Salasar Techno Engineering Ltd is an Indian company that specializes in providing customized steel solutions for infrastructure projects. Salasar Share Price on NSE as of 16 September 2024 is 22.77 INR. On this page, you will find Salasar Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Salasar Technology share price today, Salasar share price target tomorrow, Salasar Techno share price target 2025, Salasar share Price Target 2030, and more Information.

Salasar Techno Engineering Ltd Company Details

Salasar Techno Engineering Ltd is an Indian company that specializes in providing customized steel solutions for infrastructure projects. The company is involved in designing, engineering, and manufacturing telecom towers, transmission towers, and other steel structures used in various sectors like power, telecom, and renewable energy. With a strong focus on quality and innovation, Salasar Techno has built a reputation for delivering reliable solutions across India and globally. The company plays a key role in supporting large-scale infrastructure development, contributing to the growth of essential industries.

| Official Website | salasartechno.com |

| Founded | 2001 |

| Headquarters | India |

| Number of employees | 1,312 (2024) |

| Subsidiaries | EMC Limited, Salasar Adorus Infra LLP |

| Category | Share Price |

Current Market Overview Of Salasar Share Price

- Open: ₹20.99

- High: ₹22.90

- Low: ₹20.45

- Current: ₹22.77

- Mkt cap: ₹3.93KCr

- P/E ratio: 66.73

- Div yield: 0.088%

- 52-wk high: ₹33.95

- 52-wk low: ₹8.73

Salasar Share Price Today Chart

Read Also:- ECOS Mobility Share Price Target 2024, 2025 To 2030 Prediction

Salasar Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Salasar for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Salasar Share Price Target Years | SHARE PRICE TARGET |

| 1 | Salasar Share Price Target 2024 | ₹35 |

| 2 | Salasar Share Price Target 2025 | ₹49 |

| 3 | Salasar Share Price Target 2026 | ₹62 |

| 4 | Salasar Share Price Target 2027 | ₹75 |

| 5 | Salasar Share Price Target 2028 | ₹88 |

| 6 | Salasar Share Price Target 2029 | ₹103 |

| 7 | Salasar Share Price Target 2030 | ₹117 |

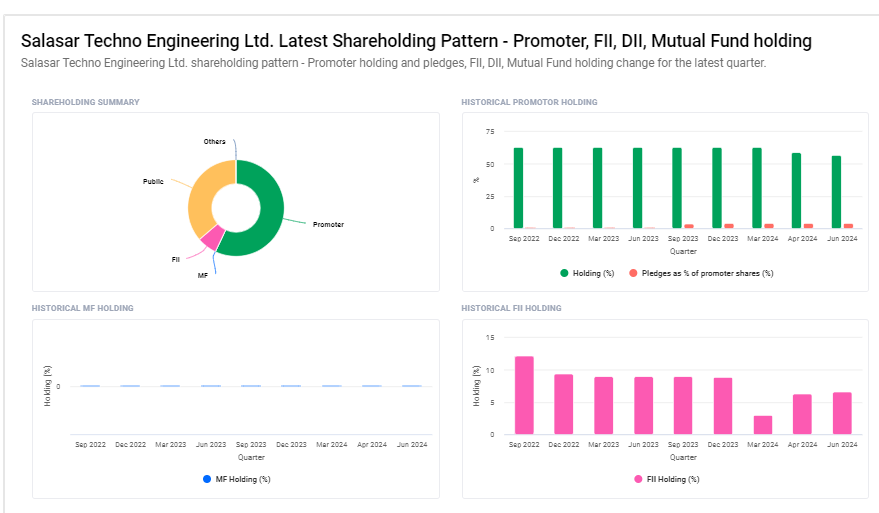

Salasar Techno Engineering Ltd Shareholding Pattern

- Promoters: 55.97%

- Retail and Others: 35.61%

- Foreign Institutions: 8.42%

Key Factors Affecting Salasar Share Price Growth

Here are six key factors affecting the growth of Salasar Techno Engineering Ltd’s share price:

- Demand for Infrastructure Development: Salasar’s business relies heavily on infrastructure projects, including telecom towers and transmission lines. As India and other countries invest in expanding infrastructure, especially in sectors like telecom, power, and renewable energy, Salasar benefits from increased demand. A rise in such projects can lead to higher revenue, boosting investor confidence and driving the share price upward.

- Government Policies and Spending: Government initiatives to promote infrastructure development, such as investments in smart cities, rural electrification, and telecom expansion, can positively impact Salasar’s growth. Favorable policies and increased public spending in these areas would enhance the company’s order book, supporting long-term share price growth.

- Diversification into Renewable Energy: Salasar has been diversifying into the renewable energy sector by providing structures for solar power plants. As the world shifts towards green energy, this diversification offers new growth opportunities. Success in expanding its presence in the renewable energy market could contribute to higher revenue and a stronger share price.

- Cost of Raw Materials: The price of steel and other raw materials is a critical factor for Salasar, as it directly affects production costs. If raw material prices rise without corresponding price increases in their products, it could squeeze profit margins. On the other hand, stable or declining raw material costs would help improve profitability, potentially boosting the company’s share price.

- Competition in the Industry: The steel fabrication and infrastructure sector is highly competitive. If Salasar can maintain or enhance its competitive edge through quality services, timely project delivery, and strong client relationships, it can secure more contracts. This would lead to business growth and a rise in investor confidence, positively affecting its stock price.

-

Expansion into New Markets: Salasar’s ability to expand geographically, both within India and internationally, plays an important role in its future growth. Successful entry into new regions or countries can open up additional revenue streams, increase market share, and positively influence the share price. Global diversification also reduces the company’s dependence on any single market.

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.