JM Financial is a company with numerous financial offerings and an extended reputation and popularity within the Indian capital markets. As a first-rate player in investing banking, wealth management, asset control, and lending offerings, the enterprise has confirmed a consistent boom through the years. With a history of prudent economic management and an assorted portfolio of offerings, JM Financial has positioned itself as a massive participant in the Indian economic vicinity. This article affords an in-depth assessment of JM Financial Share projection from 2024 to 2030.

JM Financial Share Price Performance Overview

As of the cutting-edge buying and promoting statistics, JM Financial is trading at 139.35, marking a strong 63.46 % growth during the last twelve months. The stock has witnessed a normal increase, with 52 – a week immoderate of 146.70 and 52 – a week low of 6900, highlighting its volatility but additionally its functionality for huge profits.

Key Financial Metrics For JM Financial Share Price

- Market Capital: 140.20

- Open: 140.20

- High: 144.34

- Low: 137.21

- Current Share Price: 138.44

- P / E Ratio: 32.02

- Dividend Yield: 1. 44 %

- 52 Week High: 146.70

- 52 Week Low: 69.00

JM Financial Share Price Current Graph

JM Financial Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 154 |

| 2025 | 211 |

| 2026 | 274 |

| 2027 | 336 |

| 2028 | 398 |

| 2029 | 456 |

| 2030 | 512 |

Shareholding Pattern For JM Financial Share Price

- Promotors: 56.43 %

- Foreign Institutional: 16.83 %

- Mutual Funds: 8.41 %

- Other Domestic Institutions: 0.23%

- Retail and other : 18.11 %

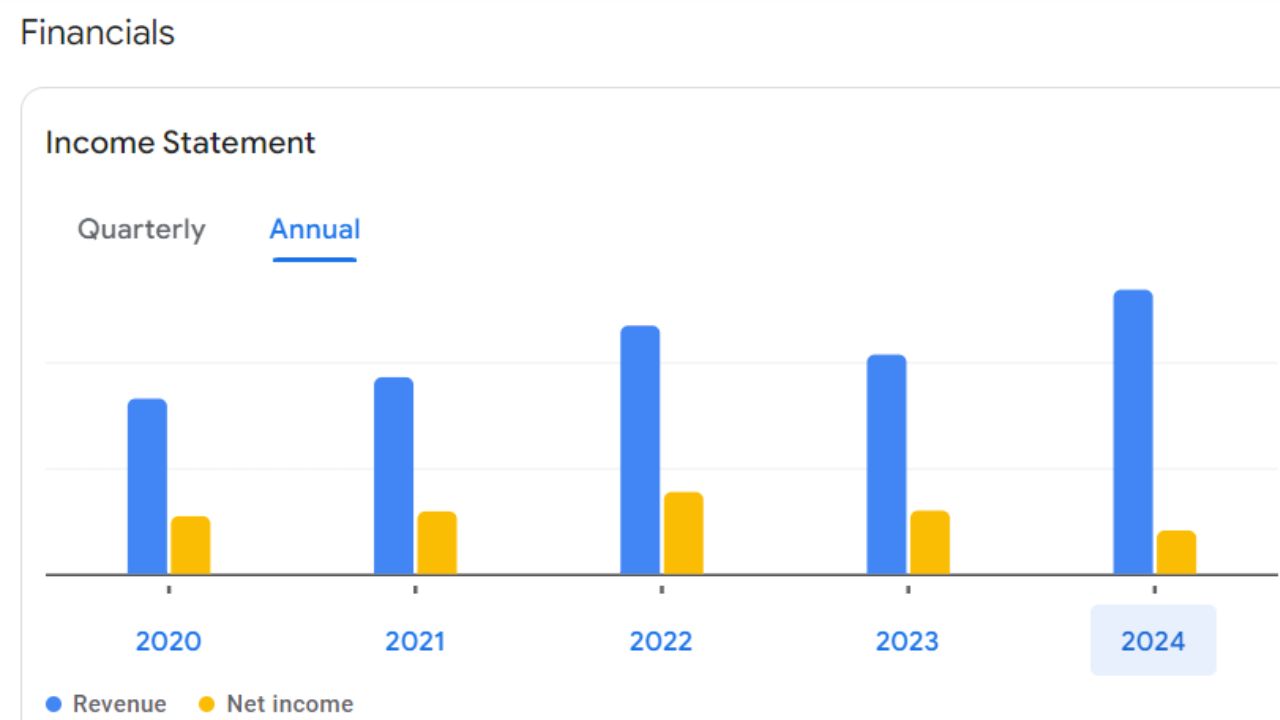

JM Financial Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 6.51 B | +14.41 % |

| Operating Expenses | 3.19 B | -5.90 % |

| Net Income | 1.71 B | +2.89 % |

| Net Profit Margin | 26.21 | -10.09 % |

| Earning Per Share | N/A | N/A |

| EBITDA | N/A | N/A |

| Effective Tax Rate | 24.13 % | N/A |

Factors Influencing JM Financial Share Price

- Technological Advancements: Broadcom’s reputation for innovation and its potential to increase modern-day semiconductor answers play a splendid role in the usage of its percentage charge.

- Strategic Acquisitions: Broadcom’s facts regarding the strategic acquisition have bolstered its product portfolio and market presence, contributing to sales increase.

- Market Demand: Demand for semiconductors in prevent markets, which consists of factories, facilities, networking, and wireless conversation, appreciably affects Broadcom’s economics well-known regular generic general overall performance.

- Global Economics Conditions: Economics health, alongside element factors that incorporate GDP boom, interest expenses, and client spending, need to have an effect on Broadcom s fashionable, not unusual performance.

- Competition: The semiconductor organization is pretty competitive, with several key gamers vying for marketplace percent. Broadcom’s aggressive positioning and capacity to innovate are vital.