Paras is an Indian company that specializes in providing cutting-edge technology for the defense and space sectors. Paras Share Price on NSE as of 6 September 2024 is 1,210.00 INR. On this page, you will find Paras Defence Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Why Paras Defence share is falling, Paras share price target tomorrow, Paras share price target 2025, Paras Petrofils share price target 2025, and more Information.

Paras Defence and Space Technologies Ltd Company Details

Paras Defence and Space Technologies Ltd is an Indian company that specializes in providing cutting-edge technology for the defense and space sectors. They design, develop, and manufacture advanced equipment, including defense electronics, space optics, and precision engineering products. With a focus on innovation and high-quality solutions, Paras Defence plays a crucial role in supporting India’s defense and space missions, contributing to the nation’s security and technological growth.

| Official Website | parasdefence.com |

| Founded | 16 June 2009 |

| Headquarters | India |

| Number of employees | 418 (2024) |

| Category | Share Price |

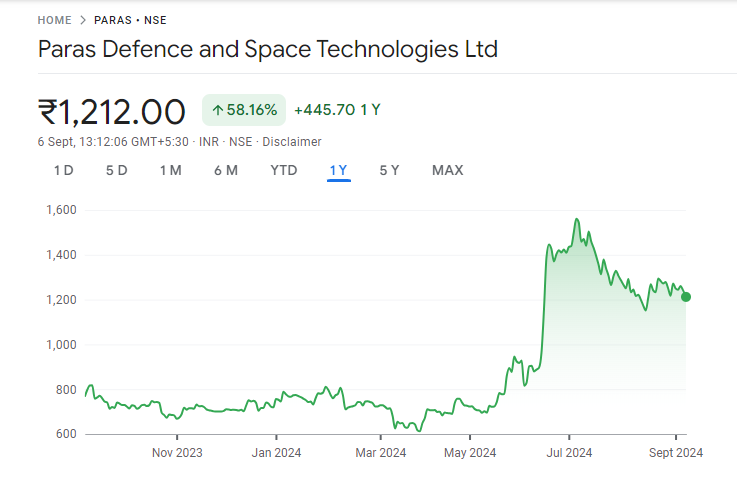

Current Market Overview Of Paras Share Price

- Open Price: ₹1,235.50

- High Price: ₹1,250.00

- Low Price: ₹1,210.00

- Current Price: ₹1,264.00

- Market Capitalization: ₹4.72K Crores

- P/E Ratio: 115.22

- Dividend Yield: Not Applicable

- 52-Week High: ₹1,592.70

- 52-Week Low: ₹610.00

Paras Share Price Today Chart

Read Also:- Mangalam Cement Share Price Target 2024, 2025 To 2030

Paras Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Paras Defence for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Paras Share Price Target Years | Share Price Target |

| 1 | Paras Share Price Target 2024 | ₹1,620 |

| 2 | Paras Share Price Target 2025 | ₹2,665 |

| 3 | Paras Share Price Target 2026 | ₹3070 |

| 4 | Paras Share Price Target 2027 | ₹3,512 |

| 5 | Paras Share Price Target 2028 | ₹4,020 |

| 6 | Paras Share Price Target 2029 | ₹4,595 |

| 7 | Paras Share Price Target 2030 | ₹5,259 |

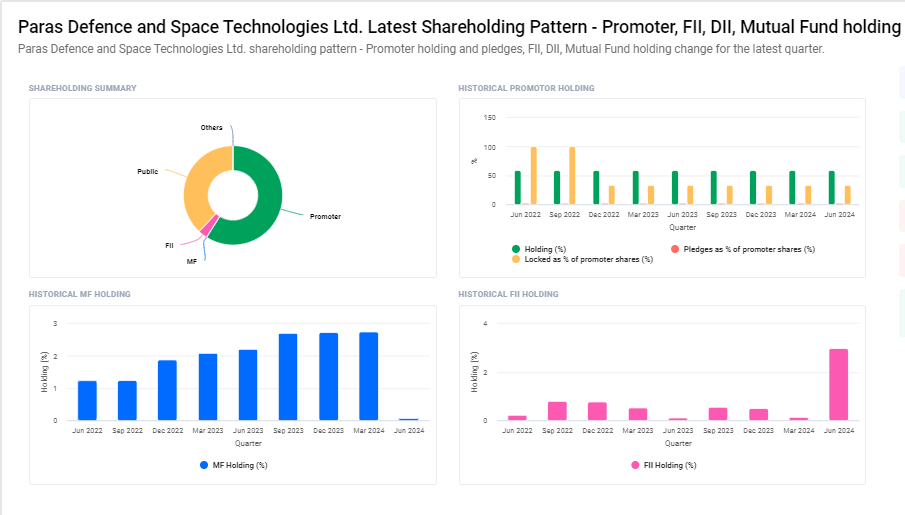

Paras Defence and Space Technologies Ltd Shareholding Pattern

- Promoters: 58.94%

- Retail and Others: 38.01%

- Foreign Institutions: 2.97%

- Mutual Funds: 0.06%

- Other Domestic Institutions: 0.01%

Risks and Challenges to Paras Share Price

Here are five risks and challenges that could impact Paras Defence and Space Technologies’ share price:

- Dependence on Government Contracts: A significant portion of Paras Defence’s business comes from government contracts. Any delays or reductions in defense and space budgets could impact the company’s revenue and, in turn, affect the share price.

- Technological Advancements: The defense and space sectors are rapidly evolving. If Paras Defence fails to keep up with new technologies or faces competition from more advanced companies, it could hurt its market position and share price.

- Regulatory Changes: Changes in government regulations, especially related to defense and export policies, can create challenges for Paras Defence. Unfavorable policies could lead to operational delays or additional costs, impacting profitability.

- Global Competition: Paras Defence operates in a highly competitive global market. Competing with international companies that have larger resources or more advanced technology could pose a challenge to its growth and share price.

-

Supply Chain Disruptions: The company relies on a complex supply chain for manufacturing its products. Any disruptions, whether due to geopolitical tensions or global shortages, can lead to production delays, affecting sales and investor confidence.

Key Factors Affecting Paras Share Price Growth

Here are five key factors that can influence the growth of Paras Defence and Space Technologies’ share price:

- Government Contracts and Defense Spending: Paras Defence relies heavily on defense and space contracts from the government. An increase in defense spending or new government projects can lead to higher revenues and positively impact the share price.

- Technological Innovation: The company’s ability to innovate and develop advanced defense and space technologies is crucial for growth. Introducing cutting-edge products can attract more clients and boost investor confidence, leading to share price growth.

- Expansion into Global Markets: Success in entering and expanding into international markets can significantly boost revenue. If Paras Defence secures global contracts or partnerships, it could enhance its market position and drive up the share price.

- Partnerships and Collaborations: Strategic alliances with other companies, research institutions, or government agencies can strengthen Paras Defence’s capabilities. These partnerships can lead to new opportunities, which can positively influence its share price.

-

Company Performance and Financial Health: Strong financial results, including steady revenue growth, healthy profit margins, and efficient cost management, are essential for attracting investors. Consistent financial performance can drive confidence and result in share price growth.

Read Also:-

- Axita Cotton Share Price Target

- HFCL Share Price Target

- GMR Power Share Price Target

- Nestle India Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.