Welcome traders and investors. SCI Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, and 2030 prediction with major levels discusses the share price of SCI from 2025 to 2030 with SCI share price target 2024 as a starting point. Also, the major low-risk entry levels for SCI share price are provided in the article below so that traders can see the SCILAL share price target from 2025 to 2030 with peace of mind and low risk.

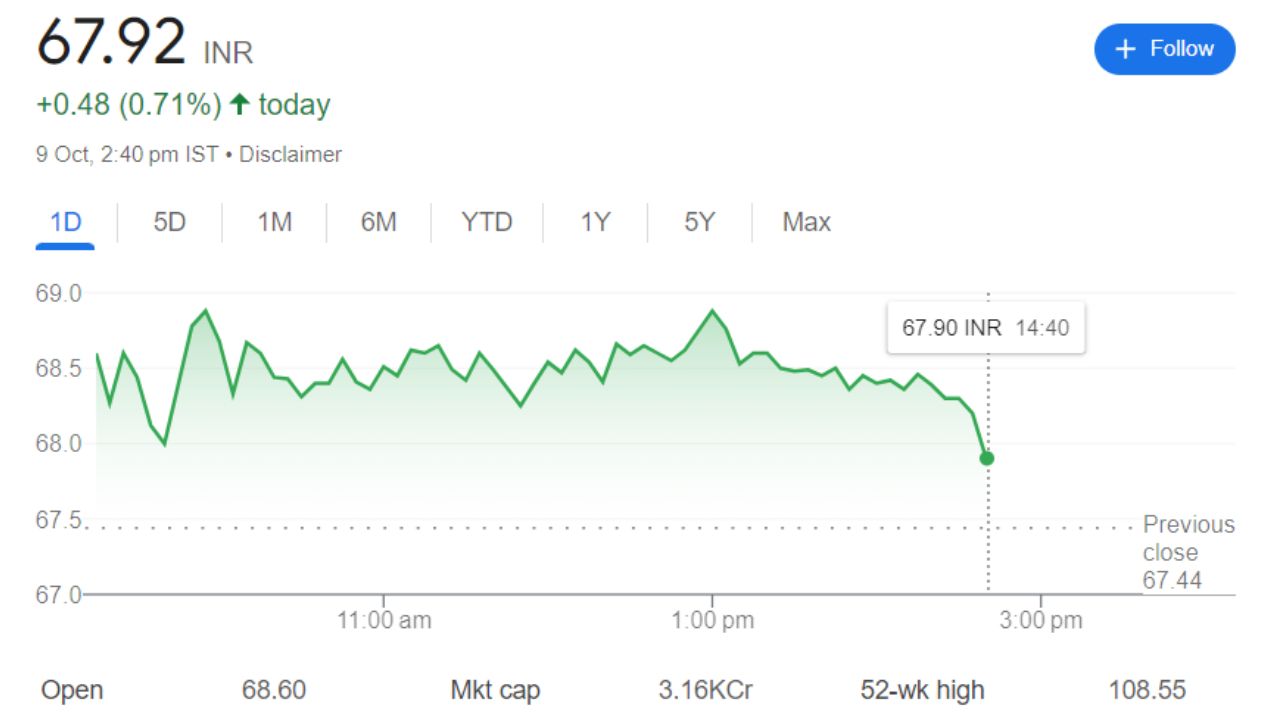

Current Market Overview Of Scilal Share Price

- Market Capital: 33.07 B INR

- Open: 70.99

- High: 70.60

- Low: 71.80

- Current Share Price: 67.92

- P / E Ratio: 73.20

- Dividend Yield: 0.93 %

- 52 Week High: 108.55

- 52 Week Low: 36

Scilal Share Price Current Graph

Scilal Share Price Target 2025 To 2030 Downslide levels

| Year | Target |

| 2024 | 210 |

| 2025 | 180 |

| 2026 | 150 |

| 2027 | 120 |

| 2028 | 85 |

| 2029 | 65 |

| 2030 | 45 |

SCILAL Share Price Targets 2024 To 2030

| YEAR | SHARE PRICE TARGET |

| 2024 | 105 |

| 2025 | 170 |

| 2026 | 240 |

| 2027 | 287 |

| 2028 | 334 |

| 2029 | 395 |

| 2030 | 467 |

Shareholding Pattern For SCILAL Share Price

- Promotors: 63.8 %

- Foreign Institutional: 4.6 %

- DLL: 8.7%

- Public: 23 %

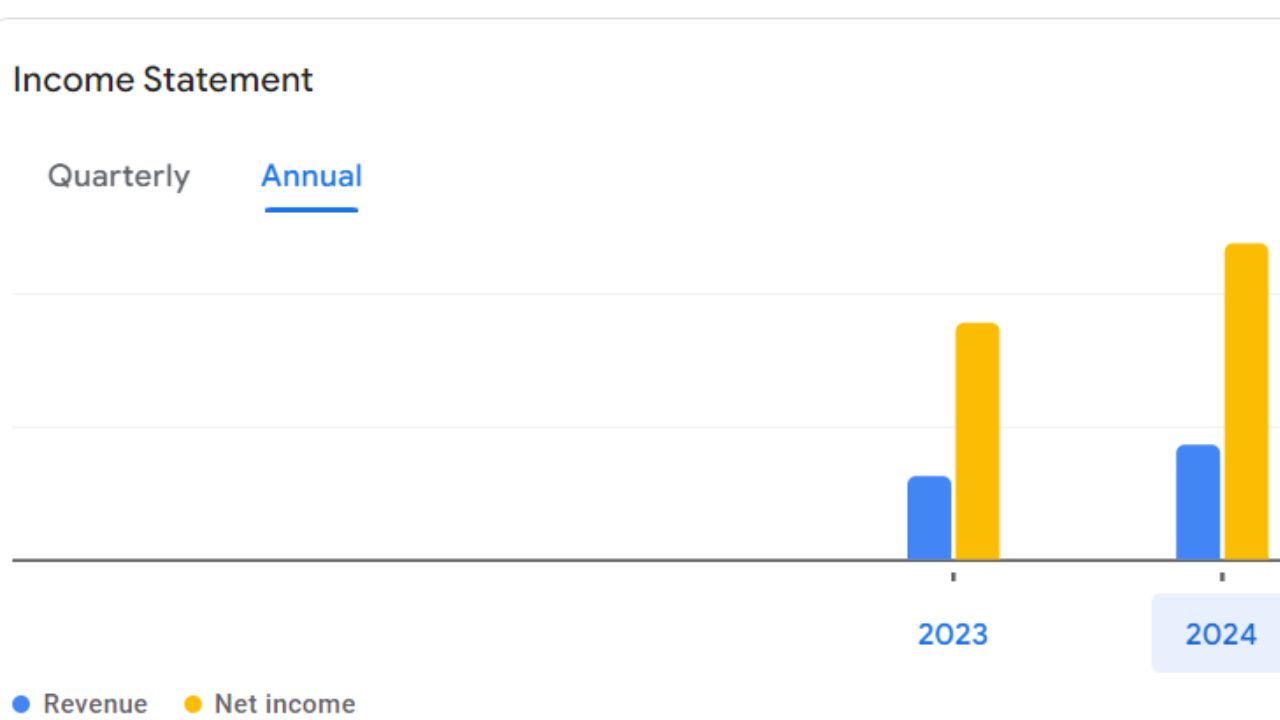

SCILAL Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 246.20 M | +9.52 % |

| Operating Expenses | 29.50 M | +107.75 % |

| Net Income | 119.90 M | -16.91 % |

| Net Profit Margin | 48.70 | -24.13 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 164.73 M | +7.17 % |

| Effective Tax Rate | 22.44 % | N/A |

Factors Influencing SCILAL Share Price

- Technological Advancements: Broadcom’s reputation for innovation and its potential to increase modern-day semiconductor answers play a splendid role in the usage of its percentage charge.

- Strategic Acquisitions: Broadcom’s strategic acquisition facts have bolstered its product portfolio and market presence, contributing to an increase in sales.

- Market Demand: Demand for semiconductors in prevent markets, which consists of factories, facilities, networking, and wireless conversation, appreciably affects Broadcom’s well-known regular generic general overall performance.

- Global Economics Conditions: Economics health, alongside element factors that incorporate GDP boom, interest expenses, and client spending, need to have an effect on Broadcom s fashionable, not unusual performance.

- Competition: The semiconductor organization is pretty competitive, with several key gamers vying for marketplace percent. Broadcom’s aggressive positioning and capacity to innovate are vital.