the Aviation Industry: The airline industry is highly competitive, with many carriers fighting for market share. SpiceJet’s ability to offer competitive fares and maintain strong occupancy rates can influence its market position and share price growth.

- Operational Efficiency: Efficient management of operations, including on-time performance and cost control, is essential for profitability. SpiceJet’s success in maintaining a smooth and cost-effective operation can attract investors and support share price growth.

- Regulatory Environment: Changes in aviation regulations, taxes, or government policies can affect the airline’s costs and operations. A favorable regulatory environment can support growth, while restrictive policies may pose challenges.

- Expansion of Routes: Expanding its flight network to new domestic and international destinations can increase SpiceJet’s customer base and revenue. Successful expansion can drive growth and positively influence the share price.

-

Economic Conditions: The overall economic environment, including factors like GDP growth and consumer spending, impacts air travel demand. A strong economy can boost passenger numbers and revenue, supporting share price growth.

Read Also:-

- Tejas Networks Share Price Target

- Allcargo Terminals Share Price Target

- Bengal Steel Share Price Target

- Mazagon Dock Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.