SEPC is an Indian company that provides engineering, procurement, and construction (EPC) services. SEPC Share Price on NSE as of 11 September 2024 is 30.93 INR. On this page, you will find SEPC Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as SEPC share News, Why SEPC share is falling, Sepc share price target tomorrow, Sepc share price target Motilal Oswal, SEPC share price target 2030, and more Information.

SEPC Ltd Company Details

SEPC Ltd, formerly known as Shriram EPC Ltd, is an Indian company that provides engineering, procurement, and construction (EPC) services. The company focuses on sectors like energy, water, renewable power, and infrastructure. SEPC is involved in executing large-scale projects, including setting up power plants, water treatment facilities, and other industrial infrastructure.

With its expertise in handling complex projects, SEPC plays a vital role in India’s infrastructure development. The company is known for delivering innovative solutions and supporting sustainable growth in the country’s industrial landscape.

| Official Website | shriramepc.com |

| Headquarters | India |

| Number of employees | 229 (2024) |

| Subsidiaries | Shriram EPC FZE, Hexa Windfram Private Limited |

| Category | Share Price |

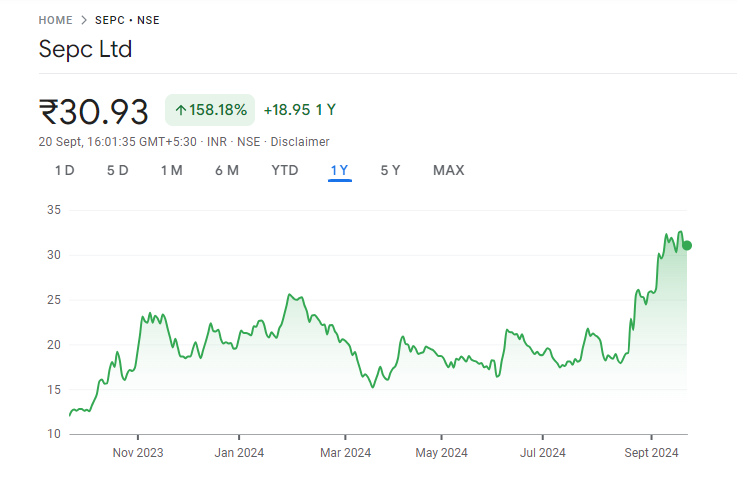

Current Market Overview Of SEPC Share Price

- Open: ₹30.75

- High: ₹31.60

- Low: ₹30.35

- Market Cap: ₹4.86K Crores

- P/E Ratio: 167.56

- Dividend Yield: N/A

- 52-Week High: ₹33.45

- 52-Week Low: ₹11.88

- Current Price: ₹30.93

SEPC Share Price Today Chart

SEPC Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of SEPC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | SEPC Share Price Target Years | SHARE PRICE TARGET |

| 1 | SEPC Share Price Target 2024 | ₹45 |

| 2 | SEPC Share Price Target 2025 | ₹56 |

| 3 | SEPC Share Price Target 2026 | ₹62 |

| 4 | SEPC Share Price Target 2027 | ₹71 |

| 5 | SEPC Share Price Target 2028 | ₹85 |

| 6 | SEPC Share Price Target 2029 | ₹97 |

| 7 | SEPC Share Price Target 2030 | ₹105 |

Read Also:- Jio Finance Share Price Target 2024, 2025, 2026, to 2030 and Forecast

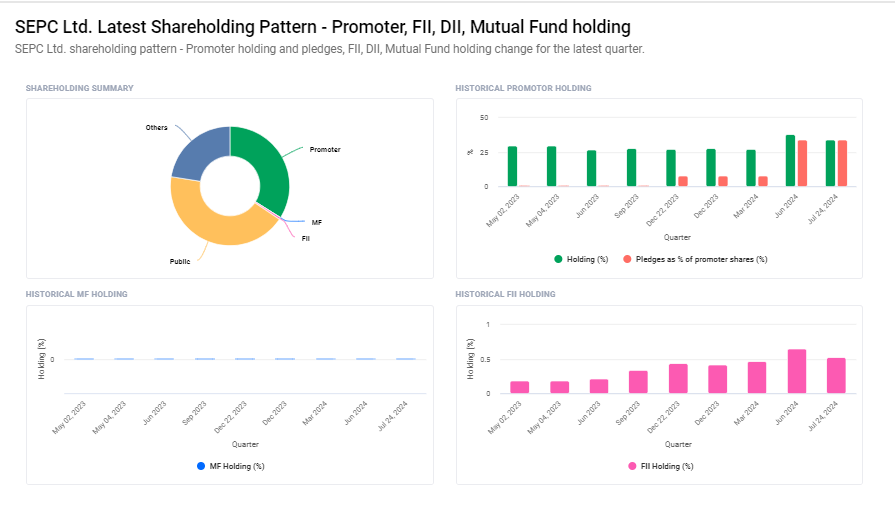

SEPC Ltd Shareholding Pattern

- Retail and Others: 43.07%

- Promoters: 33.94%

- Other Domestic Institutions: 22.47%

- Foreign Institutions: 0.52%

Key Factors Affecting SEPC Share Price Growth

Here are five key factors that can affect SEPC Ltd’s share price growth:

- New Project Wins: SEPC’s ability to secure new engineering and infrastructure contracts can boost its revenue and improve investor confidence, leading to potential share price growth.

- Government Infrastructure Spending: Increased government investment in sectors like energy, water, and infrastructure can create more opportunities for SEPC, positively impacting its business and share price.

- Timely Project Execution: Completing projects on time and within budget enhances SEPC’s reputation and profitability, which can attract more investors and support share price growth.

- Economic Conditions: Favorable economic conditions can increase demand for infrastructure projects, which boosts SEPC’s business and can lead to a rise in its stock price.

-

Technological Innovation: Adopting advanced technologies in construction and project management can improve SEPC’s efficiency and competitiveness, helping to drive future growth and share price appreciation.

Risks and Challenges to SEPC Share Price

Here are six risks and challenges that could affect SEPC Ltd’s share price:

- Project Delays: Delays in completing projects or cost overruns can impact profitability, leading to lower investor confidence and a possible decline in the share price.

- Dependence on Government Contracts: SEPC relies on government projects for a significant portion of its business. Any reduction in government spending or policy changes can affect its revenue and stock performance.

- Economic Slowdowns: A slowdown in the economy, particularly in the infrastructure sector, can reduce demand for new projects, negatively affecting SEPC’s growth and share price.

- Intense Competition: The EPC industry is highly competitive. Increased competition from other companies can reduce SEPC’s market share, putting pressure on its profit margins and stock price.

- Rising Input Costs: Fluctuations in the prices of raw materials and labor can increase project costs, squeezing SEPC’s profit margins and impacting its financial performance, which could hurt the share price.

-

Regulatory Challenges: Changes in regulations or environmental guidelines can create challenges for SEPC’s ongoing projects, potentially leading to delays, additional costs, or project cancellations, affecting its share price.

Read Also:-

- Urja Global Share Price Target

- ITC Share Price Target

- Union Bank Share Price Target

- RVNL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.