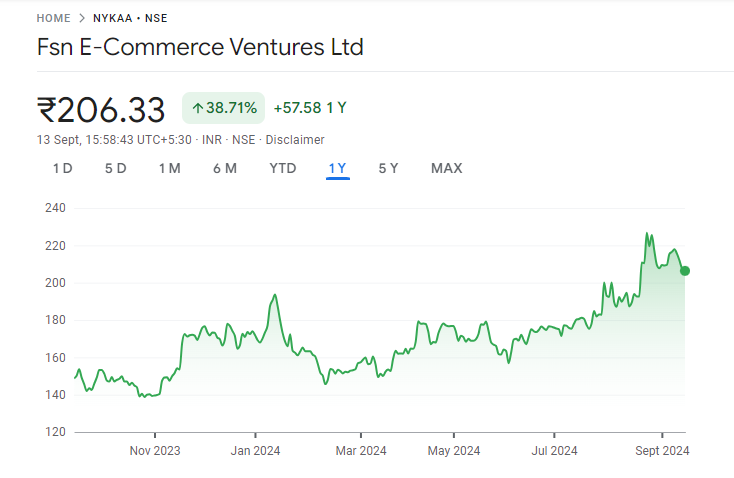

Fsn E-Commerce Ventures Ltd, commonly known as Nykaa, is an Indian e-commerce company that specializes in beauty, wellness, and fashion products. Nykaa Share Price on NSE as of 13 September 2024 is 206.33 INR. On this page, you will find Nykaa Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Nayak share price NSE, FSN Nykaa share price target, FSN Nykaa share price, Nykaa share price BSE, Nykaa share price target tomorrow, Nykaa share price target 2030, and more Information.

Fsn E-Commerce Ventures Ltd Company Details

Fsn E-Commerce Ventures Ltd, commonly known as Nykaa, is an Indian e-commerce company that specializes in beauty, wellness, and fashion products. Founded in 2012, Nykaa has become a popular platform offering a wide range of cosmetics, skincare, and fashion items from top global and Indian brands. The company operates through its online website and mobile app, as well as physical stores across India.

| Official Website | nykaa.com |

| Founded | 2012 |

| Headquarters | India |

| Number of employees | 1,669 (2024) |

| Subsidiaries | Nykaa, Fsn International Private Limited |

| Category | Share Price |

Current Market Overview Of NYKAA Share Price

- Open Price: ₹208.00

- High Price: ₹212.77

- Low Price: ₹205.13

- Current Price: ₹206.33

- Mkt cap: ₹58.86KCr

- P/E ratio: 1,549.61

- Div yield: NA

- 52-wk high: ₹229.80

- 52-wk low: ₹136.50

NYKAA Share Price Today Chart

Read Also:- Nandan Denim Share Price Target 2024, 2025, 2026 To 2030

NYKAA Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Nykaa for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | NALCO Share Price Target Years | Share Price Target (₹) |

| 1 | NALCO Share Price Target 2024 | ₹245 |

| 2 | NALCO Share Price Target 2025 | ₹285 |

| 3 | NALCO Share Price Target 2026 | ₹349 |

| 4 | NALCO Share Price Target 2027 | ₹445 |

| 5 | NALCO Share Price Target 2028 | ₹509 |

| 6 | NALCO Share Price Target 2029 | ₹800 |

| 7 | NALCO Share Price Target 2030 | ₹1000 |

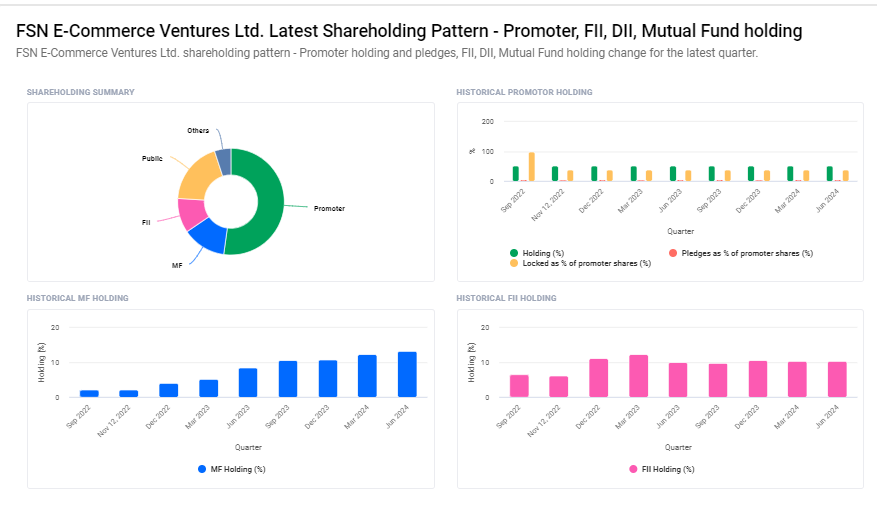

NYKAA Shareholding Pattern

- Promoters: 52.24%

- FII: 10.65%

- DII: 4.13%

- Retail & Others: 22.14%

- Mutual Funds: 10.85%

Major Factors Affecting Nykaa Share Price

Here are six major factors that can deeply affect Nykaa’s (FSN E-Commerce Ventures Ltd) share price:

- E-Commerce Industry Growth: Nykaa operates in the fast-growing e-commerce sector, where consumer preferences are shifting towards online shopping. Any growth in the overall e-commerce market, driven by increasing internet penetration, mobile usage, and digital payments, can positively impact Nykaa’s revenue. As the demand for online beauty and fashion products increases, Nykaa’s stock price may rise, reflecting investor confidence in its future growth.

- Consumer Preferences and Trends: Nykaa’s success is closely tied to consumer behavior in the beauty, wellness, and fashion sectors. Trends like the increasing preference for organic and sustainable beauty products or changing fashion preferences can influence sales. If Nykaa aligns its product offerings with emerging trends, it can capture a larger market share, positively affecting its share price.

- Competition in the Market: The beauty and fashion e-commerce space is highly competitive, with major players like Amazon, Flipkart, and other online platforms vying for market share. Intense competition can lead to pricing pressures, which may affect Nykaa’s profitability. If Nykaa can differentiate itself through product variety, exclusive partnerships, or customer loyalty, it will likely experience share price growth.

- Financial Performance and Profitability: Nykaa’s quarterly and annual financial results play a crucial role in determining its share price. Factors like revenue growth, profit margins, and overall profitability impact investor sentiment. If Nykaa consistently delivers strong financial results, demonstrating its ability to scale while maintaining healthy margins, it will encourage investor interest, leading to stock price appreciation.

- Expansion into New Categories and Markets: Nykaa has been diversifying its offerings by expanding into new product categories such as fashion, wellness, and personal care. Its ability to successfully grow these segments and reach new customers, both domestically and internationally, will influence future revenue streams. Expansion into new markets or product lines can signal growth potential, boosting the company’s stock price.

-

Technological Advancements and Customer Experience: E-commerce companies rely heavily on technology to provide a seamless and engaging shopping experience. Nykaa’s ability to continuously improve its website, mobile app, and digital infrastructure plays a critical role in customer satisfaction. A user-friendly platform, personalized recommendations, and innovative digital marketing can enhance customer loyalty and drive repeat purchases, positively affecting the company’s share price.

Read Also:-

- NALCO Share Price Target

- Deep Diamond India Share Price Target

- Sarveshwar Foods Share Price Target

- Premier Energies Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.