Radico Khaitan is a renowned Indian company specializing in the production of industrial alcohol and Indian Made Foreign Liquor (IMFL). As the fourth-largest liquor company in India, Radico Khaitan is known for its high-quality products and strong market presence. Radico Khaitan Share Price on NSE as of 28 August 2024 is 1,831.70 INR. On this page, you will find Radico Khaitan Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Radico Khaitan share latest News, Magic Moments Share price target, Why Radico Khaitan is falling, Radico Khaitan share price target tomorrow, and more Information.

Radico Khaitan Ltd Company Details

Radico Khaitan Ltd is one of India’s largest and oldest manufacturers of Indian Made Foreign Liquor (IMFL). Established in 1943, the company has grown to become a leading player in the spirits industry, known for producing popular brands like Magic Moments Vodka, 8 PM Whisky, and Morpheus Brandy.

Radico Khaitan focuses on delivering high-quality products and has a strong presence both in India and internationally. With a commitment to innovation and excellence, the company continues to expand its product portfolio, catering to diverse consumer tastes and preferences.

| Official Website | radicokhaitan.com |

| Founded | Rampur, United Provinces, British India (1943) |

| Headquarters |

Rampur, Uttar Pradesh, India

|

| Chairman | Dr. Lalit Khaitan |

| MD | Abhishek Khaitan |

| Number of employees | 1,469 (2024) |

| Category | Share Price |

Current Market Overview Of Radico Khaitan Share Price

- Open: ₹1,824.00

- High: ₹1,855.40

- Low: ₹1,805.00

- Market Cap: ₹24.54K crore

- P/E Ratio: 93.41

- Dividend Yield: 0.16%

- 52-Week High: ₹1,910.00

- 52-Week Low: ₹1,141.25

- Current Price: ₹1,831.70

Radico Khaitan Share Price Recent Graph

Read Also:- Avantel Share Price Target 2024, 2025 to 2030 and More Details

Radico Khaitan Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Radico Khaitan for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Radico Khaitan Share Price Target Years | SHARE PRICE TARGET |

| 1 | Radico Khaitan Share Price Target 2024 | ₹2110 |

| 2 | Radico Khaitan Share Price Target 2025 | ₹2205 |

| 3 | Radico Khaitan Share Price Target 2026 | ₹3190 |

| 4 | Radico Khaitan Share Price Target 2027 | ₹3650 |

| 5 | Radico Khaitan Share Price Target 2028 | ₹4195 |

| 6 | Radico Khaitan Share Price Target 2029 | ₹4807 |

| 7 | Radico Khaitan Share Price Target 2030 | ₹5498 |

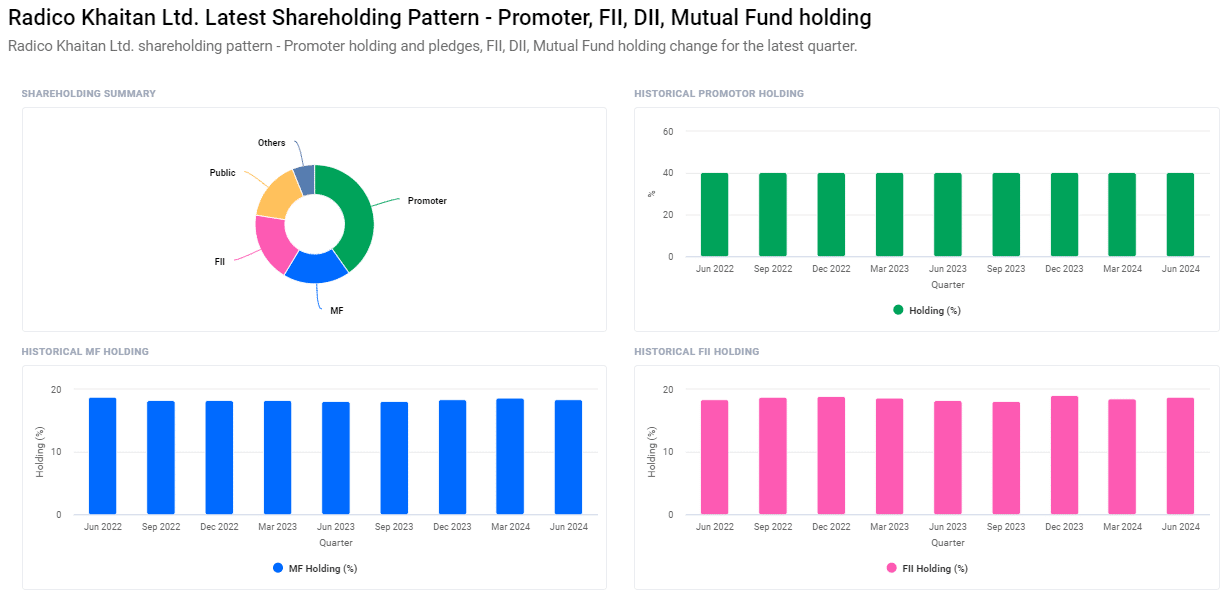

Shareholding Pattern For Radico Khaitan Share Price

- Promoters: 40.26%

- Foreign Institutions: 18.80%

- Mutual Funds: 18.41%

- Retail And Others: 16.44%

- Other Domestic Institutions: 6.07%

Risks and Challenges For Radico Khaitan Share Price

- Brand Image and Reputation: Any issues related to product quality, safety, or negative publicity can harm Radico Khaitan’s brand reputation. A damaged reputation could lead to a loss of consumer trust and decreased sales, impacting the company’s financial performance and share price.

- Foreign Exchange Fluctuations: As Radico Khaitan engages in international trade, fluctuations in foreign exchange rates can impact its costs and revenues. A strong or weak rupee could affect profitability and, in turn, influence the company’s share price.

- Supply Chain Disruptions: Disruptions in the supply chain, such as transportation strikes, natural disasters, or pandemics, can affect the availability of products, leading to lost sales and revenue. This can create uncertainty for investors and affect the share price.

- Regulatory Changes: The liquor industry is heavily regulated in India. Any sudden changes in government policies, such as increased taxes or stricter regulations on alcohol sales, can negatively impact Radico Khaitan’s profitability and share price.

- Raw Material Costs: The cost of key ingredients like grains and molasses can fluctuate due to changes in agricultural output or market conditions. Rising raw material costs can lead to higher production expenses, which could reduce profit margins.

- Competitive Market: The Indian liquor market is highly competitive, with numerous players vying for market share. Increased competition from both domestic and international brands can put pressure on Radico Khaitan to maintain its market position, affecting its share price.

- Economic Slowdown: Economic downturns can lead to reduced consumer spending, including on discretionary items like alcohol. If consumers cut back on alcohol purchases, it could lead to lower sales for Radico Khaitan and potentially impact its share price.

Read Also:-

- IDFC First Bank Share Price Target

- SBI Share Price Target

- ICIC Bank Share Price Target

- Indigo Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.