Gujarat Gas Ltd is a prominent natural gas distribution company. Gujarat Gas Share Price on NSE as of 3 September 2024 is 674.95 INR. On this page, you will find Gujarat Gas Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Gujarat Gas share News, Gujarat Gas News today, Gujarat Gas price, Why Gujarat Gas share price down today, Gujarat Gas share price target tomorrow, and more Information.

Gujarat Gas Ltd Company Details

Gujarat Gas Ltd is a prominent natural gas distribution company based in Gujarat, India. Established in 1980, it is a key player in the Indian energy sector, providing natural gas to industrial, commercial, and residential customers. The company focuses on delivering clean energy solutions and expanding its distribution network to meet growing demand. Gujarat Gas operates across various regions, ensuring a reliable supply of natural gas and contributing to the country’s energy needs.

| Official Website | gujaratgas.com |

| Founded | 2012 |

| Headquarters | Ahmedabad |

| Number of employees | 1,028 (2023) |

| Parent organization | Gujarat State Petronet |

| Category | Share Price |

Current Market Overview of Gujarat Gas Share Price

- Open Price: ₹676.00

- High Price: ₹682.50

- Low Price: ₹665.00

- Current Price: ₹674.95

- Market Capitalization: ₹46.46K Crores

- P/E Ratio: 36.94

- Dividend Yield: 0.84%

- 52-Week High: ₹689.95

- 52-Week Low: ₹397.05

Gujarat Gas Share Price Recent Graph

Read Also:- Motisons Jewellers Share Price Target 2024, 2025, 2026, 2027 to 2030

Gujarat Gas Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Gujarat Gas for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Gujarat Gas Share Price Target Years | SHARE PRICE TARGET |

| 1 | Gujarat Gas Share Price Target 2024 | ₹709 |

| 2 | Gujarat Gas Share Price Target 2025 | ₹844 |

| 3 | Gujarat Gas Share Price Target 2026 | ₹978 |

| 4 | Gujarat Gas Share Price Target 2027 | ₹1035 |

| 5 | Gujarat Gas Share Price Target 2028 | ₹1113 |

| 6 | Gujarat Gas Share Price Target 2029 | ₹1216 |

| 7 | Gujarat Gas Share Price Target 2030 | ₹1350 |

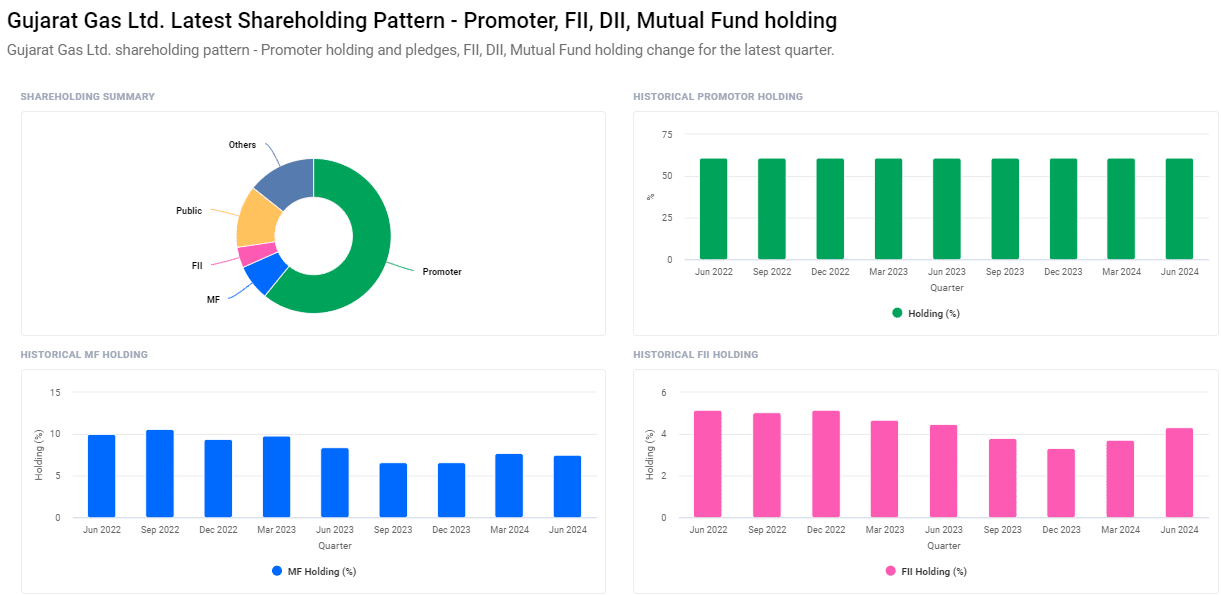

Shareholding Pattern For Gujarat Gas

- Promoters: 60.89%

- Retail and Others: 20.04%

- Mutual Funds: 7.47%

- Other Domestic Institutions: 7.28%

- Foreign Institutional Investors (FII): 4.31%

Factors Affecting Gujarat Gas Share Price Growth

Here are four key factors affecting Gujarat Gas Ltd’s share price growth:

- Regulatory Changes: Changes in government policies or regulations related to the natural gas sector can significantly impact Gujarat Gas. Favorable regulations can boost share prices, while stringent regulations might have the opposite effect.

- Gas Supply and Demand: Fluctuations in the supply and demand for natural gas directly influence Gujarat Gas’s revenue and profitability. Higher demand or stable supply can drive share price growth, while disruptions or oversupply can lead to declines.

- Economic Conditions: Broader economic conditions, including economic growth rates and inflation, can affect Gujarat Gas’s financial performance. A strong economy typically supports higher energy consumption, positively impacting share prices.

-

Operational Efficiency: The company’s ability to manage costs, expand its distribution network efficiently, and implement technology upgrades can impact its profitability and, consequently, its share price. Improvements in operational efficiency generally lead to higher investor confidence and share price growth.

Risks and Challenges to Gujarat Gas Share Price

Here are four risks and challenges that could affect Gujarat Gas Ltd’s share price:

- Fluctuating Gas Prices: Changes in global or domestic gas prices can impact the cost structure of Gujarat Gas. If gas prices rise, it might increase the company’s operational costs or squeeze profit margins, which can negatively affect the share price.

- Infrastructure Issues: Problems with infrastructure, such as pipeline leaks or maintenance issues, can disrupt the supply of gas. Any significant downtime or repair costs can lead to operational inefficiencies and financial losses, influencing investor confidence and share price.

- Technological Changes: Advances in alternative energy technologies or renewable energy sources can reduce the demand for natural gas. If Gujarat Gas fails to adapt to these changes or integrate new technologies, it might face challenges in maintaining its market position.

-

Political and Environmental Factors: Political instability or environmental concerns can impact operations. For instance, stricter environmental regulations or political unrest in the region could disrupt business activities or lead to additional compliance costs, affecting the share price.

Read Also:-

- Franklin Industries Share Price Target

- GRSE Share Price Target

- KEC International Share Price Target

- Campus Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.