Reflex Industries Ltd. It is an Indian commercial corporation business corporation on the whole involved in sectors collectively with solar energy, refrigerant gasses, and coal ash handling. Over the years, the organization has gained big traction in its respective industries, especially due to the developing call for renewable strength and clean generation answers. With an awesome boom in percent charge and growing hobby from customers, Refex Industries has emerged as a key participant in its place of hobby.

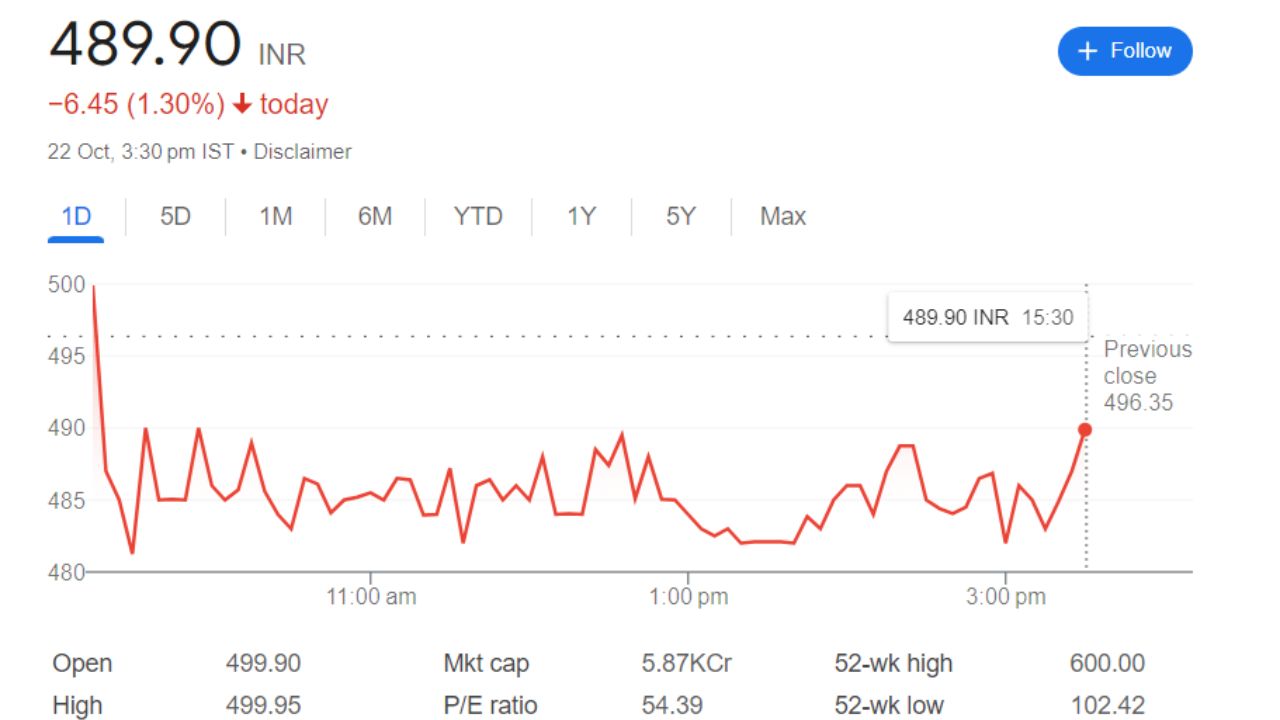

Current Overview of Refex Industries Share Performance

- Open: ₹490.00

- High: ₹505.00

- Low: ₹488.00

- Market Capitalization: ₹5.97KCr

- P/E Ratio: 55.50

- Dividend Yield: N/A

- 52-Week High: ₹600.00

- 52-Week Low: ₹102.40

- Current Price: ₹489.90

Stockholding Patterns For Refex Industries Share Price

- Promoters: 57.13%

- Retail and Others: 42.57%

- Foreign Institutions (FII/FPI): 0.29%

Refex Industries Share Price Current Graph

