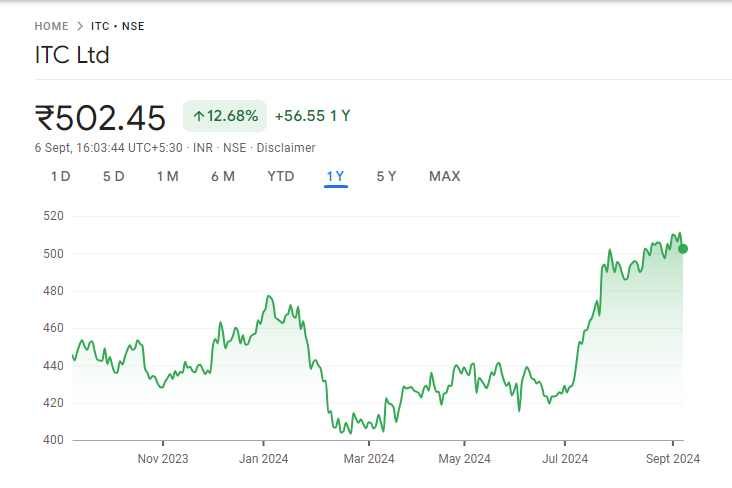

Are you looking to invest in ITC Limited? Here’s what you need to know about its share price targets. ITC, a major player in FMCG, hotels, and packaging, is closely watched by investors for its performance and prospects. We’ve outlined the projected share price targets for ITC to help you make informed decisions. ITC Share Price on NSE as of 6 September 2024 is 502.45 INR. Keep reading to explore the anticipated price movements and what they could mean for your investments.

ITC Company Details

ITC Limited is a prominent Indian conglomerate with a diverse portfolio spanning various sectors. In 1910, ITC started as a tobacco company but has since expanded into multiple industries including FMCG (fast-moving consumer goods), hotels, paperboards, and packaging.

In the FMCG sector, ITC is well-known for its popular brands like Aashirvaad (flour), Sunfeast (biscuits), and Bingo! (snacks). The company also has a significant presence in the personal care and education sectors.

ITC operates a chain of luxury hotels under the ITC Hotels brand, providing high-end hospitality services. Its commitment to sustainability is evident through its efforts to reduce environmental impact and promote green practices.

With a strong focus on innovation and quality, ITC has become a leading player in its sectors, maintaining a solid reputation for reliability and excellence in the Indian market.

| ITC Full Name | Imperial Tobacco Company |

| Official Website | itcportal.com |

| Founded | 24 August 1910 |

| Headquarters |

Virginia House, Chowringhee Road, Kolkata, India

|

| Chairman & MD | Sanjiv Puri |

| Number of employees | 33,824 (2023) |

| Category | Share Price |

|

Market cap |

₹ 5,40,964 Cr. |

|

Stock P/E ratio |

26.4 |

|

ROE |

29.1 % |

|

ROCE |

39% |

|

Dividend Yield |

2.93% |

|

Face value |

₹ 1.00 |

|

Book value |

₹ 55.40 |

|

Current Price |

₹ 433 |

Read Also:-

Current Market Overview Of ITC Share Price

- MARKET CAP: ₹6.27LCr

- OPEN: ₹512.00

- HIGH: ₹512.00

- LOW: ₹497.15

- Current Price: ₹502.45

- P/E RATIO: 30.73

- DIVIDEND YIELD: 2.74%

- 52 WEEK HIGH: ₹515.95

- 52 WEEK LOW: ₹399.35

ITC Share Price Today Chart

ITC Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of ITC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | ITC Share Price Target Years | SHARE PRICE TARGET |

| 1 | ITC Share Price Target 2024 | ₹5560 |

| 2 | ITC Share Price Target 2025 | ₹615 |

| 3 | ITC Share Price Target 2026 | ₹707 |

| 4 | ITC Share Price Target 2027 | ₹810 |

| 5 | ITC Share Price Target 2028 | ₹913 |

| 6 | ITC Share Price Target 2029 | ₹1020 |

| 7 | ITC Share Price Target 2030 | ₹1125 |

Major Factors Affecting ITC Share Price Share Price

Here are six major factors that affect the share price of ITC in simple and easy-to-understand language:

- Performance of Core Businesses: ITC’s share price is heavily influenced by the performance of its key business segments, like cigarettes, FMCG (Fast-Moving Consumer Goods), hotels, paper, and agriculture. Strong growth or setbacks in these areas can lead to a rise or fall in the stock price.

- Government Regulations and Taxes: Changes in government policies, especially regarding tobacco regulations and taxes on cigarettes, play a significant role in shaping ITC’s stock price. Higher taxes or stricter regulations often result in a drop in share prices, affecting the profitability of its cigarette business.

- Economic Conditions: Broader economic conditions, such as inflation, GDP growth, and consumer spending patterns, can affect ITC’s share price. A robust economy boosts consumer spending, leading to higher sales for ITC’s products, which can positively impact its stock price.

- Expansion and Diversification Plans: ITC’s efforts to diversify its portfolio and expand into new sectors, like FMCG and hotels, influence its stock performance. Investors are usually optimistic if these ventures show promise, pushing the stock price higher.

- Company Financials: ITC’s quarterly earnings reports, profit margins, and revenue growth are closely monitored by investors. Strong financial performance or beating market expectations typically results in a rise in share price, while weaker numbers can lead to a decline.

-

Global and Domestic Market Trends: Global events, currency fluctuations, and trends in the Indian stock market can impact ITC’s share price. For example, market volatility or uncertainty in the global economy can cause investors to react, leading to price swings in ITC shares.

Read Also:-

- NHPC Share Price Target

- Hindustan Zinc Share Price Target

- Motisons Jewellers Share Price Target

- HUDCO Share Price Target

- Orient Green Power Share Price Target

FAQ

Q1. What is the price target for ITC in 2025?

Ans. The price target for ITC in 2025 is ₹600.37.

Q2. What is the future of ITC share?

Ans. The future of ITC shares looks promising, with a projected price of ₹1,124.99 by 2030.

Q3. What is the target price of an ITC share?

Ans. The target price of ITC shares is projected to be ₹496.83 in 2024 and may reach ₹1,645.37 by 2035.

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.