GTL Limited, a global group company, is one of each of India’s primary network offerings businesses. Established in 1987, GTL offers community infrastructure offerings to telecom operators and OEMs. Over the years, GTL has prolonged its offerings and grown its presence domestically and worldwide.

GTL Share Price Current Market Overview

- Market Cap: ₹239.25cr

- Open: ₹15.49

- High: ₹15.90

- Low: ₹15.10

- Current Share Price: 2.39

- P/E Ratio: 1.14

- Dividend Yield: N/A

- 52 Week High: ₹19.45

- 52 Week Low: ₹6.85

GTL Share Price Recent Graph

GTL Share Price Target Tomorrow From 2024 To 2030

This analysis for upcoming years is based on market valuation, industrial trends, and expert analysis.

| S. No. | Share Price Target Years | Share Target Value |

|

|

2024 | 5.70 |

|

|

2025 | 22.39 |

|

|

2026 | 24.35 |

|

|

2027 | 26.39 |

|

|

2028 | 29.20 |

|

|

2029 | 30.55 |

|

|

2030 | 31.85 |

Shareholding Pattern For GTL Share Price

- Promoters: 3.28 %

- Foreign Institutions: 0.17%

- Domestic Institutions: 42.18%

- Public: 54.37%

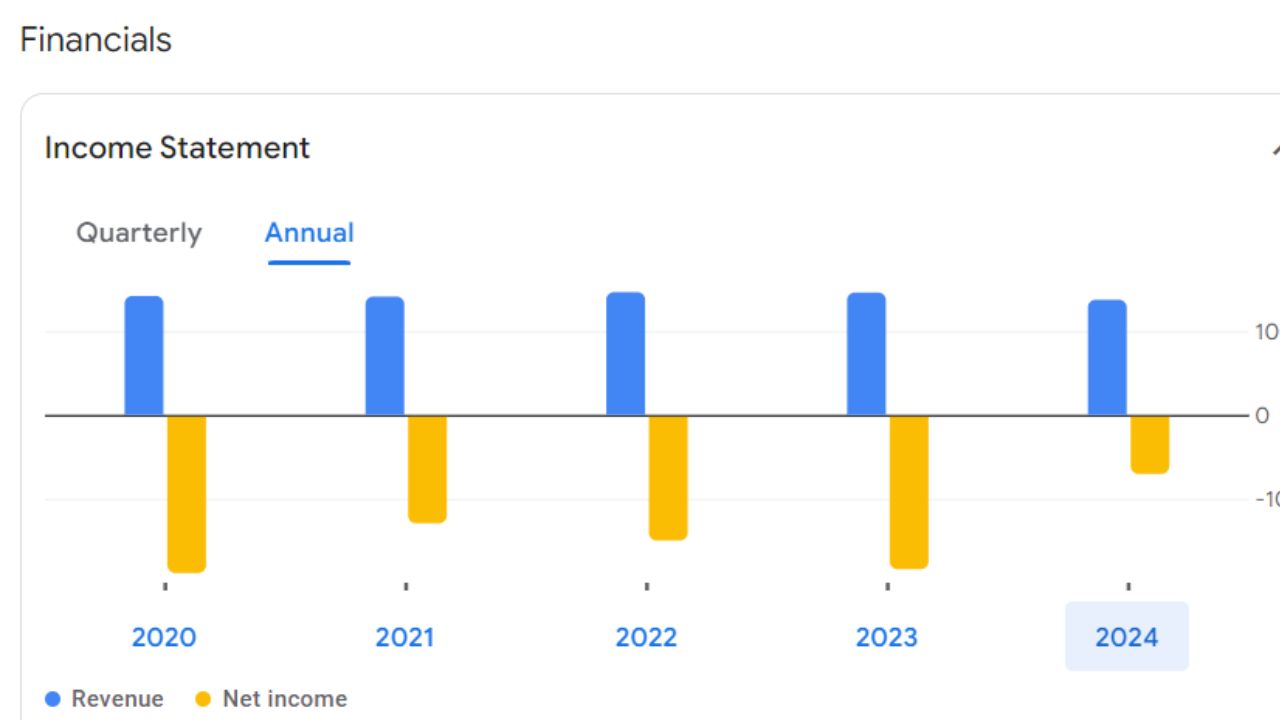

GTL Share Price For Annual Income Statement

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 3.32 B | -5.79% |

| Operating Expenses | 818.10 M | -18.59% |

| Net Income | -2.02 B | -97.13 % |

| Net Profit Margin | -60.82 | -109.22% |

| Earning Per Share | N/A | N/A |

| EBITDA | 921.68 M | -47.00% |

| Effective Tax Rate | N/A | N/A |

GTL Share Price Strategic Initiatives

- Focus on Debt Management: Implementing strategies to streamline operations and reduce debt levels.

- Investment in Technology: Allocating resources towards advanced telecom technologies to enhance service quality.

- Operational Efficiency: Emphasizing automation and process improvements to boost productivity.

- Market Positioning: Aiming to strengthen competitive advantage in the telecom infrastructure sector.

- Long-term Value Creation: Strategic initiatives designed for sustainable growth and shareholder value enhancement.