Prataap Snacks Limited is one of the primary snack manufacturers in India, for its various product portfolios, which include conventional and modern snacks. The company has mounted itself within the Indian grocery store, catering to the growing name for accessible and appealing snacks. Popularly recognized for its flagship emblem yellow Diamond, Pratap Snacks has a nicely-identified presence in each town and rural markets.

The corporation’s awareness of innovation, first-rate, and range has allowed it to gain a sturdy foothold within the pretty aggressive meals commercial enterprise company.

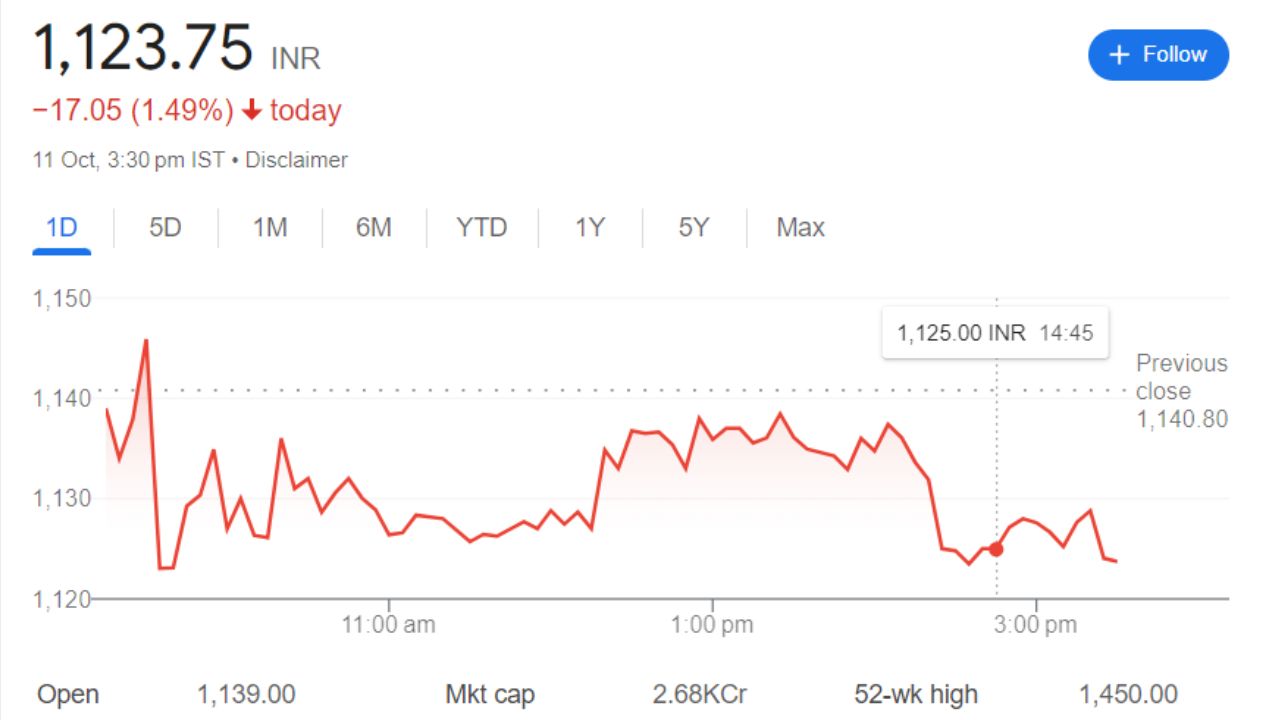

Overview Of Prataap Snacks Share Price

Before delving into the destiny projection, it is important to evaluate the contemporary financial fitness and marketplace standard overall performance of Prataap Snacks.

Here’s a breakdown of the crucial factor monetary metrics as of the maximum present-day data:

- Today’s Open: 1080.00

- Today’s High: 1167.95

- Today’s Low: 1047.00

- Current Share Price: 1123.75

- Market Capital: 2550 crore

- P/E: 51.86

- Dividend Yield: 0.19 %

- 52 Week High: 1450.00

- 52 Week Low: 746.70

Prataap Snacks Share Price Current Graph

Prataap Snacks Share Price Target Tomorrow From 2024 To 2030

This analysis for upcoming years is based on market valuation, industrial trends, and expert analysis.

