IOB (Indian Overseas Bank)is an Indian public sector bank. IOB Share Price on NSE as of 2 September 2024 is 60.57 INR. On this page, you will find IOB Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as IOB share News, IOB share Price target next week, IOB share price target tomorrow, IOB Share Price Target 2040, IOB share Price Target 2050, and more Information.

Indian Overseas Bank Information

Indian Overseas Bank, often known as IOB, is a major public sector bank in India. Founded in 1937, it has its headquarters in Chennai. IOB offers a wide range of banking services, including savings accounts, loans, and digital banking solutions, catering to both individuals and businesses. With a strong presence across the country and branches overseas, the bank focuses on providing customer-friendly services and supporting economic growth through various financial products. Over the years, IOB has built a reputation for reliability and trust among its customers.

| Official Website | iob.in |

| CEO | Ajay Kumar Srivastava (1 Jan 2023–) |

| Founded | 10 February 1937, Chennai |

| Founder | M. Ct. M. Chidambaram Chettiar |

| Headquarters | Chennai, Tamil Nadu, India |

| Number of employees | 21,475 (2024) |

| Category | Share Price |

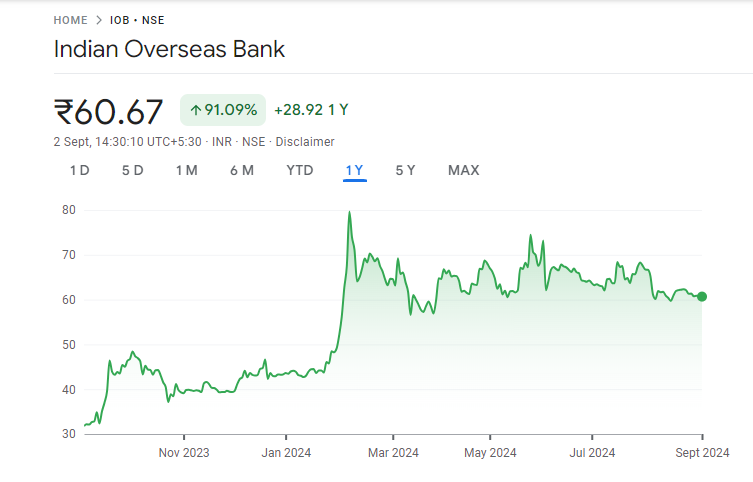

Current Market Overview Of IOB Share Price

- Open – ₹ 60.89

- High – ₹ 61.10

- Low – ₹ 59.95

- Current Price – ₹ 60.66

- Mkt cap – ₹ 1.15LCr

- P/E ratio – 40.80

- Div yield – N/A

- 52-wk high – ₹ 83.75

- 52-wk low – ₹ 30.00

IOB Share Price Recent Graph

IOB Share Price Target Tomorrow From 2024 To 2030

| S. No. | IOB Share Price Target Years | IOB Share Price Target |

| 1 | IOB Share Price Target 2024 | ₹ 80 |

| 2 | IOB Share Price Target 2025 | ₹ 92 |

| 3 | IOB Share Price Target 2026 | ₹ 100 |

| 4 | IOB Share Price Target 2027 | ₹ 112 |

| 5 | IOB Share Price Target 2028 | ₹ 125 |

| 6 | IOB Share Price Target 2029 | ₹ 140 |

| 7 | IOB Share Price Target 2030 | ₹ 155 |

Read Also:- CDSL Share Price Target 2024, 2025 To 2030 and More Details

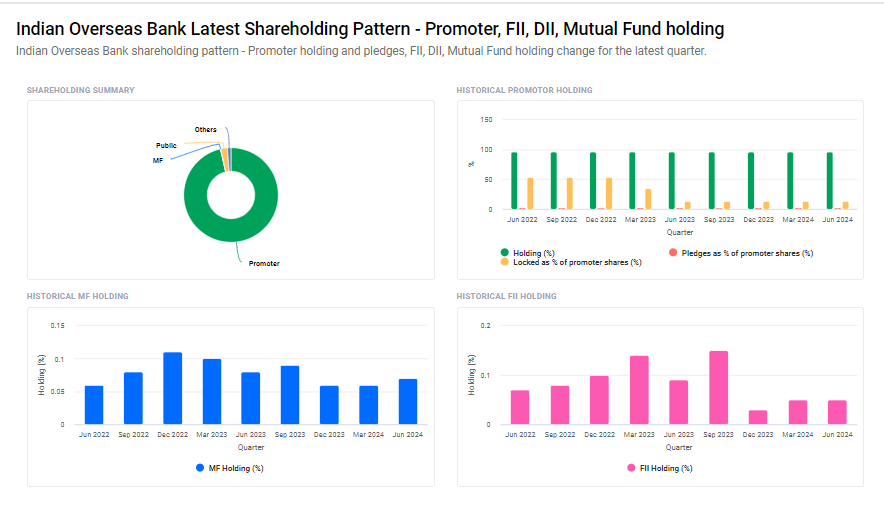

Shareholding Pattern For IOB Share Price

- Promoter Holding – 96.4%

- FII Holding – 0.1%

- DII – 1.3%

- Public – 2.3%

Factors Affecting IOB Share Price Growth

-

Economic Conditions: The overall economic health of India greatly impacts IOB’s share price. A growing economy can lead to increased lending and better asset quality, boosting the bank’s profitability and share value.

- Interest Rates: Changes in interest rates set by the Reserve Bank of India (RBI) can influence IOB’s net interest margin. Higher interest rates may improve the bank’s income from loans, while lower rates could compress margins, affecting share price.

- Asset Quality: The level of non-performing assets (NPAs) is crucial. A high amount of bad loans can hurt profitability and investor confidence, leading to a decline in share prices. Conversely, a reduction in NPAs can boost the bank’s financial health and share value.

- Government Policies: As a public sector bank, IOB is influenced by government policies, including banking reforms and recapitalization initiatives. Positive policy changes can improve the bank’s financial position, positively impacting its share price.

- Technological Advancements: IOB’s investment in digital banking and technology can enhance customer experience and operational efficiency. Successful tech integration can lead to an increased customer base and profitability, which may drive share price growth.

-

Competitive Landscape: The bank’s ability to compete effectively with other banks in terms of interest rates, customer service, and product offerings also affects its market position. Strong competitive performance can attract more customers and investors, supporting share price growth.

Risks and Challenges to IOB Share Price

-

High Non-Performing Assets (NPAs): If the Indian Overseas Bank has a large amount of loans that are not being repaid on time, it can lead to losses. High NPAs can reduce the bank’s profitability and hurt its share price, as investors may worry about the bank’s financial health.

- Economic Slowdown: A downturn in the economy can lead to reduced demand for loans and higher default rates. This can negatively affect the bank’s revenue and earnings, putting pressure on its share price.

- Regulatory Changes: Changes in banking regulations by the Reserve Bank of India (RBI) or government policies can impact the bank’s operations. Stricter regulations or new compliance requirements could increase costs and affect profitability, potentially lowering the share price.

- Competition from Private Banks: The banking sector is highly competitive, with private banks often offering more innovative products and better customer service. If IOB fails to keep up, it might lose market share, impacting its growth prospects and share price.

-

Interest Rate Fluctuations: IOB’s earnings can be sensitive to changes in interest rates. If rates are low, the bank might earn less from its loans, which can reduce profitability. Conversely, if rates are high, it could lead to fewer loans being taken out, both scenarios potentially leading to a decrease in share price.

Read Also:-

- Mtnl Share Price Target

- HPCL Share Price Target

- IndusInd Bank Share Price Target

- Syncom Formulations Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.