NIIT Ltd is a well-recognized Indian development company. NIIT Ltd Share Price on NSE as of 21 September 2024 is 174.61 INR. On this page, you will find NIIT Ltd Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as NIIT Ltd news today, NIIT share price today live, Niit Ltd share price target tomorrow, Why NIIT share is falling, niit share price target 2025 moneycontrol and more Information.

NIIT Ltd Company Details

NIIT Ltd is a leading global talent development company based in India. Known for providing training and development solutions, NIIT specializes in IT education, skills training, and professional development for individuals and businesses.

Established in 1981, the company has grown to become a trusted name in the education sector, offering a wide range of courses and certifications in technology, management, and digital transformation. With a strong focus on innovation and quality, NIIT aims to empower learners and professionals to succeed in the fast-changing world of technology and business.

| Official Website | niit.com |

| Headquarters | Gurugram |

| Number of employees | 962 (2023) |

| Subsidiaries | RPS Consulting Pvt Ltd., Niit Imperia, NIIT Yuva Jyoti Limited, NIIT Institute of Finance, Banking & Insurance Training Ltd. and More |

| Category | Share Price |

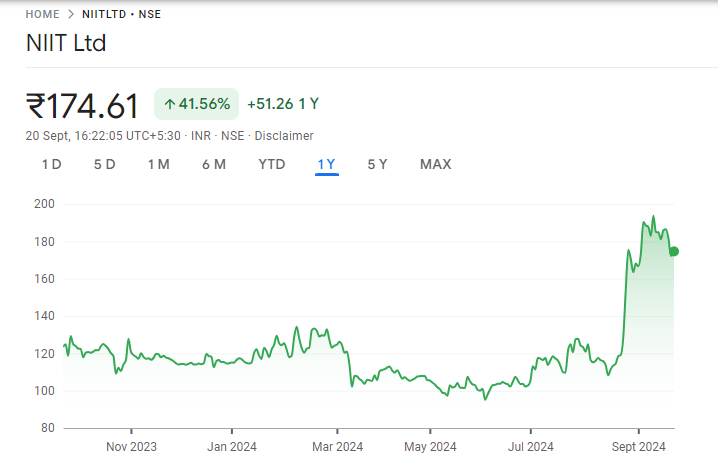

Current Market Overview Of NIIT Ltd Share Price

- Open Price: ₹173.90

- High Price: ₹179.80

- Low Price: ₹173.80

- Market Capitalization: ₹2.38K crore

- Price-to-Earnings (P/E) Ratio: 54.36

- Dividend Yield: 0.72%

- 52-Week High: ₹203.90

- 52-Week Low: ₹90.55

- Current Price: ₹174.61

NIIT Ltd Share Price Today Chart

Read Also:- Inox Wind Share Price Target 2024, 2025, 2026, 2027 to 2030

NIIT Ltd Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of NIIT Ltd for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | NIIT Share Price TargetYears | SHARE PRICE TARGET |

| 1 | NIIT Share Price Target 2024 | ₹229 |

| 2 | NIIT Share Price Target 2025 | ₹488 |

| 3 | NIIT Share Price Target 2026 | ₹559 |

| 4 | NIIT Share Price Target 2027 | ₹640 |

| 5 | NIIT Share Price Target 2028 | ₹733 |

| 6 | NIIT Share Price Target 2029 | ₹840 |

| 7 | NIIT Share Price Target 2030 | ₹963 |

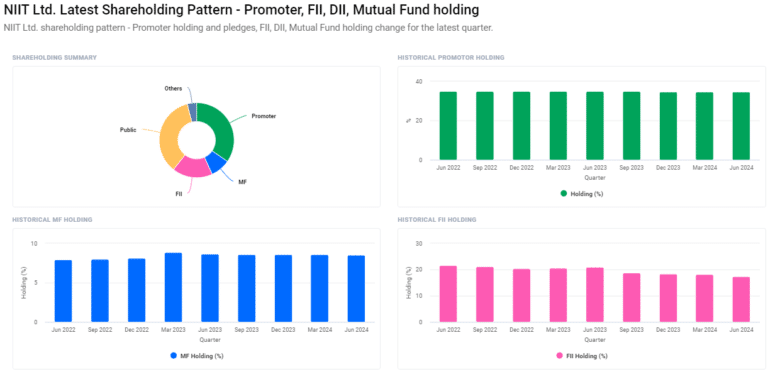

Shareholding Pattern For NIIT Ltd Share Price

- Retail and Others: 35.35%

- Promoters: 34.66%

- Foreign Institutional Investors (FII/FPI): 17.40%

- Mutual Funds: 8.56%

- Other Domestic Institutions: 4.01%

Factors Affecting NIIT Ltd Share Price Growth

-

Demand for IT and Digital Skills Training: As technology evolves, the demand for IT and digital skills training rises. NIIT’s focus on providing up-to-date courses in these areas helps drive its business growth and, in turn, influences its share price positively.

- Expansion into New Markets: NIIT’s efforts to expand its presence in international markets can lead to increased revenue streams. Successful expansion into new regions can attract more investors, boosting share price growth.

- Partnerships and Collaborations: Strategic partnerships with tech giants and educational institutions enhance NIIT’s reputation and reach. Such alliances can bring in more business, positively impacting its share price.

- Economic Conditions: The overall economic environment plays a significant role. During economic downturns, companies and individuals may cut back on training budgets, which can impact NIIT’s revenue and share price.

- Technological Advancements: Keeping pace with the latest technological advancements ensures NIIT’s offerings remain relevant. Regular updates to training modules attract more learners, contributing to share price growth.

- Government Policies and Regulations: Policies promoting skill development and digital literacy can benefit companies like NIIT. Supportive government initiatives can boost demand for training programs, positively affecting share prices.

-

Competitive Landscape: The presence of other training providers in the market can impact NIIT’s market share. Staying ahead of the competition with innovative offerings is crucial for sustaining share price growth.

Read Also:-

- IRCTC Share Price Target

- Apollo Tyres Share Price Target

- Trident Share Price Target

- Broadcom Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.