Federal Bank Limited, based in Aluva, Kerala, is a prominent private-sector bank in India. With over 1,500 branches and more than 2,000 ATMs across the country, it offers extensive banking services. The bank also has a global presence with representative offices in Abu Dhabi and Dubai, making it well-equipped to serve both domestic and international customers.

Federal Bank Share Price on NSE as of 2 September 2024 is 195.00 INR. On this page, you will find Federal Bank Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Federal Bank share price target tomorrow moneycontrol, Federal Bank share News today, Federal Bank share price target next Week, Federal Bank share price target tomorrow, and more Information.

Federal Bank Ltd Information

Federal Bank Ltd is a major private sector bank in India, known for its extensive network of branches and ATMs across the country. Headquartered in Aluva, Kerala, the bank offers a wide range of banking and financial services, including retail and corporate banking, loans, deposits, and investment services. With a focus on customer satisfaction and technological innovation, Federal Bank has built a strong reputation for reliability and efficiency in the Indian banking sector.

| Official Website | federalbank.co.in |

| CEO | Shyam Srinivasan (23 Sept 2010–) |

| Founded | 23 April 1931, Nedumpuram |

| Founder | K. P. Hormis |

| Headquarters | Aluva, Kochi, Kerala, India |

| Number of employees | 14,908 (2024) |

| Category | Share Price |

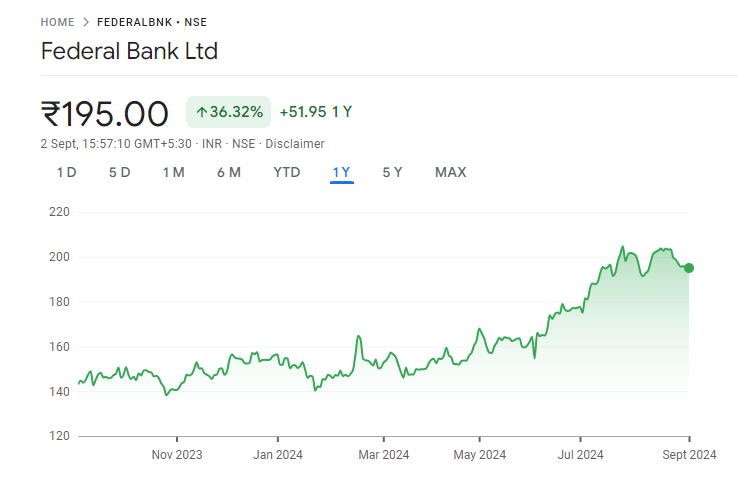

Current Market Overview Of Federal Bank Share Price

- Open – Rs 197.50

- High – Rs 197.50

- Low – Rs 193.67

- Current – Rs 195.00

- Mkt cap – Rs 47.65KCr

- P/E ratio – 11.74

- Div yield – 0.62%

- 52-wk high – Rs 206.59

- 52-wk low – Rs 137.25

Federal Bank Share Price Recent Graph

Read Also:- Delhivery Share Price Target 2024, 2025 To 2030 And More Details

Federal Bank Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Federal Bank for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Federal Bank Share Price Target Years | Federal Bank Share Price |

| 1 | Federal Bank Share Price Target 2024 | Rs 220 |

| 2 | Federal Bank Share Price Target 2025 | Rs 295 |

| 3 | Federal Bank Share Price Target 2026 | Rs 356 |

| 4 | Federal Bank Share Price Target 2027 | Rs 405 |

| 5 | Federal Bank Share Price Target 2028 | Rs 470 |

| 6 | Federal Bank Share Price Target 2029 | Rs 525 |

| 7 | Federal Bank Share Price Target 2030 | Rs 598 |

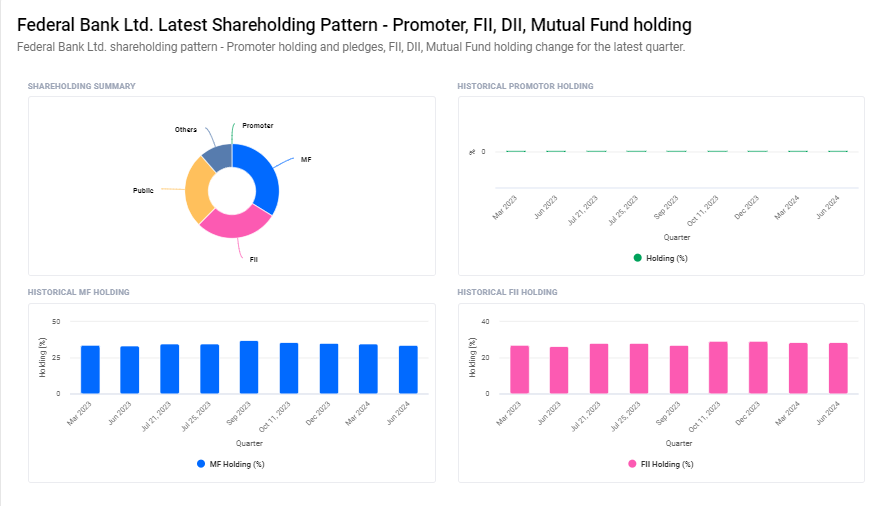

Shareholding Pattern For Federal Bank

- Promoters: 0%

- Foreign Institutions: 28.6%

- Public: 26.2%

- Domestic Institutions: 26.2%

FEDERAL BANK: NSE Financials 2023

| Revenue | 94.74 Billion INR | ⬆ 30.89% YOY |

| Operating expense | 52.11 Billion INR | ⬆ 13.48% YOY |

| Net Income | 31.65 Billion INR | ⬆ 60.66% YOY |

| Net Profit Margin | 33.40 | ⬆ 22.75% YOY |

| Earnings Per Share | 14.13 | ⬆ 55.96% |

| EBITDA |

|

|

| Effective Tax Rate | 25.30% |

|

| Total Assets | 2.68 Trillion INR | ⬆ 18.46% YOY |

| Total Liabilities | 2.46 Trillion INR | ⬆ 18.80% YOY |

| Total Equity | 224.74 Billion INR | |

| Return on assets | 1.30% | |

| Return on Capital |

|

|

| P/E Ratio |

|

|

| Dividend Yield |

|

Factors Affecting Federal Bank Share Price Growth

Here are six factors that can affect Federal Bank’s share price growth:

- Economic Conditions: The overall health of the economy plays a significant role. Positive economic growth and low inflation can boost investor confidence, leading to higher share prices. Conversely, economic downturns or recessions can have the opposite effect.

- Bank Performance: Key financial metrics like profit margins, revenue growth, and loan performance directly impact the bank’s share price. Strong earnings reports and effective management of non-performing assets can drive the share price up.

- Interest Rates: Changes in interest rates set by the Reserve Bank of India (RBI) can influence Federal Bank’s profitability. Higher interest rates can increase net interest margins, while lower rates might compress margins, affecting the share price.

- Regulatory Changes: New regulations or changes in banking laws can impact the bank’s operations and profitability. Compliance costs or restrictions may influence investor sentiment and share price.

- Market Sentiment: Investor perception and market trends can also affect share prices. Positive news about the banking sector or Federal Bank’s strategic initiatives can lead to price increases, while negative news can have the opposite effect.

-

Competitive Landscape: The performance and strategies of other banks in the sector can impact Federal Bank’s market position. Innovations, customer service improvements, or mergers and acquisitions by competitors can influence Federal Bank’s share price.

Read Also:-

- Radico Khaitan Share Price Target

- Bajaj Auto Share Price Target

- ZYDUS Share Price Target

- Igarashi Motors Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.