RBL Bank is a private-sector bank. RBL Share Price on NSE as of 26 August 2024 is 228.54 INR. On this page, you will find RBL Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as RBL Bank share price target by the brokerage firm, RBL Bank share News today, Rbi share price NSE, RBL Bank latest News today, RBL Bank share price target tomorrow, RBL Bank share price target 2030, and more Information.

RBL Bank Ltd Details

RBL Bank Ltd is a private sector bank headquartered in Mumbai, India. It provides a wide range of financial services, including personal and business banking, loans, and investment solutions. With a focus on customer-centric services and innovative banking solutions, RBL Bank aims to meet the diverse needs of its clients. The bank operates through an extensive network of branches and ATMs across India, offering both traditional and digital banking services to enhance customer convenience.

| Official Website | rblbank.com |

| Founded | 14 June 1943 |

| Headquarters | Mumbai, Maharashtra, India |

| MD & CEO | R Subramaniakumar |

| Number of employees | 22,564 (2024) |

| Category | Share Price |

Current Market Overview Of RBL Share Price

- Open: ₹227.38

- High: ₹228.79

- Low: ₹223.52

- Market Cap: ₹13.87K Crores

- P/E Ratio: 10.88

- Dividend Yield: 0.66%

- 52-Week High: ₹300.70

- 52-Week Low: ₹205.25

RBL Share Price Recent Graph

Read Also:- Indigo Share Price Target 2024, 2025, 2026 to 2030 Prediction

RBL Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of RBL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | RBL Share Price Target Years | Target Share Price |

| 1 | RBL Share Price Target 2024 | ₹ 320 |

| 2 | RBL Share Price Target 2025 | ₹ 430 |

| 3 | RBL Share Price Target 2026 | ₹ 605 |

| 4 | RBL Share Price Target 2027 | ₹ 797 |

| 5 | RBL Share Price Target 2028 | ₹ 1004 |

| 6 | RBL Share Price Target 2029 | ₹ 1136 |

| 7 | RBL Share Price Target 2030 | ₹ 1310 |

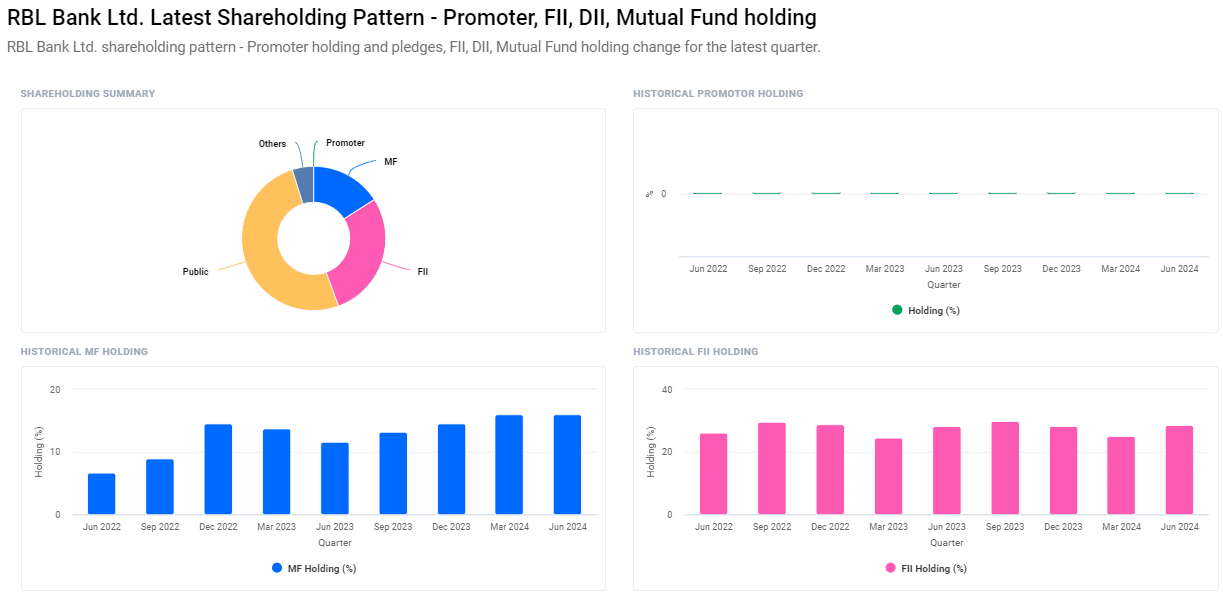

Shareholding Pattern For RBL Share Price

- Retail and Others: 50.87%

- Foreign Institutions (FII/FPI): 28.46%

- Mutual Funds: 15.95%

- Other Domestic Institutions: 4.70%

Risks and challenges to RBL Bank share price

-

Credit Risk: RBL Bank faces the risk of loan defaults and non-performing assets (NPAs). If borrowers are unable to repay their loans, it can lead to financial losses for the bank and affect its profitability, potentially impacting the share price.

- Regulatory Changes: Changes in banking regulations and policies can affect RBL Bank’s operations and financial performance. New regulatory requirements or compliance costs could impact the bank’s profitability and investor confidence, influencing its share price.

- Economic Conditions: The broader economic environment plays a crucial role in the bank’s performance. Economic slowdowns or fluctuations can affect loan demand, asset quality, and overall financial stability, which can impact the share price.

- Interest Rate Fluctuations: Changes in interest rates can affect RBL Bank’s interest income and expense. Rising rates might increase borrowing costs and reduce loan demand, while falling rates could impact the bank’s profitability from interest income, affecting its share price.

-

Competitive Pressure: The banking sector is highly competitive, with numerous players offering similar services. Increased competition can lead to pressure on profit margins, reduced market share, and potentially impact the bank’s financial performance and share price.

Read Also:-

- Bajaj Finance Share Price Target

- Bharat Dynamics Share Price Target

- Deepak Nitrite Share Price Target

- DCW Share Price Target

- Avantel Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.