Saksoft Ltd is a technology solutions company based in India, specializing in providing innovative digital transformation services. Saksoft Share Price on NSE as of 23 September 2024 is 272.80 INR. On this page, you will find Saksoft Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Saksoft News Today, Why Saksoft share is falling, Saksoft Share Price Target Tomorrow, Saksoft Share Price Target 2030, Saksoft Share Price Target 2040, and more Information.

Saksoft Ltd Company Details

Saksoft Ltd is a technology solutions company based in India, specializing in providing innovative digital transformation services. The company offers a range of solutions, including data analytics, cloud computing, and application development, aimed at helping businesses improve their efficiency and performance. With a strong focus on customer satisfaction, Saksoft partners with clients across various industries to deliver tailored solutions that meet their unique needs. By leveraging advanced technologies, Saksoft aims to drive growth and enable businesses to thrive in a competitive environment.

| Official Website | saksoft.com |

| Headquarters | Chennai |

| Number of employees | 1,946 (2024) |

| Subsidiaries | Augmento Labs Private Limited, STL Tech, and more |

| Category | Share Price |

Saksoft Share Price Today Chart

Current Market Overview Of Saksoft Share Price

- Open Price: ₹278.00

- High Price: ₹281.20

- Low Price: ₹272.15

- Market Capitalization: ₹3.49K crore

- P/E Ratio: 38.45

- Dividend Yield: 0.23%

- 52-Week High: ₹321.76

- 52-Week Low: ₹167.96

- Current Share Price: ₹272.80

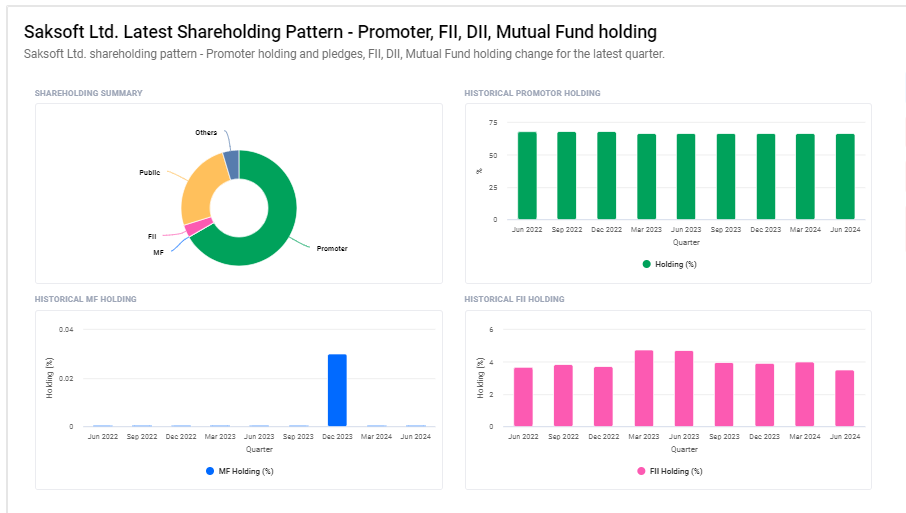

Saksoft Ltd Shareholding Pattern

- Promoters: 66.64%

- Retail and Others: 29.80%

- Foreign Institutions: 3.54%

Read Also:- NTPC Share Price Target 2024, 2025, 2026, 2027 to 2030 Prediction

Saksoft Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Saksoft for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Saksoft Share Price Target Years | SHARE PRICE TARGET |

| 1 | Saksoft Share Price Target 2024 | ₹390 |

| 2 | Saksoft Share Price Target 2025 | ₹455 |

| 3 | Saksoft Share Price Target 2026 | ₹470 |

| 4 | Saksoft Share Price Target 2027 | ₹495 |

| 5 | Saksoft Share Price Target 2028 | ₹545 |

| 6 | Saksoft Share Price Target 2029 | ₹580 |

| 7 | Saksoft Share Price Target 2030 | ₹635 |

Saksoft Share Price Target 2024

The share price target for Saksoft Ltd in 2024 is set at ₹390, reflecting a positive outlook for the company’s growth potential. This target suggests confidence in Saksoft’s ability to continue delivering innovative technology solutions that meet the needs of its clients.

Saksoft Share Price Target 2025

The share price target for Saksoft Ltd in 2025 is projected at ₹455, signaling an optimistic view of the company’s future. This target reflects confidence in Saksoft’s continued growth as it adapts to the evolving technology landscape and meets the demands of its clients.

Key Factors Affecting Saksoft Share Price Growth

Here are five key factors that can influence the growth of Saksoft’s share price:

- Demand for Digital Solutions: As businesses increasingly focus on digital transformation, the demand for Saksoft’s technology services, such as data analytics and cloud computing, is likely to rise. Higher demand can lead to increased revenue and a positive impact on share price.

- Innovation and Product Development: Saksoft’s ability to innovate and develop new solutions that address changing market needs can enhance its competitiveness. Successful product launches can attract more clients and investors, supporting share price growth.

- Market Trends: Overall trends in the technology sector, such as advancements in artificial intelligence or machine learning, can influence Saksoft’s performance. Staying ahead of these trends can help the company capture new opportunities and boost its share price.

- Client Relationships: Building and maintaining strong relationships with clients is essential for Saksoft’s success. High customer satisfaction can lead to repeat business and referrals, positively affecting the company’s financial health and share price.

-

Economic Conditions: The overall economic environment impacts business spending on technology. A strong economy may lead to higher investment in digital solutions, benefiting Saksoft’s growth and positively influencing its share price. Conversely, economic downturns could pose challenges.

Read Also:-

- Chambal Fertilisers Share Price Target

- Astral Share Price Target

- Unitech Share Price Target

- SEPC Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.