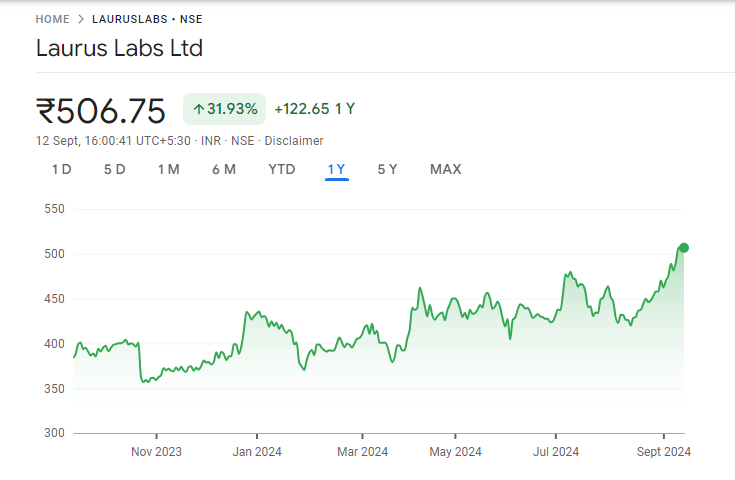

Laurus Labs Ltd is an Indian pharmaceutical company known for manufacturing high-quality generic medicines, active pharmaceutical ingredients (APIs), and advanced intermediates. Laurus Labs Share Price on NSE as of 12 September 2024 is 506.75 INR. On this page, you will find Laurus Labs Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Laurus Labs share News, Laurus Labs News today, Lawrence lab share price NSE, Why Laurus Labs share falling today, Laurus Labs share price target tomorrow, Laurus Labs share price target 2030, and more Information.

Laurus Labs Ltd Company Details

Laurus Labs Ltd is an Indian pharmaceutical company known for manufacturing high-quality generic medicines, active pharmaceutical ingredients (APIs), and advanced intermediates. Established in 2005, the company focuses on providing affordable healthcare solutions globally, with expertise in areas like antiviral, oncology, and cardiovascular therapies.

Laurus Labs has a strong presence in both domestic and international markets, supplying its products to leading pharmaceutical companies. With a commitment to innovation and research, the company plays a key role in improving access to essential medicines around the world.

| Official Website | lauruslabs.com |

| Founded | 2005 |

| Founder | Satyanarayana Chava |

| CEO | Satyanarayana Chava |

| Headquarters |

Hyderabad, Telangana, India

|

| Number of employees | 6,007 (2024) |

| Category | Share Price |

Current Market Overview Of Laurus Labs Share Price

- Open Price: 510.00 INR

- High Price: 514.Ninety INR

- Low Price: 506.30 INR

- Market Cap: 27,500 Crore INR

- P/E Ratio: 185.94

- Dividend Yield: 0.16%

- 52-Week High: 518.00 INR

- 52-Week Low: 349.Forty INR

- Current Share Price: 509.90 INR

Laurus Labs Share Price Today Chart

Read Also:- Shree Renuka Sugars Share Price Target 2025, 2026, 2027, to 2030

Laurus Labs Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Laurus Labs for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Laurus Labs Share Price Target Years | SHARE PRICE TARGET |

| 1 | Laurus Labs Share Price Target 2024 | ₹545 |

| 2 | Laurus Labs Share Price Target 2025 | ₹628 |

| 3 | Laurus Labs Share Price Target 2026 | ₹737 |

| 4 | Laurus Labs Share Price Target 2027 | ₹842 |

| 5 | Laurus Labs Share Price Target 2028 | ₹938 |

| 6 | Laurus Labs Share Price Target 2029 | ₹1023 |

| 7 | Laurus Labs Share Price Target 2030 | ₹1156 |

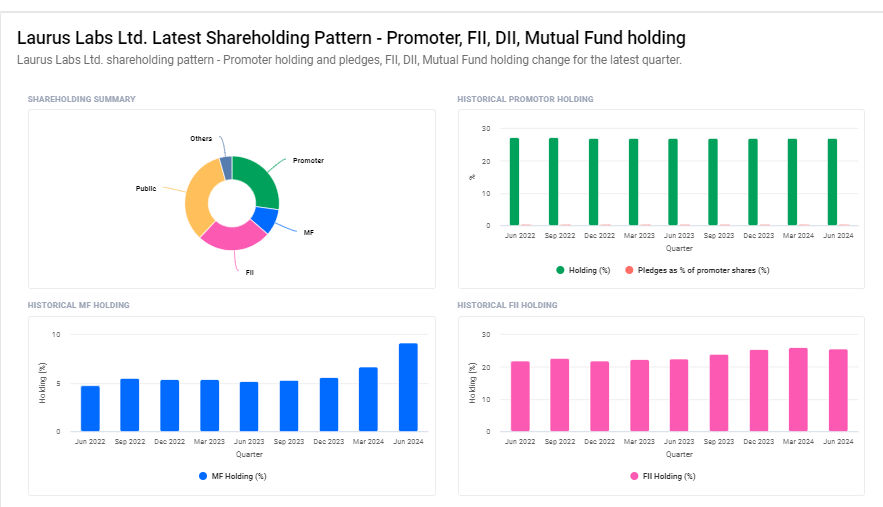

Laurus Labs Ltd Shareholding Pattern

- Retail and Others: 33.59%

- Promoters: 27.18%

- Foreign Institutions: 25.67%

- Mutual Funds: 9.18%

- Other Domestic Institutions: 4.38%

Key Factors Affecting Laurus Labs Share Price Growth

Here are five key factors that can affect Laurus Labs’ share price growth:

- Product Demand: Increasing global demand for generic medicines and APIs, particularly in the antiviral and oncology sectors, can drive Laurus Labs’ sales and positively impact its share price.

- Regulatory Approvals: Obtaining regulatory approvals for new drugs from global authorities like the US FDA and European agencies can boost investor confidence, leading to potential share price growth.

- Expansion into New Markets: Expanding operations into new international markets can increase Laurus Labs’ customer base, contributing to revenue growth and supporting its stock price.

- Research and Development: Strong investments in research and development (R&D) for new medicines and therapies can lead to product innovation, enhancing the company’s long-term growth prospects and share value.

-

Cost Efficiency: Effective management of production costs and supply chain operations can improve profit margins, positively influencing the company’s financial performance and share price.

Risks and Challenges to Laurus Labs Share Price

Here are five risks and challenges that could affect Laurus Labs’ share price:

- Regulatory Risks: Delays or rejections in regulatory approvals from global agencies like the US FDA can impact the launch of new products, affecting Laurus Labs’ revenue and share price.

- Competition: Intense competition from other pharmaceutical companies in both the generic and API segments can pressure Laurus Labs’ market share, potentially impacting its stock performance.

- Pricing Pressure: Government regulations and market dynamics that lead to price controls on medicines, especially in key markets, can affect profit margins and influence the company’s share price.

- Supply Chain Disruptions: Any disruptions in the supply chain for raw materials or manufacturing operations can slow production, impacting the company’s ability to meet demand and affecting its stock price.

-

Currency Fluctuations: As Laurus Labs operates in global markets, changes in currency exchange rates can affect revenue from exports, creating financial volatility and impacting the share price.

Read Also:-

- Rattan Power Share Price Target

- RBL Share Price Target

- Lotus Chocolate Share Price Target

- Chennai Petroleum Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.