MosChip Technologies Ltd is an Indian semiconductor and electronic design company. MosChip Share Price on BSE as of 13 September 2024 is 273.55 INR. On this page, you will find Asian Paints Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Is Moschip Technologies a good buy, Moschip share price target tomorrow, Moschip share price target 2025 in Hindi, Moschip Share Price target 2030 in Hindi, and more Information.

Moschip Technologies Ltd Company Details

MosChip Technologies Ltd is an Indian semiconductor and electronic design company, specializing in providing services in chip design, system design, and software development. Established in 1999, MosChip serves clients across various industries such as aerospace, automotive, telecommunications, and consumer electronics. The company offers end-to-end solutions in semiconductor design and has a growing presence in the Internet of Things (IoT) and connectivity solutions.

| Official Website | moschip.com |

| CEO | Srinivasa Kakumanu (Oct 2023–) |

| Headquarters | India |

| Number of employees | 1,068 (2024) |

| Subsidiaries | Gigacom Semiconductor Private Limited, Maven Systems Pvt. Ltd, Gigacom Semiconductor Inc., Softnautics Inc., and more |

| Category | Share Price |

Current Market Overview Of MosChip Share Price

- Open Price: ₹273.55

- High Price: ₹273.55

- Low Price: ₹273.55

- Market Capitalization: ₹5.18K Crores

- P/E Ratio: 494.88

- Dividend Yield: –

- 52-Week High: ₹326.80

- 52-Week Low: ₹77.00

- Current Price: ₹273.55

MosChip Share Price Today Chart

Read Also:- Olectra Greentech Share Price Target 2024, 2025, 2026, 2027 to 2030 and More Details

MosChip Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of MosChip for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | MosChip Share Price Target Years | SHARE PRICE TARGET |

| 1 | MosChip Share Price Target 2024 | ₹375 |

| 2 | MosChip Share Price Target 2025 | ₹537 |

| 3 | MosChip Share Price Target 2026 | ₹690 |

| 4 | MosChip Share Price Target 2027 | ₹865 |

| 5 | MosChip Share Price Target 2028 | ₹1030 |

| 6 | MosChip Share Price Target 2029 | ₹1189 |

| 7 | MosChip Share Price Target 2030 | ₹1356 |

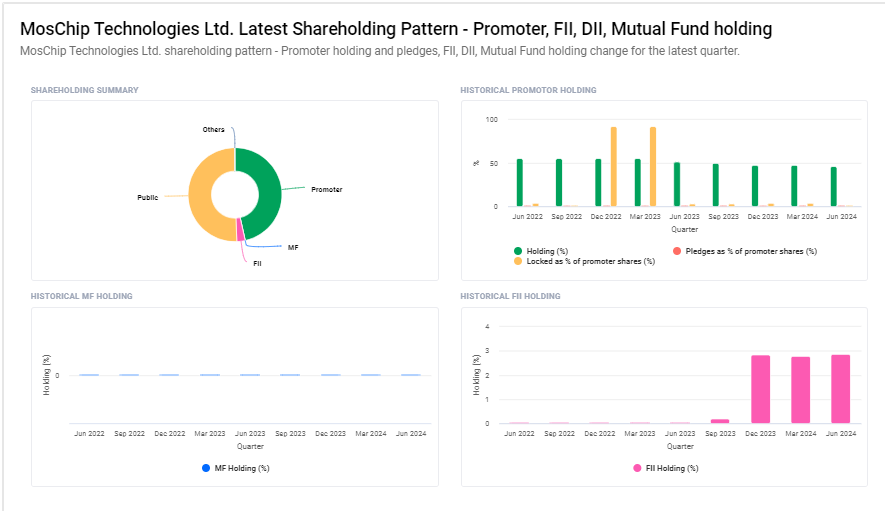

MosChip Technologies Ltd Shareholding Pattern

- Retail and Others: 50.63%

- Promoters: 46.51%

- Foreign Institutions: 2.86%

Risks and Challenges to MosChip Share Price

Here are six major risks and challenges that can affect MosChip Technologies’ share price:

- Industry Competition: The semiconductor industry is highly competitive, with global giants like Intel, Qualcomm, and other established players constantly innovating. MosChip, being a smaller player, faces stiff competition. If larger competitors introduce more advanced technologies or lower pricing, it could reduce MosChip’s market share, affecting its revenue and, consequently, its share price.

- Dependence on Key Clients: MosChip relies on a limited number of key clients for a significant portion of its revenue. If any of these clients reduce their orders, delay payments, or switch to other vendors, it could lead to a sharp decline in revenue. This dependence poses a significant risk to the company’s financial stability, which can negatively impact investor confidence and lead to a drop in share price.

- Technological Advancements: The semiconductor and technology industry evolves rapidly, with new innovations constantly entering the market. If MosChip fails to keep up with these technological advancements or invest sufficiently in research and development, it risks losing its competitive edge. This could impact the company’s ability to attract new customers or retain existing ones, leading to reduced profitability and lower share prices.

- Global Supply Chain Disruptions: The semiconductor industry is heavily dependent on a complex global supply chain for raw materials, components, and manufacturing. Disruptions due to geopolitical tensions, trade restrictions, or global events (like the COVID-19 pandemic) can cause delays or increase costs. Any supply chain issues could hinder MosChip’s ability to meet demand, thereby affecting its financial performance and share price.

- Regulatory and Policy Changes: Being part of a highly regulated industry, MosChip is subject to government policies, both in India and globally. Changes in regulations related to technology exports, data security, or environmental standards can impact the company’s operations. If MosChip faces legal challenges or has to comply with stricter policies, it could increase operational costs, reduce profitability, and lead to a decline in its share price.

-

Currency Fluctuations: Since MosChip operates globally and earns revenue from different countries, it is exposed to currency exchange rate fluctuations. A stronger Indian Rupee or volatility in other currencies can reduce the company’s earnings when converted back to its home currency, which could lower profit margins and, in turn, affect its share price.

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.