Kalyan Jewellers is an Indian jewelry brand. Kalyan Jewellers Share Price on NSE as of 4 September 2024 is 654.20 INR. On this page, you will find Kalyan Jewellers Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Kalyan Jewellers share price NSE, Kalyan Jewellers share price today live chart, Kalyan share price today, Kalyan Jewellers share price target tomorrow, Kalyan Jewellers share price target 2030, and more Information.

Kalyan Jewellers Information

Kalyan Jewellers is a well-known Indian jewelry brand that was founded in 1993. The company offers a wide range of gold, diamond, and gemstone jewelry, and it is known for its craftsmanship and quality. With numerous showrooms across India and a growing international presence, Kalyan Jewellers has built a reputation for trust and customer satisfaction, making it a popular choice for those seeking traditional and contemporary jewelry designs.

| Official Website | kalyanjewellers.net |

| Customer service | 1800 425 7333 |

| Founder | T. S. Kalyanaraman |

| CEO | Sanjay Raghuraman |

| Parent organization | Kalyan Jewellers FZE |

| Founded | 1993, Thrissur |

| Headquarters | Thrissur, Kerala, India |

| Number of employees | 8,000 |

| Category | Share Price |

Current Market Overview Of Kalyan Jewellers Share Price

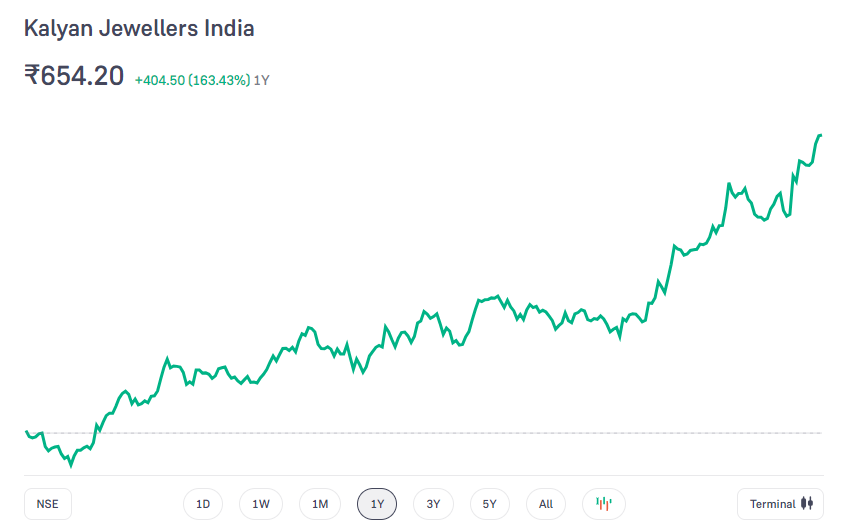

- Market Cap – ₹ 67,437 Cr.

