Praj Industries Limited is an Indian company that specializes in process engineering and project development on a global scale. Praj Industries Share Price on NSE as of 10 September 2024 is 721.00 INR. On this page, you will find Praj Industries Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Praj Industries share price target tomorrow, Praj Industries share price target by Equity, Praj Industries news today, Praj Industries Share Price target 2027, Praj Industries share price target 2030, and more Information.

Praj Industries Ltd Company Details

Praj Industries Ltd is an Indian company specializing in sustainable solutions for bioenergy, biofuels, and environmental technology. Established in 1983, Praj is a global leader in bioethanol production technology, helping industries and governments transition to cleaner, renewable energy sources.

The company is known for its innovative solutions in bio-based processing, wastewater treatment, and high-purity systems. Praj Industries operates in over 75 countries and has built a strong reputation for its commitment to sustainability and green energy. Its focus on advanced technology and environmental conservation has made it a key player in the renewable energy sector.

| Official Website | praj.net |

| CEO | Shishir Joshipura (2 Apr 2018–) |

| Founded | 1983 |

| Headquarters | Pune, Maharashtra, India |

| Chairman | Pramod Chaudhari |

| Number of employees | 1,400 (2024) |

| Category | Share Price |

Current Market Overview Of Praj Industries Share Price

- Open: ₹729.00

- High: ₹735.90

- Low: ₹718.95

- Current Price: ₹721.00

- Mkt cap: ₹13.25KCr

- P/E ratio: 42.89

- Div yield: 0.83%

- 52-wk high: ₹812.95

- 52-wk low: ₹448.00

Praj Industries Share Price Today Chart

Read Also:- Titagarh Share Price Target 2024, 2025 To 2030 and More Details

Praj Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Praj Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Praj Industries Share Price Target Years | Share Price Target |

|---|---|---|

| 1 | Praj Industries Share Price Target 2024 | ₹914 |

| 2 | Praj Industries Share Price Target 2025 | ₹1275 |

| 3 | Praj Industries Share Price Target 2026 | ₹1458 |

| 4 | Praj Industries Share Price Target 2027 | ₹1661 |

| 5 | Praj Industries Share Price Target 2028 | ₹1915 |

| 6 | Praj Industries Share Price Target 2029 | ₹2180 |

| 7 | Praj Industries Share Price Target 2030 | ₹2495 |

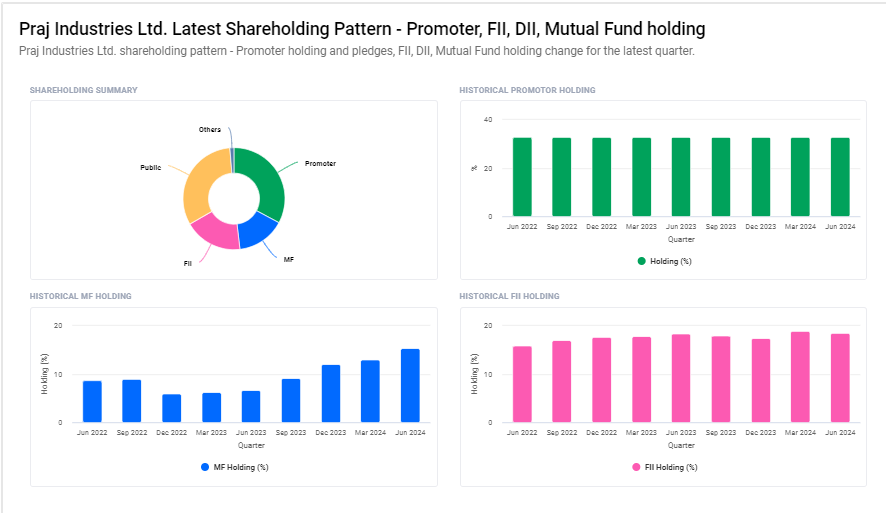

Praj Industries Ltd Shareholding Pattern

- Promoters: 32.8%

- Foreign Institutions: 18.6%

- Mutual Fund: 32%

- Domestic Institutions: 16.7%

Key Factors Affecting Praj Industries Share Price Growth

Here are six key factors that can affect Praj Industries’ share price growth:

- Demand for Biofuels: As Praj Industries specializes in biofuels, increased global demand for renewable energy and biofuels can lead to higher sales, positively impacting the company’s share price.

- Government Policies: Favorable policies promoting clean energy and biofuel adoption, both in India and internationally, can boost Praj’s business, contributing to share price growth.

- Innovation and Technology: Praj’s focus on developing advanced bioenergy and environmental technologies keeps it competitive. Successful innovations can attract investors and drive up the stock price.

- Sustainability Trends: Growing awareness and demand for sustainable and eco-friendly solutions across industries can enhance Praj’s market position, leading to potential stock price growth.

- Global Expansion: As Praj operates in multiple countries, expanding into new international markets or securing large global contracts can boost revenues and positively affect its share price.

-

Economic Conditions: Favorable economic conditions, particularly in sectors like energy and infrastructure, can increase demand for Praj’s solutions, supporting its financial growth and share price performance.

Read Also:-

- Alok Industries Share Price Target

- Natco Pharma Share Price Target

- EID Parry Share Price Target

- Voltas Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.