If you’re keeping an eye on NTPC’s stock, you’ll be interested in the anticipated price targets. NTPC Share Price on NSE as of 20 September 2024 is 423.00 INR. We’ve outlined the projected share prices for NTPC over the coming years, providing insights into its potential growth. Whether you’re considering investing or just curious, this guide offers a clear look at what to expect from NTPC’s stock soon. This article will provide more details on NTPC Share Price Target 2024, 2025, 2026, 2027 to 2030.

NTPC Ltd. Company Details

NTPC Ltd., or National Thermal Power Corporation, is a leading power generation company in India. Established in 1975, it is one of the largest publicly-owned utilities in the country. NTPC specializes in the production and distribution of electricity, primarily from thermal power plants, but it is also expanding into renewable energy sources like solar and wind. Known for its robust performance and significant contribution to India’s energy sector, NTPC aims to provide reliable power and drive growth in the nation’s infrastructure.

| Official Website | ntpc.co.in |

| Founded | 7 November 1975 |

| Headquarters |

New Delhi, India

|

| Chairman & MD | Gurdeep Singh |

| Number of employees | 15,786 (2022) |

| Category | Share Price |

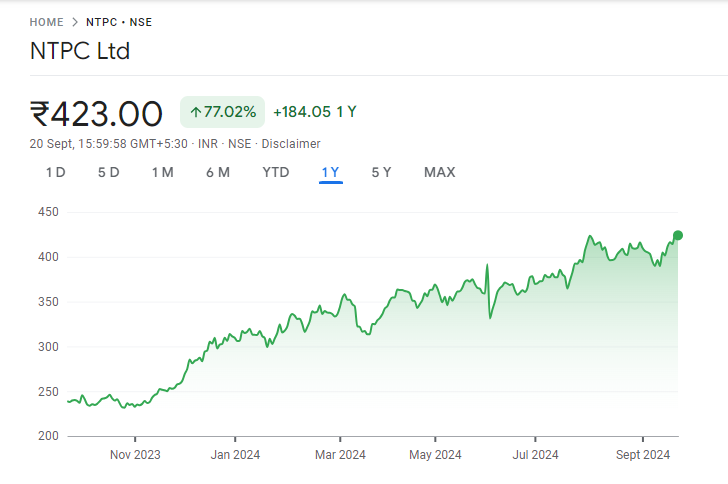

Current Market Overview Of NTPC Share Price

- Current Price: ₹423.00

- Open: ₹428.05

- High: ₹429.85

- Low: ₹416.55

- Mkt cap: ₹4.11LCr

- P/E ratio: 19.15

- Div yield: 1.83%

- 52-wk high: ₹431.85

- 52-wk low: ₹227.75

NTPC Share Price Today Graph

Read Also:-

- Yes Bank Share Price Target

- Tata Motors Share Price Target

- Suzlon Share Price Target

- NCC Share Price Target

NTPC Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of NTPC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | NTPC Share Price Target Years | SHARE PRICE TARGET |

| 1 | NTPC Share Price Target 2024 | ₹485 |

| 2 | NTPC Share Price Target 2025 | ₹556 |

| 3 | NTPC Share Price Target 2026 | ₹625 |

| 4 | NTPC Share Price Target 2027 | ₹727 |

| 5 | NTPC Share Price Target 2028 | ₹825 |

| 6 | NTPC Share Price Target 2029 | ₹946 |

| 7 | NTPC Share Price Target 2030 | ₹908 |

Read Also:-

- Jio Finance Share Price Target

- Adani Power Share Price Target

- GTL Infra Share Price Target

- HAL Share Price Target

Risks and Challenges to NTPC Share Price

Here are five risks and challenges that could impact NTPC’s share price:

- Regulatory Changes: NTPC operates in a heavily regulated industry. Any changes in government policies, environmental regulations, or electricity tariffs could increase costs or limit operations, potentially affecting its profitability and share price.

- Fuel Supply and Costs: NTPC relies on coal and other fuels for power generation. Fluctuations in fuel availability or rising costs can impact production efficiency and margins, posing a risk to its share price.

- Transition to Renewable Energy: As the world shifts towards renewable energy, NTPC faces the challenge of adapting its business model. Delays in adopting clean energy solutions or inefficiencies in transitioning could affect investor sentiment and share value.

- Operational Risks: Power plants are subject to various operational risks, such as equipment failure, maintenance issues, or natural disasters. Any significant disruption in power generation could impact revenue and share price negatively.

-

Economic Slowdown: A downturn in the economy can reduce industrial electricity demand, affecting NTPC’s revenue. Lower demand for power can lead to reduced profitability, which may result in a decline in the company’s share price.

Read Also:-

- Bank of Baroda Share Price Target

- Zomato Share Price Target

- NBCC Share Price Target

- IRB Infra Share Price Target

NTPC Ltd Financials:-

| Market Capitalization value | 348352.70 crores |

| Total Share Capital | 9696.67 crores |

| Total Borrowings | 156315.69 crores |

| Trade Payables | 12007.34 crores |

| Trade Receivables | 24741.45 crores |

| Total Investments | 29719.75 crores |

| Total Assets | 382387.26 crores |

| Total Revenue | 167724.41 crores |

| ROE | 12.38 percent |

| ROCE | 11.02 percent |

| PE ratio | 15.46 percent |

| PB ratio | 2.37 percent |

| DE ratio | 1.33 percent |

| Dividend payout ratio | 13.58 percent |

| Dividend Yield ratio | 2.09 percent |

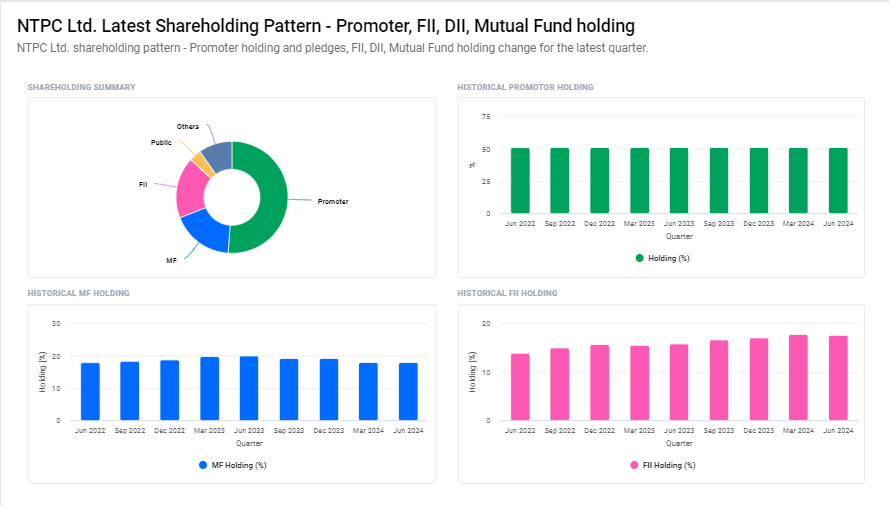

NTPC Ltd Shareholding Pattern:-

| Shareholders | Share Percentage |

| Promoters | 51.10 |

| FII | 17.7% |

| DII | 27.7% |

| Public | 3.6% |

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.