Page Industries Ltd is an Indian company known for manufacturing and distributing innerwear, sportswear, and leisurewear under the Jockey brand. Page Industries Share Price on NSE as of 18 September 2024 is 42,983.35 INR. On this page, you will find Page Industries Share Price Target 2024, 2025, 2026, 2027 to 2030, as well as Jockey Share price target, Jockey share price NSE today, Page Industries, share price target tomorrow, Page Industries share price target 2030, and more Information.

Page Industries Ltd Company Details

Page Industries Ltd is an Indian company known for being the exclusive licensee of Jockey International in India, Sri Lanka, Bangladesh, Nepal, and the UAE. It manufactures and distributes innerwear, sportswear, and leisurewear under the Jockey brand. Founded in 1994, the company has grown into a well-known name in the apparel industry, providing high-quality and comfortable clothing. Page Industries focuses on innovation, product quality, and a strong retail presence, making it a leader in its segment within the Indian market.

| Official Website | jockey.in |

| Founded | 1994 |

| Headquarters |

Bangalore, Karnataka, India

|

| Chairman |

Sunder Genomal |

| CEO | V S Ganesh (1 Jun 2021–) |

| Number of employees | 19,461 (2024) |

| Category | Share Price |

Current Market Overview Of Page Industries Share Price

- Open Price: ₹43,500.00

- High Price: ₹44,100.00

- Low Price: ₹42,603.90

- Market Cap: ₹47.96KCr

- P/E Ratio: 83.27

- Dividend Yield: 1.38%

- 52-Week High: ₹44,100.00

- 52-Week Low: ₹33,070.05

- Current Price: ₹42,983.35

Page Industries Share Price Today Chart

Page Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Page Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Page Industries Share Price Target Years | SHARE PRICE TARGET |

| 1 | Page Industries Share Price Target 2024 | ₹47720 |

| 2 | Page Industries Share Price Target 2025 | ₹48524 |

| 3 | Page Industries Share Price Target 2026 | ₹55540 |

| 4 | Page Industries Share Price Target 2027 | ₹63525 |

| 5 | Page Industries Share Price Target 2028 | ₹70698 |

| 6 | Page Industries Share Price Target 2029 | ₹83195 |

| 7 | Page Industries Share Price Target 2030 | ₹95207 |

Read Also:- SAIL Share Price Target 2024, 2025 To 2030 and More Details

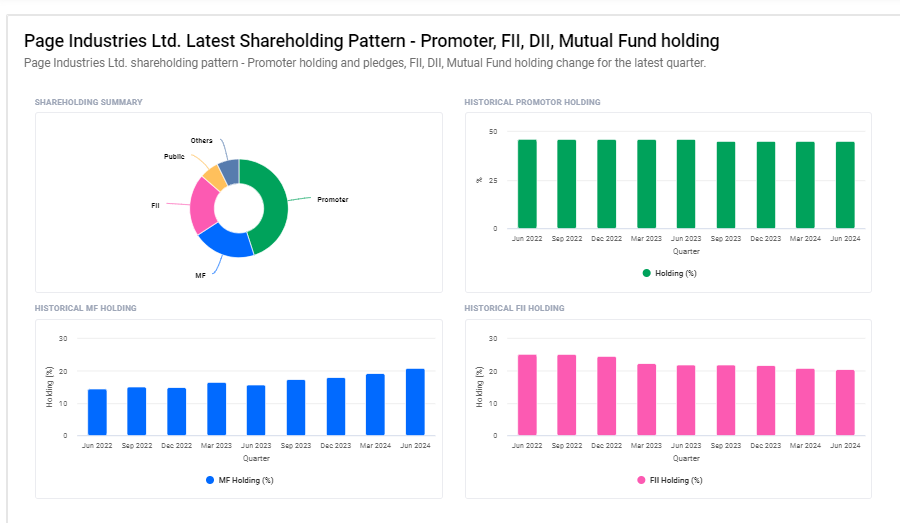

Page Industries Ltd Shareholding Pattern

- Promoters: 45.04%

- Mutual Funds: 20.81%

- Foreign Institutions: 20.54%

- Other Domestic Institutions: 7.29%

- Retail and Others: 6.31%

Key Factors Affecting Page Industries Share Price Growth

Here are four key factors affecting Page Industries’ share price growth:

- Consumer Demand: Page Industries’ growth largely depends on demand for its products, especially in the innerwear and sportswear segments. Increasing disposable income and rising awareness of branded apparel can drive higher sales, positively impacting the share price.

- Brand Strength: As the exclusive licensee of Jockey, Page Industries benefits from the brand’s strong reputation. Continued focus on brand building and marketing efforts can boost consumer loyalty, enhancing revenue and supporting share price growth.

- Expansion and Retail Presence: Page Industries’ ability to expand its retail network, both online and offline, can significantly influence its share price. A wider reach means more customers, potentially leading to higher sales and investor confidence.

-

Cost Management: Efficient cost management in areas like production and distribution helps the company maintain profitability. Strong profit margins due to controlled costs can lead to increased investor trust, contributing to share price growth.

Risks and Challenges to Page Industries Share Price

Here are four risks and challenges that could affect Page Industries’ share price:

- Rising Competition: The apparel market is highly competitive, with both local and international brands expanding their presence. Increased competition may impact Page Industries’ market share and profitability, posing a risk to its share price.

- Raw Material Costs: Fluctuations in the cost of raw materials, such as cotton and fabric, can increase production expenses. If Page Industries is unable to manage these rising costs, it may affect profit margins and investor sentiment.

- Changing Consumer Preferences: Shifts in fashion trends or consumer preferences could reduce demand for Page Industries’ products. Failure to adapt to these changes may limit growth opportunities and negatively influence the share price.

-

Economic Slowdowns: Economic downturns can reduce consumer spending on non-essential goods like premium innerwear and sportswear. Lower demand during such periods could affect the company’s revenues, which may lead to a decline in its share price.

Read Also:-

- ARC Finance Share Price Target

- Bajaj Housing Finance Share Price Target

- Apar Industries Share Price Target

- BCL Industries Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.