Natco Pharma Ltd is an Indian pharmaceutical company. Natco Pharma Share Price on NSE as of 9 September 2024 is 1,541.10 INR. On this page, you will find Natco Pharma Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Natco Pharma News, Why Natco Pharma is falling today, Natco Pharma share price target tomorrow, Natco Pharma share price target 2030, and more Information.

Natco Pharma Ltd Company Details

Natco Pharma Ltd is an Indian pharmaceutical company known for manufacturing affordable and high-quality medicines, particularly in the areas of oncology (cancer treatment) and chronic diseases. Founded in 1981, the company has made a significant mark in both the Indian and global markets by producing a wide range of generic and specialty pharmaceuticals.

Natco Pharma is also recognized for its research and development capabilities, focusing on creating complex and niche products. It exports its medicines to several countries worldwide, contributing to better healthcare access. The company’s commitment to innovation and affordability has helped it become a trusted name in the pharmaceutical industry.

| Official Website | natcopharma.co.in |

| Headquarters | Banjara Hills, Hyderabad |

| Founded | 1981 |

| Founder | VC Nannapaneni |

| CEO | Rajeev Nannapaneni |

| Number of employees | 4,016 (2024) |

| Category | Share Price |

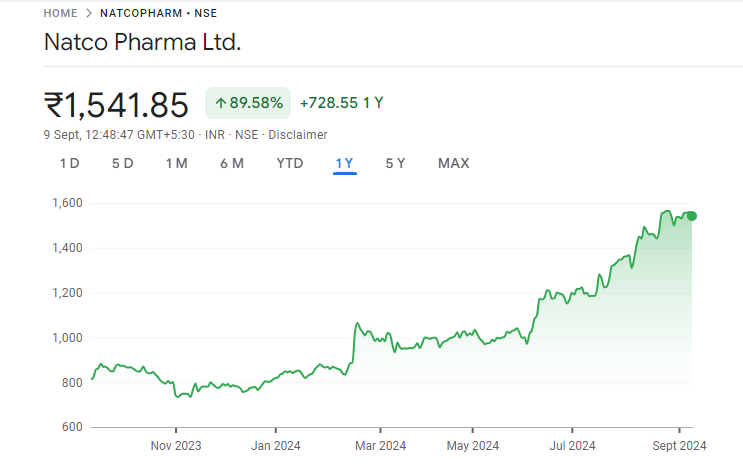

Current Market Overview Of Natco Pharma Share Price

- Open: ₹ 1,564.40

- High: ₹ 1,564.40

- Low: ₹ 1,523.05

- Mkt cap: ₹ 27.59KCr

- P/E ratio: 16.86

- Div yield: 0.36%

- 52-wk high: ₹ 1,598.00

- 52-wk low: ₹ 724.20

- Current Price: ₹ 1,541.10

Natco Pharma Share Price Today Chart

Read Also:- Doms Share Price Target 2024, 2025 to 2030 Prediction and More

Natco Pharma Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Natco Pharma for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | NATCO Pharma Share Price Target Years | Share Price Target |

| 1 | NATCO Pharma Share Price Target 2024 | ₹1,580 |

| 2 | NATCO Pharma Share Price Target 2025 | ₹1,695 |

| 3 | NATCO Pharma Share Price Target 2026 | ₹1,756 |

| 4 | NATCO Pharma Share Price Target 2027 | ₹1,830 |

| 5 | NATCO Pharma Share Price Target 2028 | ₹1,977 |

| 6 | NATCO Pharma Share Price Target 2029 | ₹2,055 |

| 7 | NATCO Pharma Share Price Target 2030 | ₹2,600 |

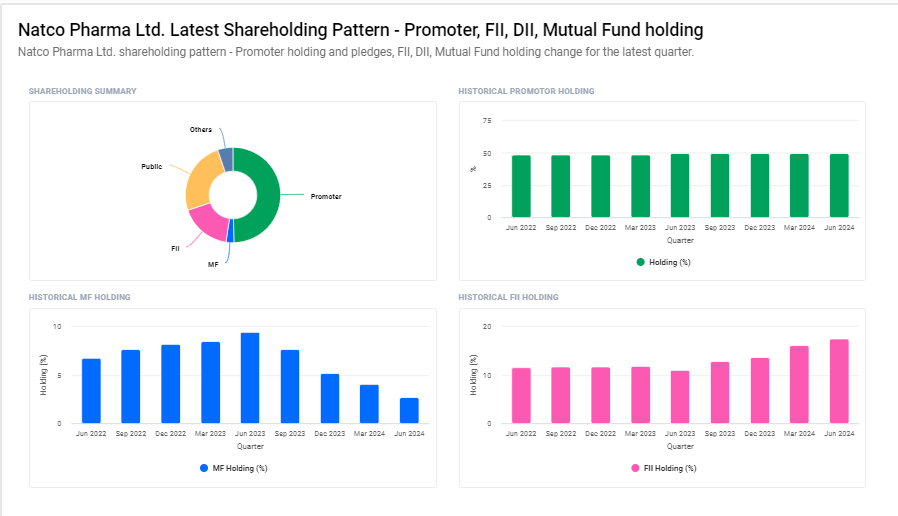

Natco Pharma Ltd. Shareholding Pattern

- Promoters: 49.71%

- Foreign Institutions: 17.23%

- Retail And Others: 21.65%

- Mutual Funds: 9.94%

- Other Domestic Institutions: 7.871%

Risks and Challenges to Natco Pharma Share Price

Here are seven risks and challenges that could affect Natco Pharma’s share price:

- Regulatory Issues: Natco Pharma operates in highly regulated markets. Changes in drug approval processes or stricter regulations in key markets like the US and Europe could delay product launches or lead to compliance costs, affecting its share price.

- Patent Litigations: As a company that manufactures generic drugs, Natco faces the risk of patent disputes with large pharmaceutical companies. Losing a legal battle over patent rights can lead to financial losses and impact investor confidence.

- Competition: The pharmaceutical industry is highly competitive, with many players offering similar generic drugs. Intense competition can affect pricing power and market share, putting pressure on the company’s profitability and stock price.

- Research and Development Costs: Developing new drugs requires significant investment in research and development (R&D). If the company’s R&D efforts do not result in successful products, it could face financial strain, negatively affecting the share price.

- Global Economic Conditions: Economic slowdowns or recessions in key markets can reduce healthcare spending, impacting the demand for Natco Pharma’s products and potentially leading to lower sales and a declining share price.

- Foreign Exchange Fluctuations: Since Natco Pharma exports a large portion of its products, fluctuations in currency exchange rates can impact the company’s earnings. A strong Indian rupee, for example, could reduce its international revenue, affecting stock performance.

-

Product Recalls: If any of Natco Pharma’s products are found to have safety or quality issues, the company may face product recalls, legal liabilities, and damage to its reputation, which could negatively affect its stock price.

Read Also:-

- Bajaj Finance Share Price Target

- Bharat Dynamics Share Price Target

- Deepak Nitrite Share Price Target

- IDFC First Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.