- Current Price – ₹ 654

- High / Low – ₹ 658 / 203

- Stock P/E – 107

- Book Value – ₹ 40.7

- Dividend Yield – 0.18 %

- ROCE – 14.0 %

- ROE – 15.2 %

- Face Value – ₹ 10.0

Kalyan Jewellers Share Price Recent Graph

Kalyan Jewellers Share Price Target Tomorrow From 2024 To 2030

| S. No. | Kalyan Jewellers Share Price Target Years | Share Price Target |

| 1 | Kalyan Jewellers Share Price Target 2024 | ₹725 |

| 2 | Kalyan Jewellers Share Price Target 2025 | ₹940 |

| 3 | Kalyan Jewellers Share Price Target 2026 | ₹1,075 |

| 4 | Kalyan Jewellers Share Price Target 2027 | ₹1,240 |

| 5 | Kalyan Jewellers Share Price Target 2028 | ₹1,410 |

| 6 | Kalyan Jewellers Share Price Target 2029 | ₹1,620 |

| 7 | Kalyan Jewellers Share Price Target 2030 | ₹1,865 |

Read Also:- GRSE Share Price Target 2024, 2025, 2026 to 2030 Prediction

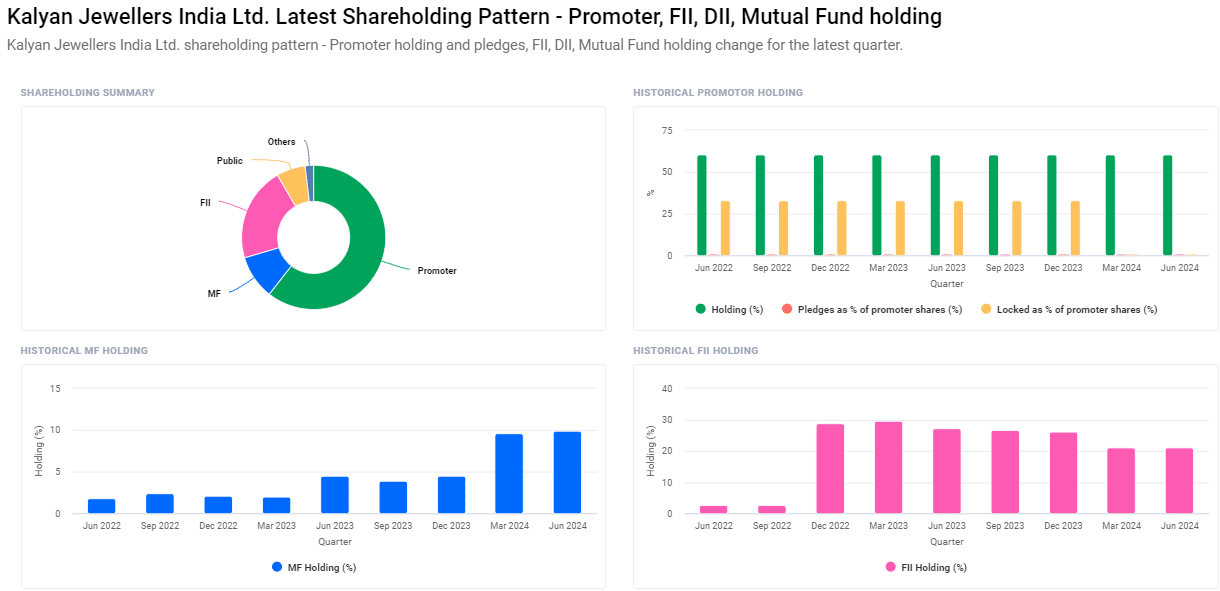

Shareholding Pattern For Kalyan Jewellers

- Promoters: 60.59%

- Foreign Institutions: 21.19%

- Mutual Funds: 9.87%

- Retail and Others: 6.46%

- Other Domestic Institutions: 1.89%

Risks and Challenges to Kalyan Jewellers Share Price

Here are five risks and challenges that could affect Kalyan Jewellers’ share price:

- Economic Slowdown: An economic downturn can reduce consumer spending on luxury items like jewelry, leading to lower sales and potentially impacting the share price negatively.

- Currency Fluctuations: As gold prices are often tied to the U.S. dollar, any adverse currency movements can increase costs for Kalyan Jewellers, squeezing profit margins and affecting investor sentiment.

- Intense Competition: The jewelry market is highly competitive, with established players and new entrants vying for market share. This competition can put pressure on Kalyan Jewellers’ pricing strategies and profitability.

- Regulatory Hurdles: Stricter regulations around gold import duties, hallmarking standards, or taxation could increase operational costs, challenging the company’s financial performance and influencing its stock price.

-

Supply Chain Disruptions: Any disruption in the supply chain, whether due to geopolitical issues, strikes, or global pandemics, could impact the availability of raw materials, leading to production delays and potential losses.

Key Factors Influencing Kalyan Jewellers Share Price

Here are four key factors that can influence Kalyan Jewellers’ share price:

- Consumer Demand and Trends: The share price can fluctuate based on changing consumer preferences, especially during festive seasons or economic downturns, which affect the demand for luxury jewelry.

- Gold Price Volatility: Since gold is a primary material for Kalyan Jewellers, any significant changes in gold prices directly impact the company’s costs and profitability, influencing the share price.

- Expansion and Growth Strategies: The company’s efforts to expand its domestic and international footprint can positively affect investor confidence and boost the share price.

-

Regulatory Changes: Changes in government policies related to import duties, taxation on gold, or jewelry manufacturing can either benefit or challenge the company, thereby impacting its stock performance.

Read Also:-

- Waaree Renewables Share Price Target

- Gujarat Gas Share Price Target

- ZUDIO Share Price Target

- Franklin Industries Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.