Nestlé India Limited is the Indian branch of the renowned Swiss multinational, Nestlé. Nestle India Share Price on NSE as of 5 September 2024 is 2,500.35 INR. On this page, you will find Nestlé India Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Nestle share price NSE India Chart, Nestle share price NSE India today, Nestle share price India today, Nestle India share price target tomorrow, Nestle India share price target 2030, and more Information.

Nestle India Limited Company Details

Nestlé India Limited is one of the top food and beverage companies in India. It is a subsidiary of the global giant Nestlé, which is based in Switzerland. Nestlé India is well-known for producing popular brands like Maggi noodles, Nescafé coffee, KitKat, and Milkmaid. The company focuses on providing nutritious and tasty products that are enjoyed by people of all ages. With a strong presence in the Indian market for many years, Nestlé India continues to grow by adapting to local tastes and preferences, while maintaining high standards of quality and safety.

| Official Website | nestle.in |

| Founded | 28 March 1959 |

| Headquarters | Nestle House, Jacaranda Marg, ‘M’ Block, DLF Phase II, Gurgaon, Haryana, India |

| Number of employees | 8,736 (2024) |

| Category | Share Price |

Current Market Overview of Nestle India Share Price

- Open – INR 2,534.75

- High – INR 2,535.00

- Low – INR 2,492.15

- Current Price – INR 2,500.35

- Mkt cap – INR 2.41LCr

- P/E ratio – 74.31

- Div yield – 1.18%

- 52-wk high – INR 2,769.30

- 52-wk low – INR 2,175.46

Nestle India Share Price Recent Chart

Read Also:- HUDCO Share Price Target 2024, 2025, 2026 to 2030 and More Details

Nestle India Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of Nestle India for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Nestle India Share Price Target Years | Share Price Target |

| 1 | Nestle India Share Price Target 2024 | Rs 2,860 |

| 2 | Nestle India Share Price Target 2025 | Rs 3,150 |

| 3 | Nestle India Share Price Target 2026 | Rs 4,240 |

| 4 | Nestle India Share Price Target 2027 | Rs 5,728 |

| 5 | Nestle India Share Price Target 2028 | Rs 6,960 |

| 6 | Nestle India Share Price Target 2029 | Rs 7,820 |

| 7 | Nestle India Share Price Target 2030 | Rs 8,770 |

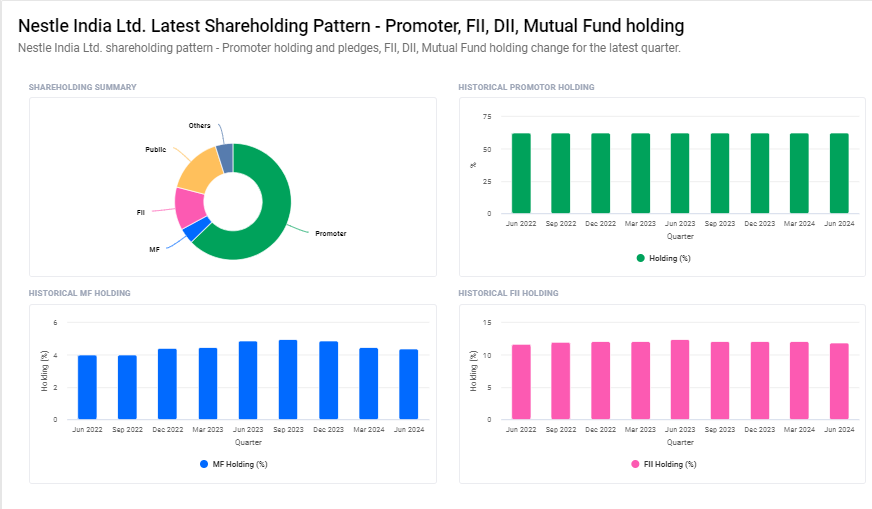

Nestle India Ltd. Shareholding Pattern

- Promoters: 62.8%

- Foreign Institutions: 11.9%

- Public: 16.1%

- Domestic Institutions: 9.2%

Risks and Challenges to Nestle India Share Price

Here are five risks and challenges that could affect Nestlé India’s share price:

- Fluctuations in Raw Material Costs: Nestlé India relies on various raw materials like milk, sugar, and cocoa. If the prices of these ingredients rise unexpectedly, it could increase production costs and squeeze profit margins, potentially impacting the share price.

- Intense Market Competition: The food and beverage industry in India is highly competitive, with many strong local and international brands. If Nestlé India struggles to maintain its market share or faces challenges from new entrants, it could affect its financial performance and stock value.

- Regulatory Changes: New regulations or changes in food safety standards and taxation policies can affect operations. If Nestlé India needs to comply with stricter regulations or faces higher taxes, it could impact profitability and, consequently, the share price.

- Economic Slowdown: A slowdown in the Indian economy can reduce consumer spending and demand for discretionary products. If people cut back on spending, it could lead to lower sales for Nestlé India, which might hurt its stock performance.

-

Supply Chain Disruptions: Any disruptions in the supply chain, whether due to natural disasters, transportation issues, or other factors, can affect Nestlé India’s ability to produce and deliver products on time. These disruptions can impact sales and investor confidence, potentially affecting the share price.

Read Also:-

- Mangalam Cement Share Price Target

- Bajaj Hindusthan Sugar Share Price Target

- CG Power Share Price Target

- Orient Green Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.