Morepen Laboratories Ltd is an Indian pharmaceutical company known for manufacturing and marketing. Morepen Share Price on NSE as of 11 September 2024 is 94.85 INR. On this page, you will find Morepen Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Morepen Labs IPO price, Morepen share price target tomorrow, Morepen Lab Share Price target 2030, Morepen Lab Share Price target 2025 Moneycontrol, and more Information.

Morepen Laboratories Ltd Company Details

Morepen Laboratories Ltd is an Indian pharmaceutical company known for manufacturing and marketing a wide range of healthcare products, including active pharmaceutical ingredients (APIs), finished formulations, and over-the-counter (OTC) products. Established in 1984, the company has a strong presence in both domestic and international markets.

Morepen Laboratories is recognized for its focus on producing quality medicines, diagnostics, and wellness products. Its commitment to research and innovation has helped the company build a solid reputation in the pharmaceutical industry, offering affordable healthcare solutions to millions.

| Official Website | morepen.com |

| Founded | 1984 |

| Headquarters | New Delhi |

| Number of employees | 2,152 (2024) |

| Subsidiaries | Morepen Inc., Doctor Morepen Limited |

| Category | Share Price |

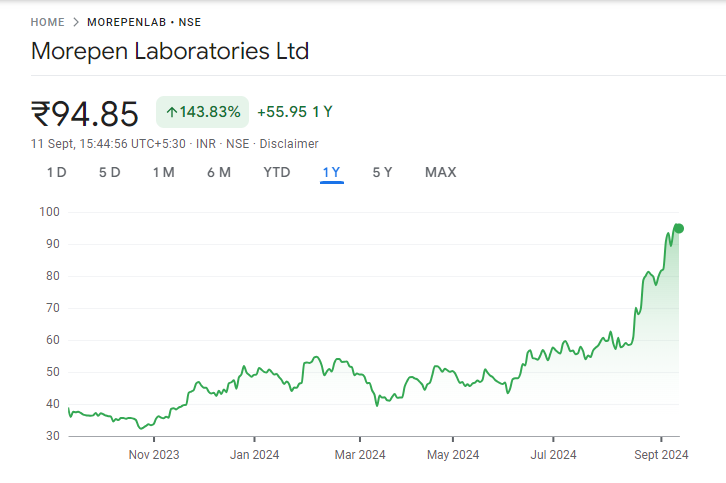

Current Market Overview Of Morepen Share Price

- Open: ₹96.20

- High: ₹99.24

- Low: ₹93.50

- Market Cap: ₹5.19K Crores

- P/E Ratio: 41.05

- Dividend Yield: N/A

- 52-Week High: ₹100.90

- 52-Week Low: ₹31.30

- Current Price: ₹94.85

Morepen Share Price Today Chart

Read Also:- Natco Pharma Share Price Target 2024, 2025 To 2030 Prediction

Morepen Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Morepen for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Morepen Share Price Target Years | SHARE PRICE TARGET |

| 1 | Morepen Share Price Target 2024 | ₹105 |

| 2 | Morepen Share Price Target 2025 | ₹157 |

| 3 | Morepen Share Price Target 2026 | ₹215 |

| 4 | Morepen Share Price Target 2027 | ₹267 |

| 5 | Morepen Share Price Target 2028 | ₹330 |

| 6 | Morepen Share Price Target 2029 | ₹390 |

| 7 | Morepen Share Price Target 2030 | ₹455 |

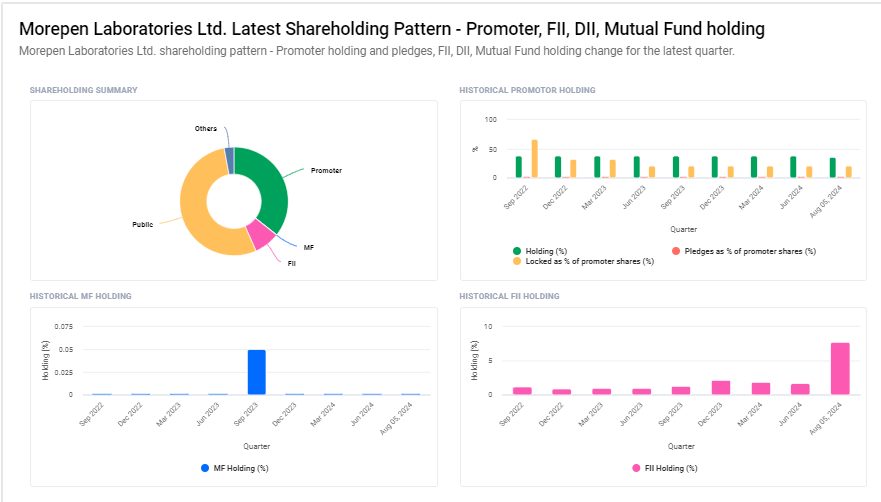

Morepen Laboratories Ltd Shareholding Pattern

- Retail and Others: 53.73%

- Promoters: 35.65%

- Foreign Institutions: 7.72%

- Other Domestic Institutions: 2.90%

Major Factors Affecting Morepen Share Price Share Price

Here are eight major factors that can affect Morepen Laboratories’ share price:

- Product Launches: New and successful product launches, especially in high-demand categories like pharmaceuticals or diagnostics, can boost revenue and positively impact the share price.

- Research and Development: Morepen’s investment in R&D for developing innovative medicines or health products plays a key role in attracting investors, which can help increase the share price.

- Regulatory Approvals: Approvals from regulatory authorities for new drugs or manufacturing facilities can enhance Morepen’s growth prospects, supporting its stock price.

- Global Market Demand: Since Morepen exports APIs and other products internationally, global demand trends for its offerings can significantly influence the company’s sales and stock price.

- Raw Material Costs: Fluctuations in the prices of raw materials used for manufacturing pharmaceuticals can affect Morepen’s profit margins, which may impact the share price.

- Competitive Landscape: Increased competition from other pharmaceutical companies can affect Morepen’s market share and profitability, influencing its share price growth.

- Economic Conditions: Favorable economic conditions, both globally and in India, encourage higher consumer spending on healthcare, which can drive Morepen’s business and positively affect its stock performance.

-

Government Policies: Changes in healthcare policies, drug pricing regulations, or taxation can influence Morepen’s financial performance, which may affect its share price.

Read Also:-

- KCP Sugar Share Price Target

- GSK Pharma Share Price Target

- Alok Industries Share Price Target

- EID Parry Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.