Piramal Pharma Ltd is a leading Indian pharmaceutical company. Piramal Pharma Share Price on BSE as of 13 September 2024 is 229.15 INR. On this page, you will find Piramal Pharma Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Piramal Pharma News, PPL Pharma share price NSE, Piramal Pharma share price target tomorrow, Piramal Pharma Share Price target 2030, Piramal Pharma Share Price Target 2040, and more Information.

Piramal Pharma Ltd Company Details

Piramal Pharma Ltd is a leading Indian pharmaceutical company that focuses on providing high-quality healthcare solutions. The company operates in various segments, including contract development and manufacturing (CDMO), critical care, and consumer healthcare products. Piramal Pharma is known for its global reach and strong presence in developed and emerging markets. The company aims to deliver innovative and affordable medicines, catering to a wide range of therapeutic areas. With its commitment to research and quality, Piramal Pharma is key in improving healthcare worldwide.

| Official Website | piramalpharma.com |

| Founded | 2020 |

| Headquarters | India |

| Number of employees | 6,719 (2024) |

| Subsidiaries | Piramal Critical Care, Piramal Critical Care Limited |

| Category | Share Price |

Current Market Overview Of Piramal Pharma Share Price

- Open: ₹227.95

- High: ₹233.70

- Low: ₹227.60

- Current: ₹229.15

- Mkt cap: ₹ 30.32KCr

- P/E ratio: 1,087.46

- Div yield: 0.048%

- 52-wk high: ₹244.10

- 52-wk low: ₹87.55

Piramal Pharma Share Price Today

Read Also:- Subex Share Price Target 2024, 2025, 2026 To 2030 Prediction

Piramal Pharma Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Piramal Pharma for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Piramal Pharma Share Price Target Years | SHARE PRICE TARGET |

| 1 | Piramal Pharma Share Price Target 2024 | ₹252 |

| 2 | Piramal Pharma Share Price Target2025 | ₹390 |

| 3 | Piramal Pharma Share Price Target 2026 | ₹518 |

| 4 | Piramal Pharma Share Price Target 2027 | ₹650 |

| 5 | Piramal Pharma Share Price Target 2028 | ₹792 |

| 6 | Piramal Pharma Share Price Target 2029 | ₹947 |

| 7 | Piramal Pharma Share Price Target 2030 | ₹1102 |

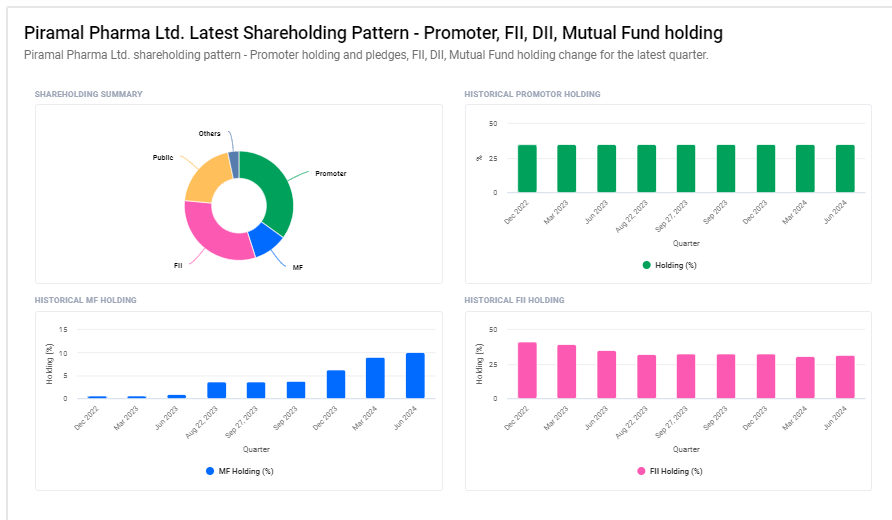

Piramal Pharma Ltd Shareholding Pattern

- Promoters: 34.95%

- Foreign Institutions: 31.40%

- Retail and Others: 20.68%

- Mutual Funds: 10.12%

- Other Domestic Institutions: 2.84%

Factors Influencing Piramal Pharma Share Price

Here are six key factors that can influence Piramal Pharma’s share price:

- Performance in Contract Development and Manufacturing (CDMO): Piramal Pharma’s CDMO segment plays a major role in its revenue generation. Growth in this area depends on the company’s ability to secure long-term contracts from global pharmaceutical companies. If the company continues to attract new clients and expand its manufacturing capabilities, this can boost earnings and drive the share price higher.

- Regulatory Approvals and Compliance: As a pharmaceutical company, Piramal Pharma operates in a highly regulated environment. Any delays in obtaining regulatory approvals for new products or issues related to compliance with safety and quality standards could negatively impact the share price. On the other hand, timely approvals for key products and adherence to regulations can build investor confidence and positively influence the stock.

- Global Market Demand for Healthcare: Piramal Pharma’s products cater to both developed and emerging markets. The demand for critical care products, consumer healthcare items, and other pharmaceuticals affects the company’s performance. A rise in global healthcare spending, especially in critical care and specialty treatments, could fuel revenue growth, pushing the share price upward.

- Expansion in Consumer Healthcare: The company’s consumer healthcare segment, which offers over-the-counter (OTC) products, has growth potential. Successful launches of new products or expansion into new regions can increase market share and drive revenue. Strong performance in this segment can have a positive impact on Piramal Pharma’s overall profitability, supporting share price growth.

- Research and Development (R&D) Investments: Innovation is crucial for the pharmaceutical industry. Piramal Pharma’s focus on research and development determines its ability to introduce new and improved treatments. Significant R&D investments that lead to successful product launches can enhance the company’s growth prospects, positively impacting its stock price.

-

Mergers, Acquisitions, and Strategic Partnerships: Piramal Pharma has a history of growing through acquisitions and partnerships. Any future mergers, acquisitions, or collaborations that strengthen its position in key markets or broaden its product portfolio can boost investor optimism. Positive developments in this area could lead to an increase in the company’s valuation and share price.

Read Also:-

- Suzlon Share Price Target

- NCC Share Price Target

- Tata Motors Share Price Target

- Infosys Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.