| S. No. | Share Price Target Years | Share Target Value |

|

|

2024 | 1551 |

|

|

2025 | 1696 |

|

|

2026 | 1941 |

|

|

2027 | 2221 |

|

|

2028 | 2540 |

|

|

2029 | 2907 |

|

|

2030 | 3325 |

Shareholding Pattern For Prataap Snacks

- Promoters: 64.20 %

- Foreign Institutions: 5.41 %

- Domestic Institutions: 2.79 %

- Mutual Funds: 7.90 %

- Retail and Others: 19.70 %

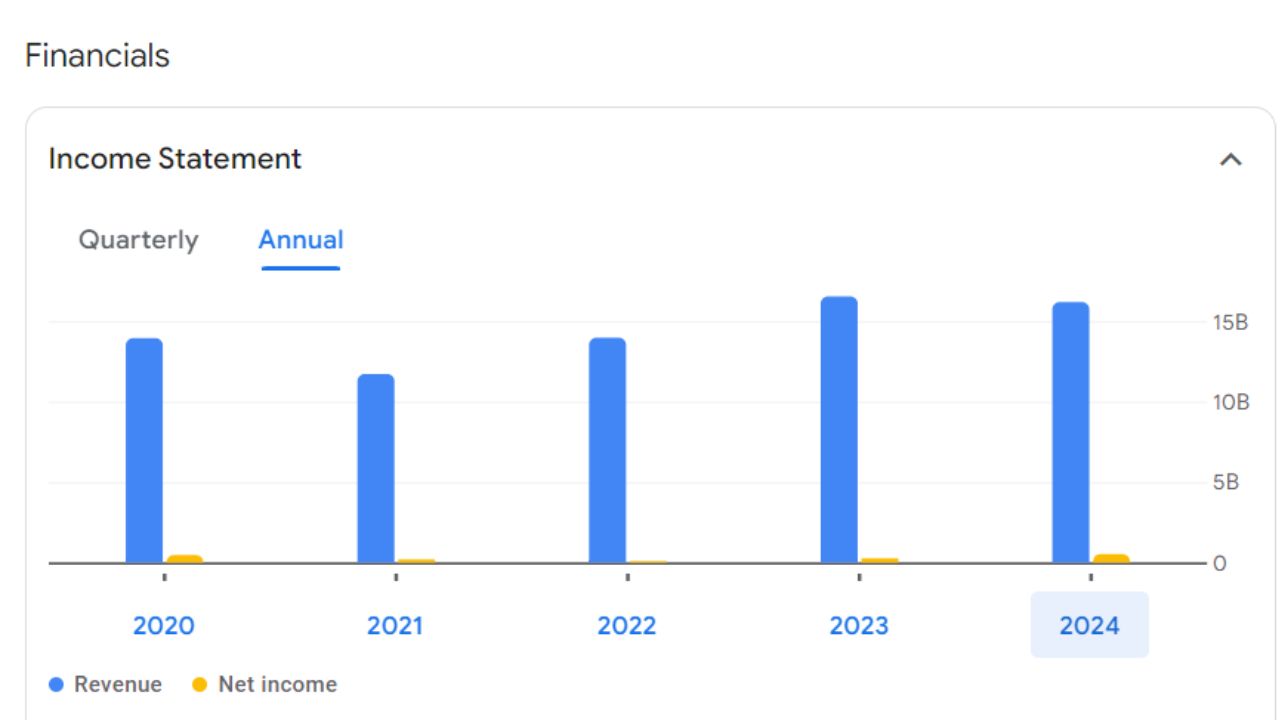

Prataap Snacks Annual Income Statement

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 4.21 B | 8.67 % |

| Operating Expenses | 1.91 B | +5.06 % |

| Net Income | 94.39 M | -29.69 % |

| Net Profit Margin | 2.24 | -35.26 % |

| Earning Per Share | 3.95 | -33.58 % |

| EBITDA | 290.72 M | +3.26 % |

| Effective Tax Rate | 26.39 % | N/A |

Factors For Prataap Snacks Share Price

Prataap Snacks’ share price is influenced by several key factors:

- Market Demand: The Indian snacks industry is resilient, with consistent consumer demand for affordable snacks, benefiting Prataap Snacks’ popular Yellow Diamond brand

- Recent Acquisition: A significant stake acquisition by Authum Investment & Infrastructure has boosted investor confidence, driving a 23% share price increase recently

- Strategic Initiatives: The company is focusing on expanding its nankeen segment and optimizing distribution costs, aiming for sustainable growth and improved profitability.