IndusInd Bank is an Indian private sector bank. IndusInd Bank Share Price on NSE as of 30 August 2024 is 1,427.45 INR. On this page, you will find IndusInd Bank Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Why IndusInd Bank share falling today, IndusInd Bank share price target tomorrow, IndusInd Bank share price target by Motilal Oswal, and more Information.

IndusInd Bank Ltd Information

IndusInd Bank is a well-known private sector bank in India, established in 1994. The bank offers a wide range of banking products and services, including savings and current accounts, loans, credit cards, and investment options. IndusInd Bank is recognized for its customer-focused approach, innovative digital banking solutions, and strong presence in both urban and rural areas. Over the years, it has built a reputation for reliability and efficiency, catering to the financial needs of individuals, businesses, and corporations.

| Official Website | indusind.com |

| CEO | Sumant Kathpalia (24 Mar 2020–) |

| Founded | April 1994, Mumbai |

| Founder | S. P. Hinduja |

| Headquarters | Mumbai, Maharashtra, India |

| Number of employees | 45,637 (2024) |

| Category | Share Price |

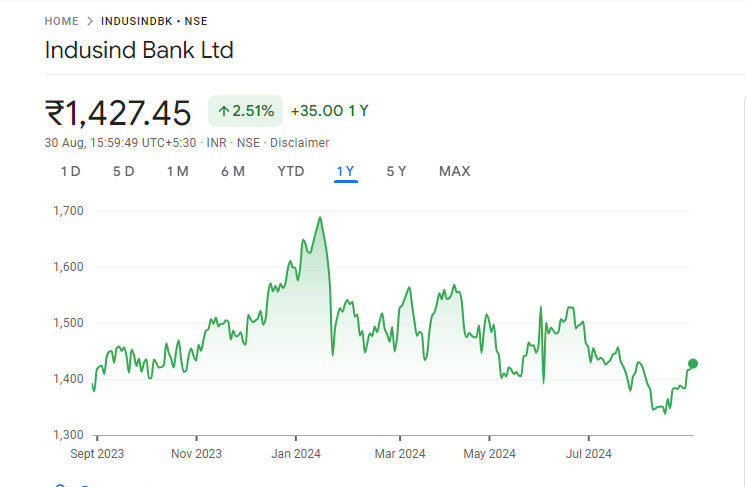

Current Market Overview Of IndusInd Bank Share Price

- Open Price: ₹1,422.15

- High Price: ₹1,430.00

- Low Price: ₹1,415.55

- Market Capitalization: ₹1.11 lakh crore

- Price-to-Earnings (P/E) Ratio: 12.32

- Dividend Yield: 1.16%

- 52-Week High: ₹1,694.50

- 52-Week Low: ₹1,329.20

- Current Price: ₹1,427.45

IndusInd Bank Share Price Recent Graph

IndusInd Bank Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of IndusInd Bank for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | IndusInd Bank Share Price Target Years | SHARE PRICE TARGET |

