GMR Power and Urban Infra Ltd is an Indian company focused on developing power generation and urban infrastructure. GMR Power Share Price on NSE as of 5 September 2024 is 143.65 INR. On this page, you will find GMR Power Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as GMR Power News, GMR Power and Urban Infra Limited News today, GMR Power and Urban Infra Limited share price target, GMR Power share price target tomorrow, Gmr power share price target 2030, and more Information.

GMR Power and Urban Infra Ltd Company Details

GMR Power and Urban Infra Ltd is an Indian company focused on developing power generation and urban infrastructure. They are involved in managing power plants, providing energy solutions, and working on projects related to urban development and infrastructure. The company aims to enhance city living through efficient energy solutions and modern infrastructure, contributing to economic growth and improved quality of life.

| Official Website | gmrpui.com |

| Founded | 2019 |

| Headquarters | India |

| Number of employees | 863 (2024) |

| Parent organization | GMR Group |

| Subsidiaries | GMR Energy Limited, GMR Coal Resources Pte. Ltd. |

| Category | Share Price |

Current Market Overview Of GMR Power Share Price

- Open Price: ₹149.71

- High Price: ₹154.53

- Low Price: ₹141.40

- Current Price: ₹143.65

- Market Capitalization: ₹10.25K Crores

- P/E Ratio: 7.27

- Dividend Yield: Not Applicable

- 52-Week High: ₹154.53

- 52-Week Low: ₹29.70

GMR Power Share Price Today Chart

Read Also:- Udaipur Cement Share Price Target 2024, 2025 to 2030 Prediction

GMR Power Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of GMR Power for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | GMR Power Share Price Target Years | SHARE PRICE TARGET |

| 1 | GMR Power Share Price Target 2024 | ₹160 |

| 2 | GMR Power Share Price Target 2025 | ₹180 |

| 3 | GMR Power Share Price Target 2026 | ₹191 |

| 4 | GMR Power Share Price Target 2027 | ₹103 |

| 5 | GMR Power Share Price Target 2028 | ₹212 |

| 6 | GMR Power Share Price Target 2029 | ₹228 |

| 7 | GMR Power Share Price Target 2030 | ₹242 |

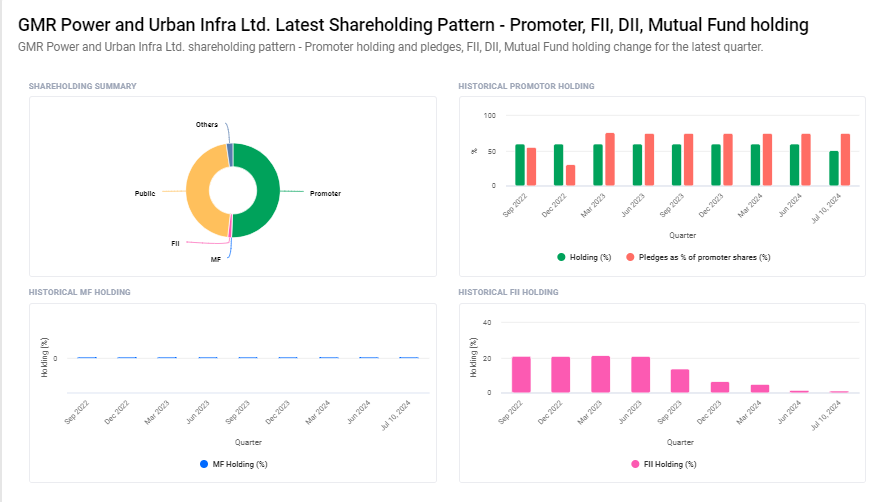

GMR Power and Urban Infra Ltd Shareholding Pattern

- Promoters: 50.50%

- Retail and Others: 45.91%

- Other Domestic Institutions: 2.29%

- Foreign Institutions: 1.28%

Key Factors Affecting GMR Power Share Price Growth

Here are seven key factors that can influence the growth of GMR Power’s share price:

- Energy Demand: The demand for power and energy directly affects GMR Power’s revenue. Higher energy consumption in various sectors can boost the company’s performance and share price.

- Regulatory Environment: Government policies and regulations related to the energy sector can impact GMR Power’s operations. Supportive regulations and incentives can enhance growth, while stringent regulations might pose challenges.

- Power Plant Efficiency: The efficiency and performance of GMR Power’s energy plants play a crucial role. Well-maintained and high-performing plants can lead to increased production and profits, positively influencing the share price.

- Infrastructure Projects: GMR Power’s involvement in urban infrastructure projects can contribute to its growth. Successful completion of these projects and their impact on urban development can enhance investor confidence and support share price growth.

- Economic Conditions: Overall economic health affects energy consumption and infrastructure investments. A strong economy typically leads to a higher demand for power and infrastructure, benefiting GMR Power.

- Market Competition: The competitive landscape in the power and infrastructure sectors can influence GMR Power’s market position. Effective strategies to stay ahead of competitors can positively impact the share price.

-

Financial Performance: GMR Power’s financial results, including revenue, profit margins, and debt levels, are crucial. Strong financial health and consistent performance can attract investors and lead to share price growth.

Read Also:-

- Apollo Hospitals Share Price Target

- Indus Towers Share Price Target

- Rama Steel Share Price Target

- NMDC Steel Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.