Refex Industry Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 685 |

| 2025 | 1087 |

| 2026 | 1244 |

| 2027 | 1424 |

| 2028 | 1630 |

| 2029 | 1865 |

| 2030 | 2134 |

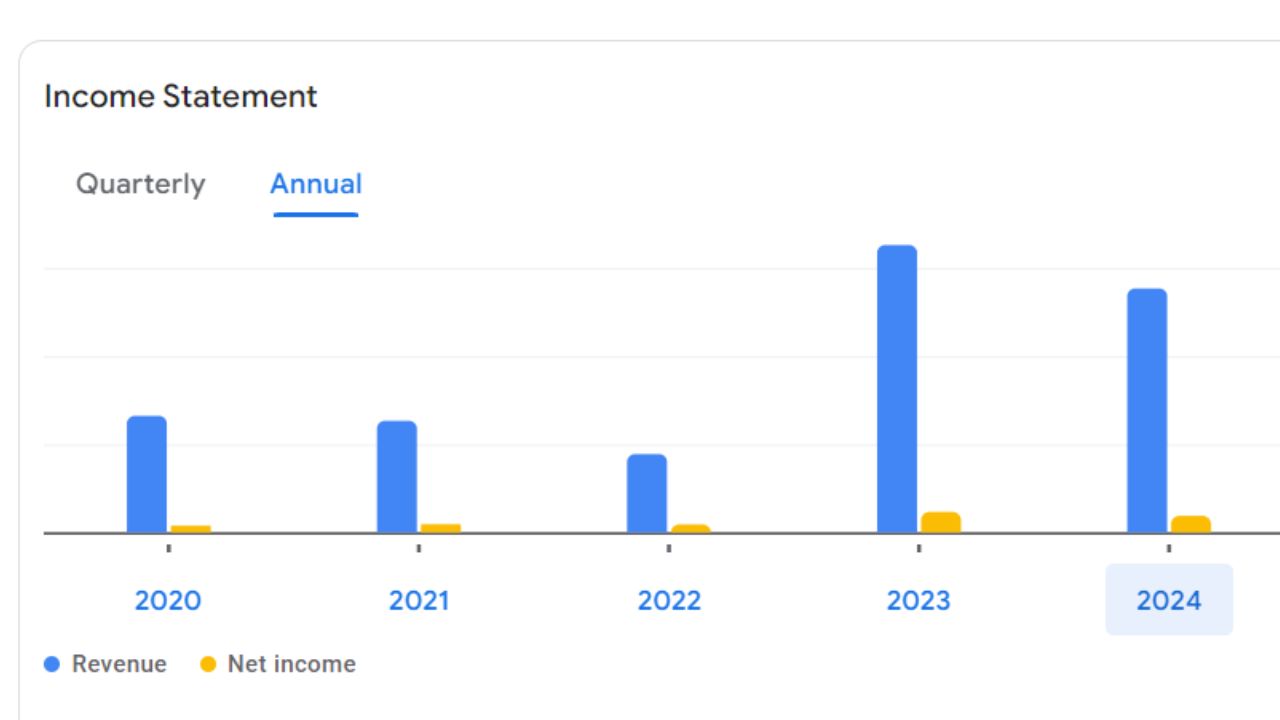

Refex Industries Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 5.95 B | +55.66 % |

| Operating Expenses | 201.74 M | +48.84 % |

| Net Income | 300.31 M | +41.8% |

| Net Profit Margin | 5.05 | -9.17 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 461.97 M | +29.73 % |

| Effective Tax Rate | 24.87 % | N/A |

Historical Performance For Avance Technologies Share Price

Understanding Orient Green Power’s historical stock performance is crucial for forecasting future trends. The company’s share price has been influenced by several factors.

- Market Condition: Broader market trends and investor sentiments towards renewable energy stocks.

- Financial Performance: Revenue growth, profit margin, and operational efficiency.

- Regulatory Environment: Government Policies and incentives related to renewable energy.