Hind Rectifier Ltd is an Indian company specializing in the design, manufacturing, and supply of power electronics and electrical equipment. Hind Rectifier Share Price on NSE as of 24 September 2024 is 901.85 INR. On this page, you will find Hind Rectifier Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Hind Rectifiers Ltd. products, Hind Rectifiers salary, Hind Rectifiers share price screener, Hind Rectifiers Results, Hind Rectifiers owner, Hind Rectifiers News, and more Information.

Hind Rectifier Ltd Company Details

Hind Rectifier Ltd is an Indian company specializing in the design, manufacturing, and supply of power electronics and electrical equipment. Established in 1958, the company provides a wide range of products such as rectifiers, transformers, and inverters, catering to industries like railways, healthcare, and power generation. Known for its focus on innovation and quality, Hind Rectifier has built a strong reputation for delivering reliable and efficient solutions. The company’s dedication to technology and customer satisfaction makes it a trusted name in the power electronics sector.

| Official Website | hirect.com |

| Established | 1958 |

| Headquarters | India |

| Number of employees | 425 (2024) |

| Category | Share Price |

Hind Rectifier Share Price Today Chart

Current Price Overview Of Hind Rectifier Share Price

- Open Price: ₹901.85

- High: ₹901.85

- Low: ₹886.00

- Market Capitalization: ₹1.55K Crore

- Price to Earnings (P/E) Ratio: 88.45

- Dividend Yield: 0.13%

- 52-Week High: ₹1,012.60

- 52-Week Low: ₹333.00

- Current Price: ₹901.85

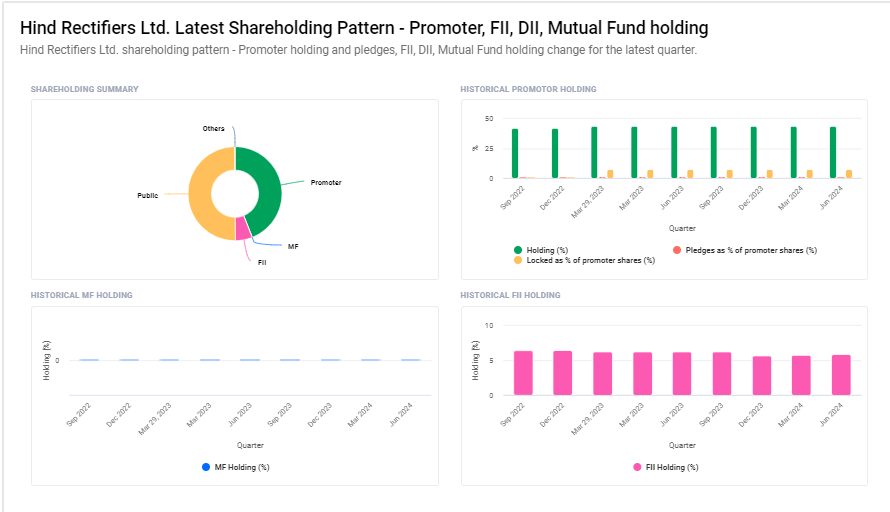

Hind Rectifier Ltd Shareholding Pattern

- Retail and Others: 50.12%

- Promoters: 44.05%

- Foreign Institutions: 5.82%

- Other Domestic Institutions: 0.01%

Read Also:- GE T&D Share Price Target 2024, 2025, 2026 To 2030 Prediction

Hind Rectifier Share Price Target Tomorrow From 2024 To 2030

Predicting the exact share price target for Hind Rectifier tomorrow can be challenging due to the influence of various market factors, such as company news, market trends, and broader economic conditions. Investors often consider technical analysis, market sentiment, and recent performance to estimate potential price movements.

| S. No. | Hind Rectifier Share Price Target Years | SHARE PRICE TARGET |

| 1 | Hind Rectifier Share Price Target 2024 | ₹1206 |

| 2 | Hind Rectifier Share Price Target 2025 | ₹1332 |

| 3 | Hind Rectifier Share Price Target 2026 | ₹1545 |

| 4 | Hind Rectifier Share Price Target 2027 | ₹1755 |

| 5 | Hind Rectifier Share Price Target 2028 | ₹1996 |

| 6 | Hind Rectifier Share Price Target 2029 | ₹2281 |

| 7 | Hind Rectifier Share Price Target 2030 | ₹2610 |

Hind Rectifier Share Price Target 2024

The share price target for Hind Rectifiers in 2024 is projected at ₹1,206, reflecting a positive outlook for the company. With its strong presence in power electronics and a reputation for quality, this target highlights the company’s growth potential.

Hind Rectifier Share Price Target 2025

The share price target for Hind Rectifiers in 2025 is set at ₹1,332, showcasing optimism about the company’s future performance. As Hind Rectifiers continues to innovate and expand its reach in key industries like power and railways, investors can feel assured of steady growth.

Key Factors Affecting Hind Rectifier Share Price Growth

Here are six key factors that can influence Hind Rectifier Ltd’s share price growth:

- Increasing Demand for Power Electronics: As industries such as railways, healthcare, and power generation expand, the demand for Hind Rectifier’s products like transformers and rectifiers can grow, boosting revenues and share price.

- Technological Advancements: Innovation in power electronics and the company’s ability to introduce new, efficient products can give Hind Rectifier a competitive edge. This technological progress can enhance market share, positively impacting the share price.

- Government Initiatives: Policies and investments in infrastructure, especially in railways and renewable energy, can create opportunities for Hind Rectifier. Benefiting from these initiatives can drive growth and positively affect the stock value.

- Expansion of Client Base: Securing new contracts or clients, particularly in sectors like healthcare and industrial power solutions, can lead to higher sales and revenue growth, contributing to share price appreciation.

- Operational Efficiency: Effective cost management, production optimization, and maintaining product quality are crucial for profitability. Strong operational efficiency can support higher margins and share price growth.

-

Global Market Trends: Expansion into international markets or increased demand for power electronics globally can provide new growth avenues. Positive global market trends can fuel revenue growth and strengthen the company’s share price.

Read Also:-

- Good Luck Share Price Target

- Tolins Tyres Share Price Target

- Spicejet Share Price Target

- Torrent Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.