Manappuram Finance is a brilliant name in the non-banking economic employer (NBFC) sector in India, specializing in gold loans. Over the years, the agency has received a strong foothold, especially in rural and semi – town areas. Founded in 1992, it has grown to turn out to be one of the most important gamers in its area of interest, offering a whole lot of monetary services which include gold loans, microfinance, vehicle loans, and insurance.

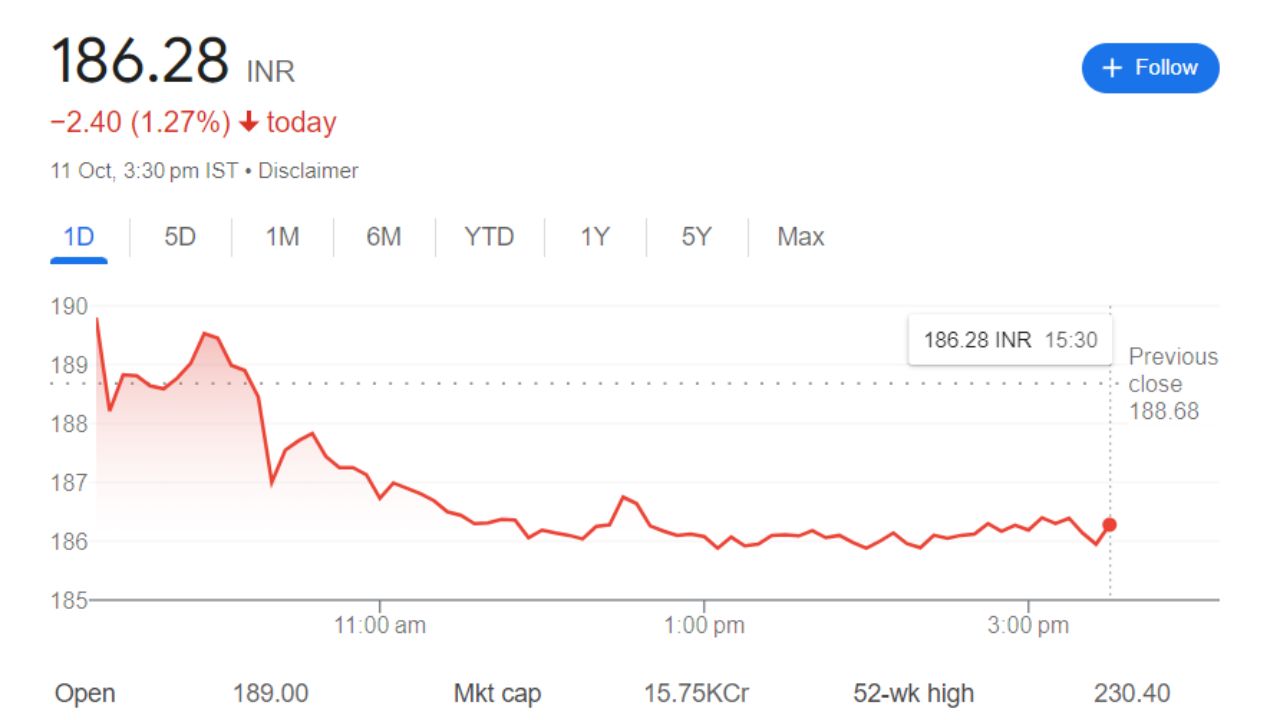

Current Financial Overview For Manappuram Finance Share Price

Before diving into the destiny projections, let’s examine the cutting-edge financial statistics of Manappuram Finance:

- Today’s Open: 202.51

- Today’s High: 206.25

- Today’s Low: 202.16

- Current Share Price: 186.28

- Market Capital: 17,150 crore

- P/E: 7.65

- Dividend Yield: 1.85 %

- 52 Week High: 230.40

- 52 Week Low: 125.35

Manappuram Finance Share Price Current Graph

Manappuram Share Price Target Tomorrow From 2024 To 2030

This analysis for upcoming years is based on market valuation, industrial trends, and expert analysis.