| 1 | IndusInd Bank Share Price Target 2024 | ₹1702 |

| 2 | IndusInd Bank Share Price Target 2025 | ₹1859 |

| 3 | IndusInd Bank Share Price Target 2026 | ₹1964 |

| 4 | IndusInd Bank Share Price Target 2027 | ₹2110 |

| 5 | IndusInd Bank Share Price Target 2028 | ₹2264 |

| 6 | IndusInd Bank Share Price Target 2029 | ₹2426 |

| 7 | IndusInd Bank Share Price Target 2030 | ₹2596 |

Read Also:- Igarashi Motors Share Price Target 2024, 2025 To 2030 Prediction

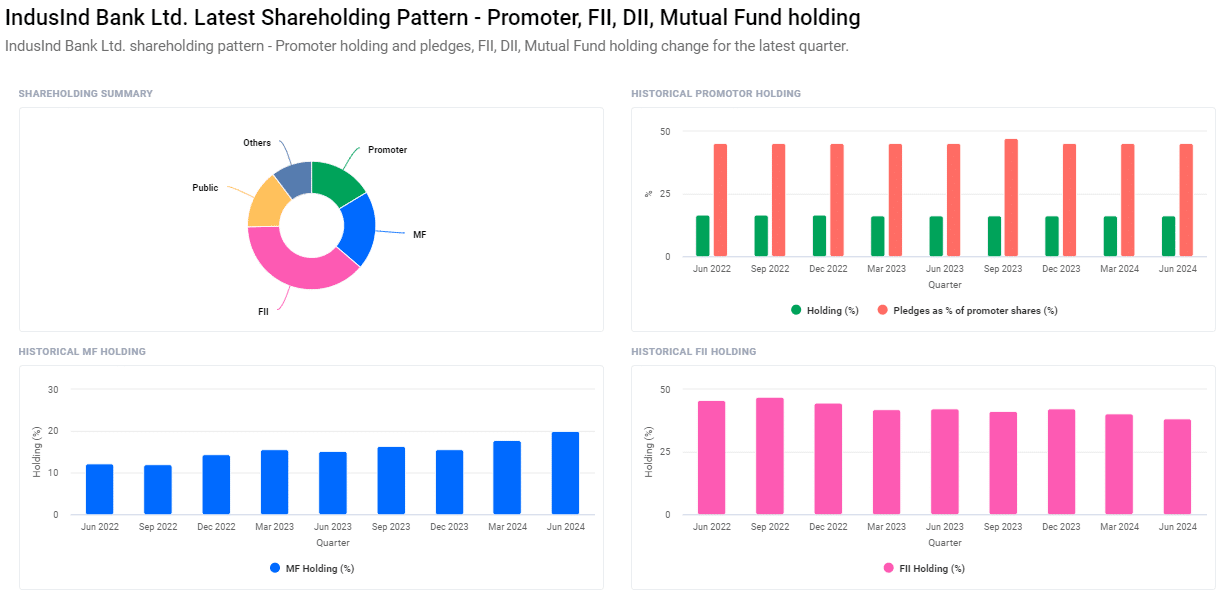

Shareholding Pattern For IndusInd Bank Share Price

- Foreign Institutions (FII/FPI): 38.40%

- Mutual Funds: 19.91%

- Promoters: 16.38%

- Retail and Others: 15.04%

- Other Domestic Institutions: 10.27%

IndusInd Bank Financials:-

| Market Capitalization value | 115474 crores |

| Total Share Capital | 775.90 crores |

| Total Borrowings | 49011.23 crores |

| Total Investments | 83116.20 crores |

| Total Assets | 457804.4 crores |

| Total Income | 44534.28 crores |

| Total Interest earned | 36367.91 crores |

| EPS | 19.34 |

| ROCE | 3.26 percent |

| ROE | 13.40 percent |

| PE ratio | 14.32 percent |

| Return on Assets | 1.61 percent |

| Price-to-sales ratio | 2.28 percent |

| Earnings yield ratio | 0.09 percent |

| Capital Adequacy ratio | 17.86 percent |

Factors Affecting IndusInd Bank Share Price Growth

Here are five key factors that can influence the share price growth of IndusInd Bank:

- Economic Conditions: The overall economic environment in India plays a significant role. A strong economy with growth in GDP and consumer spending boosts the bank’s lending and deposit activities, positively impacting its share price.

- Interest Rate Changes: Interest rates set by the Reserve Bank of India (RBI) affect borrowing costs and profit margins. Lower interest rates can encourage more borrowing, while higher rates can increase the bank’s interest income, both of which can influence the share price.

- Loan Growth and Asset Quality: An increase in loan disbursements and maintaining good asset quality with low non-performing assets (NPAs) are critical. Healthy loan growth and minimal bad loans signal good financial health, supporting share price growth.

- Technological Advancements: IndusInd Bank’s investment in digital banking platforms and technological innovations can enhance customer experience, attract more clients, and improve operational efficiency, leading to positive market sentiment.

-

Regulatory Changes: Changes in banking regulations and policies by the RBI or government can impact IndusInd Bank’s operations. Favorable regulations can enhance profitability and business opportunities, boosting share prices.

Read Also:-

- CDSL Share Price Target

- Genus Power Share Price Target

- Radico Khaitan Share Price Target

- Bajaj Auto Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.