Sarveshwar Foods Ltd is an Indian company specializing in producing and exporting premium quality rice, particularly Basmati rice. Sarveshwar Foods Share Price on NSE as of 12 September 2024 is 10.55 INR. On this page, you will find Sarveshwar Foods Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Sarveshwar Foods share price target Motilal Oswal, Sarveshwar Foods share News, Sarveshwar Foods share price target tomorrow, Sarveshwar Foods Share Price Target 2025 In Hindi, Sarveshwar Foods share price target 2030, and more Information.

Sarveshwar Foods Ltd Company Details

Sarveshwar Foods Ltd is an Indian company specializing in producing and exporting premium quality rice, particularly Basmati rice. Established with a focus on sustainable farming practices, the company emphasizes organic and natural products. Sarveshwar Foods caters to both domestic and international markets, offering a range of rice varieties and other food products.

Known for its commitment to quality and innovation in the food industry, Sarveshwar Foods aims to deliver healthy and high-standard products, while also promoting environmentally-friendly farming methods.

| Official Website | sarveshwarrice.com |

| Headquarters | India |

| Number of employees | 35 (2023) |

| Subsidiaries | Himalayan Bio Organic Foods Private Limited, Green Point Pte. Ltd. |

| Category | Share Price |

Current Market Overview Of Sarveshwar Foods Share Price

- Open Price: ₹10.55

- High Price: ₹10.80

- Low Price: ₹10.55

- Current Price: ₹10.55

- Market Capitalization: ₹1.03KCrores

- P/E Ratio: Not Available (NA)

- Dividend Yield: Not Available (NA)

- 52-Week High: ₹15.55

- 52-Week Low: ₹4.00

Sarveshwar Foods Share Price Today Chart

Read Also:- Voltas Share Price Target 2024, 2025, 2026, To 2030 Prediction

Sarveshwar Foods Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Sarveshwar Foods for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Sarveshwar Foods Share Price Target Years | SHARE PRICE TARGET |

| 1 | Sarveshwar Foods Share Price Target 2024 | ₹15 |

| 2 | Sarveshwar Foods Share Price Target 2025 | ₹23 |

| 3 | Sarveshwar Foods Share Price Target 2026 | ₹31 |

| 4 | Sarveshwar Foods Share Price Target 2027 | ₹40 |

| 5 | Sarveshwar Foods Share Price Target 2028 | ₹48 |

| 6 | Sarveshwar Foods Share Price Target 2029 | ₹55 |

| 7 | Sarveshwar Foods Share Price Target 2030 | ₹62 |

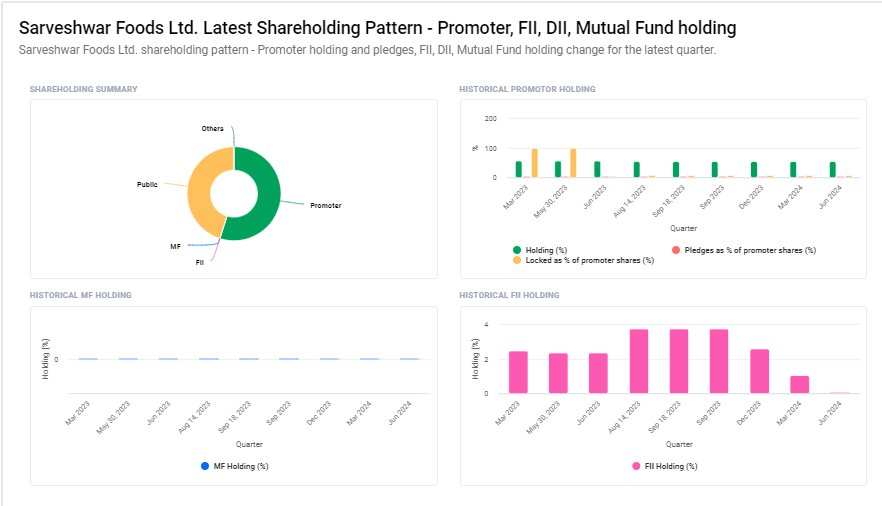

Sarveshwar Foods Ltd. Shareholding Pattern

- Promoters: 54.91%

- Retail and Others: 45.08%

Key Factors Affecting Sarveshwar Foods Share Price Growth

Here are eight key factors that can affect Sarveshwar Foods’ share price growth:

- Demand for Organic Products: Growing consumer preference for organic and healthy food products can increase demand for Sarveshwar Foods’ offerings, positively influencing its share price.

- Export Growth: As Sarveshwar Foods exports to international markets, higher global demand for Basmati rice and other food products can drive revenue growth, boosting the share price.

- Brand Reputation: A strong reputation for quality and sustainable farming can enhance customer loyalty and attract new buyers, supporting share price growth.

- Expansion into New Markets: Expanding into new regions or launching new product lines can increase the company’s market presence, driving sales and improving its stock performance.

- Agricultural Output: Favorable weather conditions and good harvests can lead to higher rice production, lowering costs and supporting profitability, which can boost the share price.

- Government Policies: Supportive policies related to agriculture, exports, or organic farming can benefit Sarveshwar Foods and enhance investor confidence, driving up its share price.

- Cost Management: Efficient management of production and supply chain costs can improve profit margins, positively impacting the company’s financial performance and stock value.

-

Currency Fluctuations: As the company relies on exports, a favorable exchange rate can increase revenue from international sales, supporting share price growth.

Read Also:-

- PNB Share Price Target

- Ola Electric Share Price Target

- IRFC Share Price Target

- BEL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.