| S. No. | Share Price Target Years | Share Target Value |

|

|

2024 | 253 |

|

|

2025 | 343 |

|

|

2026 | 393 |

|

|

2027 | 449 |

|

|

2028 | 513 |

|

|

2029 | 585 |

|

|

2030 | 670 |

Shareholding Pattern For Manappuram Share Price

- Promoters: 35.24 %

- Foreign Institutions: 33.00 %

- Domestic Institutions: 1.73 %

- Mutual Funds: 7.61 %

- Retail and Other: 22.42 %

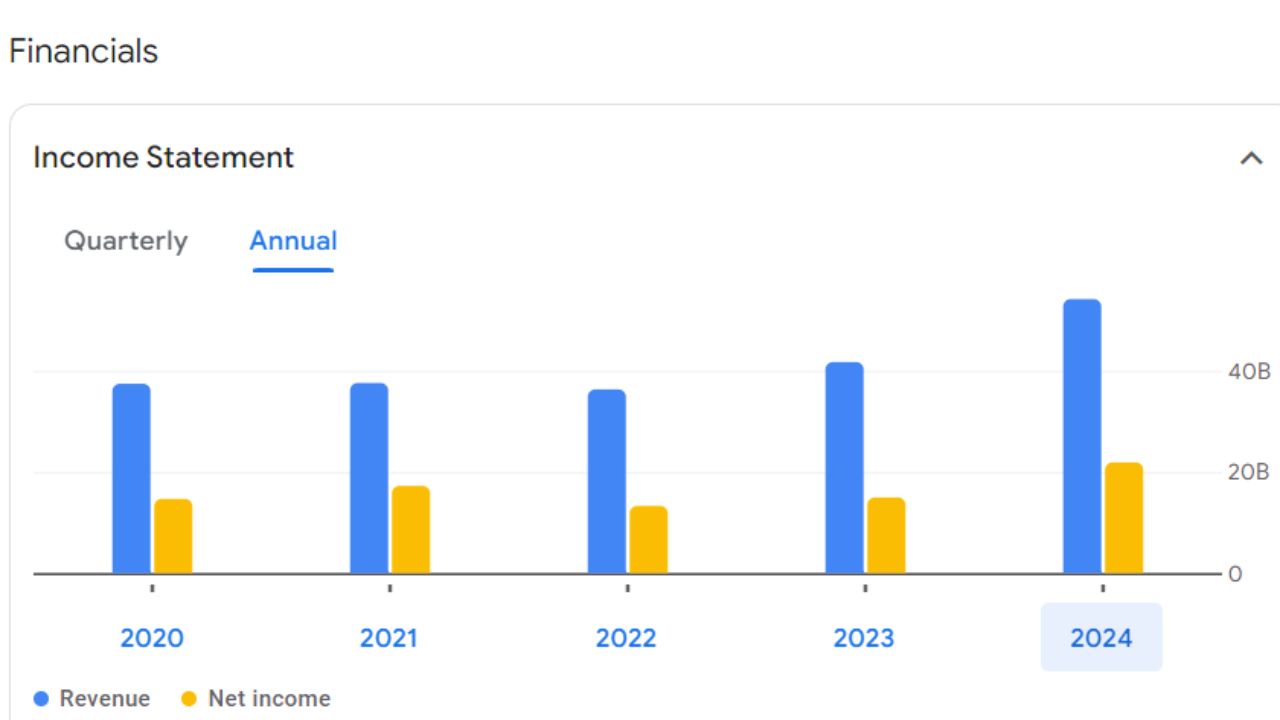

Manappuram Annual Income Statement

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 14.11B | +11.83 % |

| Operating Expenses | 6.41 B | +12.23 % |

| Net Income | 5.55 B | +11.84 % |

| Net Profit Margin | 39.30 | 0.00 % |

| Earning Per Share | 6.58 | 11.90 % |

| EBITDA | N/A | N/A |

| Effective Tax Rate | 26.07 % | N/A |

Factors Influencing the Manappuram Share Price

- Market Trends : The fintech sector in India is rapidly expanding and is driven by increased digital adaptation and government initiatives.

- Strategies Acquisitions: Infibeams acquisition of a 54 % stake in Rediff Enhances its service offerings and market.

- Financial Performance: The company reported a 31% increase in net profit, contributing to positive investor sentiments.

- Technological Advances: Investment in AI for fraud detection is expected to boost security and user trust, further supporting growth.

- Investor Confidence: Despite recent challenges, a significant share price indicates renewed investor interest and confidence in the company’s future.