HFCL Limited is a dynamic Indian technology company that designs and manufactures cutting-edge telecommunications equipment, fiber-optic cables, and other advanced electronics. HFCL Share Price on NSE as of 5 September 2024 is 157.24 INR. On this page, you will find HFCL Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as HFCL share News, HFCL share price target tomorrow, HFCL Share Price target tomorrow Moneycontrol, and more Information.

HFCL Ltd Company Details

HFCL Ltd (Himachal Futuristic Communications Limited) is an Indian company that specializes in telecommunications and technology. They offer a range of products and services including telecom equipment, network solutions, and software solutions. HFCL is known for its innovative approach in the telecom sector, aiming to provide high-quality and reliable communication solutions. The company serves both domestic and international markets, focusing on advancing technology and enhancing connectivity.

| Official Website | hfcl.com |

| Founded | 1987 |

| Headquarters | Gurugram, Haryana, India |

| Key people | Mahendra Pratap Shukla (Chairman) Mahendra Nahata (MD) |

| Number of employees | 2,108 (2023) |

| Category | Share Price |

Current Market Overview Of HFCL Share Price

- Open Price: ₹154.40

- High Price: ₹160.30

- Low Price: ₹152.67

- Current Price: ₹157.24

- Market Capitalization: ₹22.73K Crores

- P/E Ratio: 60.25

- Dividend Yield: 0.13%

- 52-Week High: ₹160.30

- 52-Week Low: ₹61.50

HFCL Share Price Today Chart

Read Also:- Bajaj Finance Share Price Target 2024, 2025 to 2030 Prediction

HFCL Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of HFCL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | HFCL Share Price Target Years | SHARE PRICE TARGET |

| 1 | HFCL Share Price Target 2024 | ₹175 |

| 2 | HFCL Share Price Target 2025 | ₹190 |

| 3 | HFCL Share Price Target 2026 | ₹220 |

| 4 | HFCL Share Price Target 2027 | ₹250 |

| 5 | HFCL Share Price Target 2028 | ₹280 |

| 6 | HFCL Share Price Target 2029 | ₹330 |

| 7 | HFCL Share Price Target 2030 | ₹370 |

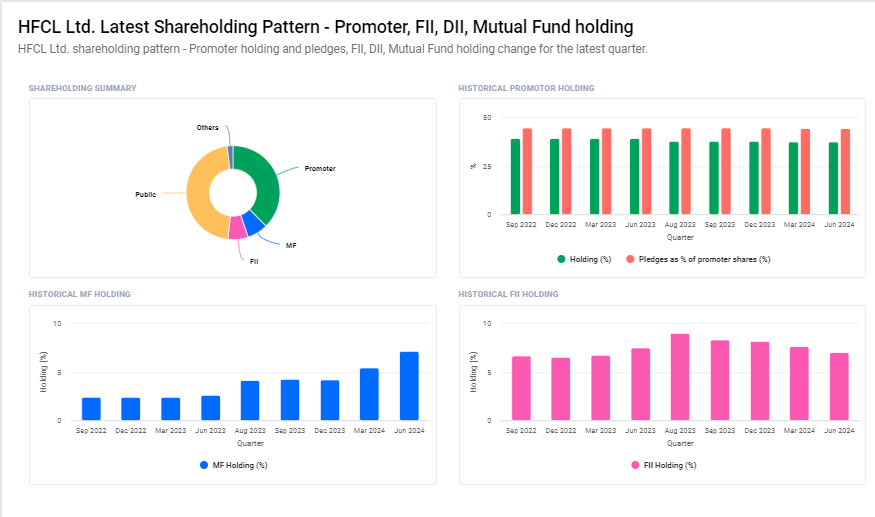

HFCL Ltd Shareholding Pattern

- Retail and Others: 46.28%

- Promoters: 37.63%

- Mutual Funds: 7.15%

- Foreign Institutional Investors (FII/FPI): 7.02%

- Other Domestic Institutions: 1.93%

Key Factors Affecting HFCL Share Price Growth

Here are five key factors that can impact the growth of HFCL’s share price:

- Technological Advancements: HFCL’s ability to innovate and develop new technologies plays a crucial role in its growth. Successful introduction of advanced products and solutions can attract investors and drive up the share price.

- Market Demand for Telecom Solutions: The demand for telecommunications infrastructure and services can significantly influence HFCL’s financial performance. High demand in both domestic and international markets can boost revenue and positively impact the share price.

- Government Policies and Regulations: Changes in government policies, regulations, or incentives related to the telecom sector can affect HFCL’s operations. Supportive policies can enhance growth prospects, while restrictive regulations might create challenges.

- Company Performance and Financial Health: HFCL’s financial results, including revenue, profit margins, and cost management, directly impact investor confidence. Strong performance and solid financial health can lead to a rise in share price.

-

Industry Competition: The competitive landscape in the telecommunications industry can influence HFCL’s market position. How well HFCL performs against competitors, including pricing strategies and market share, can affect its stock performance.

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.