GSK Pharma is an Indian leading pharmaceutical company. GSK Pharma Share Price on NSE as of 10 September 2024 is 2,822.80 INR. On this page, you will find GSK Pharma Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as GlaxoSmithKline share price screener, Gsk pharma Share bonus history, GlaxoSmithKline share price NSE dividend, GlaxoSmithKline share price NSE Chart, GlaxoSmithKline share price NSE, and more Information.

GlaxoSmithKline Pharmaceuticals Limited Company Details

GlaxoSmithKline Pharmaceuticals Limited, commonly known as GSK, is a leading pharmaceutical company in India. It is part of the global healthcare company GlaxoSmithKline, known for its focus on producing medicines, vaccines, and healthcare products. GSK India is recognized for providing a wide range of treatments for diseases such as respiratory illnesses, infections, and chronic conditions.

With a strong emphasis on research and innovation, GSK aims to improve public health by offering affordable, high-quality medicines. The company’s commitment to advancing healthcare has made it a trusted name in the Indian pharmaceutical industry.

| Official Website | india-pharma.gsk.com |

| Founded | 13 November 1924 |

| Headquarters |

Mumbai, Maharashtra, India

|

| Number of employees | 3,211 (2024) |

| Parent organization | GSK plc |

| Category | Share Price |

Current Market Overview Of GSK Pharma Share Price

- Open: ₹2,878.00

- High: ₹2,891.70

- Low: ₹2,826.80

- Market Cap: ₹47.94K Crores

- P/E Ratio: 74.91

- Dividend Yield: 1.13%

- 52-Week High: ₹3,088.00

- 52-Week Low: ₹1,385.05

- Current Price: ₹2,822.80

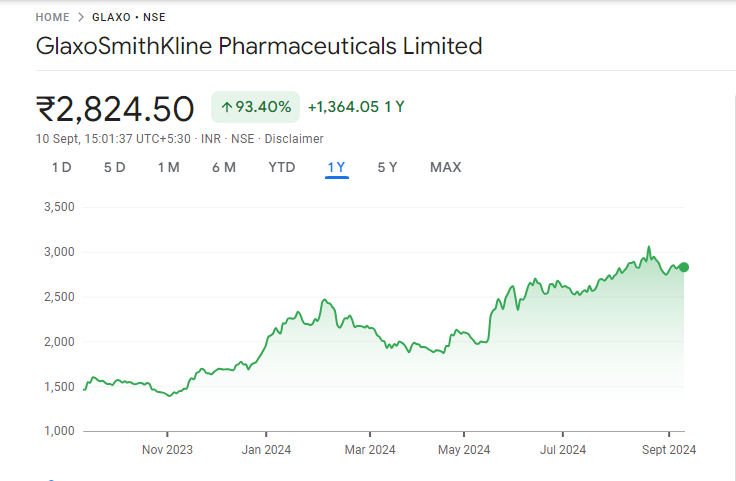

GSK Pharma Share Price Today Chart

GSK Pharma Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of GSK Pharma for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No | GSK Pharma Share Price Target Years | SHARE PRICE TARGET |

| 1 | GSK Pharma Share Price Target 2024 | ₹3315 |

| 2 | GSK Pharma Share Price Target 2025 | ₹4710 |

| 3 | GSK Pharma Share Price Target 2026 | ₹5080 |

| 4 | GSK Pharma Share Price Target 2027 | ₹6455 |

| 5 | GSK Pharma Share Price Target 2028 | ₹7860 |

| 6 | GSK Pharma Share Price Target 2029 | ₹8125 |

| 7 | GSK Pharma Share Price Target 2030 | ₹9456 |

Read Also:- Mangalam Cement Share Price Target 2024, 2025 To 2030

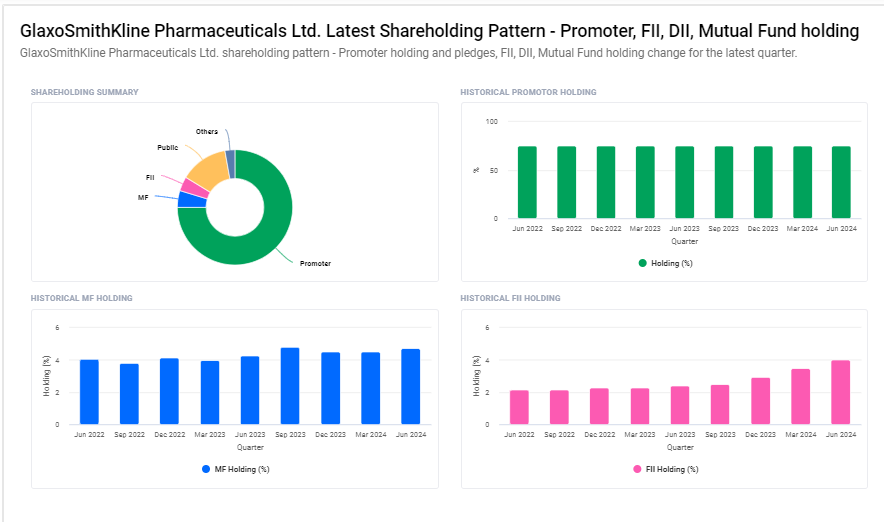

GlaxoSmithKline Pharmaceuticals Limited Shareholding Pattern

- Promoters: 60.76%

- Retail and Others: 16.07%

- Foreign Institutions: 11.94%

- Other Domestic Institutions: 4.85%

- Mutual Funds: 4.38%

Key Factors Affecting GSK Pharma Share Price Growth

Here are five key factors that can affect GSK Pharma’s share price growth:

- New Drug Approvals: GSK Pharma’s share price can rise when the company successfully develops and receives approval for new medicines or vaccines, as these products drive revenue growth.

- Research and Development: GSK’s investment in research and development (R&D) plays a key role in its future growth. Breakthrough innovations in treatments can attract investor confidence and boost the stock price.

- Market Demand for Healthcare: Increasing demand for healthcare products and medicines, especially for chronic conditions like asthma or diabetes, positively impacts GSK Pharma’s sales and share price.

- Regulatory Changes: Government policies and regulations related to drug pricing, patents, and healthcare can influence GSK’s profitability. Favorable regulations can support share price growth, while stricter ones may pose challenges.

-

Global Economic Conditions: As GSK operates internationally, global economic trends can impact its performance. A strong global economy boosts healthcare spending, leading to higher sales and potential stock price growth.

Risks and Challenges to GSK Pharma Share Price

Here are five risks and challenges that could affect GSK Pharma’s share price:

- Regulatory Hurdles: Stricter government regulations or delays in drug approvals can slow down product launches and impact GSK’s revenue, potentially leading to a decline in its share price.

- Patent Expiry: When patents for key medicines expire, GSK faces competition from generic drug manufacturers, which can reduce its market share and negatively affect its stock price.

- Product Recalls: If any of GSK’s products are found to have safety issues, the company may face product recalls, legal liabilities, and damage to its reputation, which could hurt investor confidence and the share price.

- Rising Competition: The pharmaceutical industry is highly competitive. Increased competition from other pharmaceutical companies or new entrants can limit GSK’s market growth and put pressure on its stock price.

-

Economic Slowdowns: Economic downturns, both in India and globally, can reduce healthcare spending, impacting GSK’s sales and profits, which may result in a fall in its share price.

Read Also:-

- Axita Cotton Share Price Target

- HFCL Share Price Target

- GMR Power Share Price Target

- Nestle India Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.