Exide Industries Ltd is a leading Indian company known for manufacturing batteries and energy storage solutions. Exide Industries Share Price on NSE as of 17 September 2024 is 482.15 INR. On this page, you will find Exide Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Exide share News today, Why Exide share is falling, Exide share price target tomorrow, Exide share price target 2030, Exide share price target 2040, and more Information.

Exide Industries Ltd Company Details

Exide Industries Ltd is a leading Indian company known for manufacturing batteries and energy storage solutions. It produces a wide range of batteries for automotive, industrial, and home use, including for vehicles, inverters, and solar energy systems. With a strong presence in both domestic and international markets, Exide is recognized for its reliable and high-quality products. The company also focuses on innovation and sustainable energy solutions, contributing to its growth and leadership in the battery industry.

| Official Website | exideindustries.com |

| CEO | Avik Kumar Roy (1 May 2024–) |

| Founded | 1947 |

| Headquarters | Exide House, Kolkata, West Bengal, India |

| Number of employees | 5,151 (2024) |

| Category | Share Price |

Current Market Overview Of Exide Share Price

- Opening Price: INR 493.10

- Day’s High: INR 493.10

- Day’s Low: INR 482.00

- Current Price: INR 482.15

- Market Capitalization: INR 41.00K Crore

- P/E Ratio: 46.88

- Dividend Yield: 0.41%

- 52-Week High: INR 620.35

- 52-Week Low: INR 241.70

Exide Share Price Today Chart

Read Also:- NCC Share Price Target 2024, 2025, 2026, to 2030 and Full Details

Exide Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Exide for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Exide Share Price Target Years | SHARE PRICE TARGET |

| 1 | Exide Share Price Target 2024 | ₹730 |

| 2 | Exide Share Price Target 2025 | ₹1082 |

| 3 | Exide Share Price Target 2026 | ₹1242 |

| 4 | Exide Share Price Target 2027 | ₹1425 |

| 5 | Exide Share Price Target 2028 | ₹1629 |

| 6 | Exide Share Price Target 2029 | ₹1865 |

| 7 | Exide Share Price Target 2030 | ₹2131 |

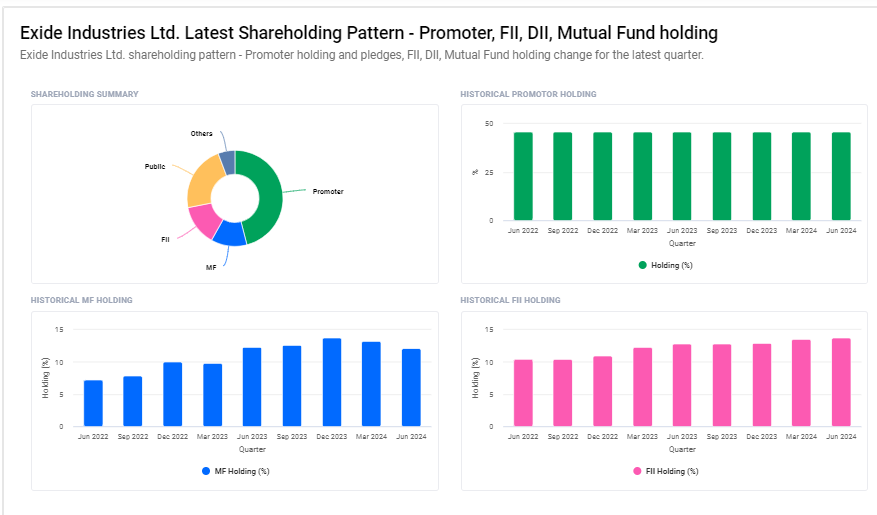

Exide Industries Ltd Shareholding Pattern

- Promoter: 46%

- FII: 13.7%

- DII: 17.9%

- Public: 22.4%

Key Factors Affecting Exide Share Price Growth

Here are five key factors affecting Exide Industries Ltd’s share price growth:

- Demand for Automotive Batteries: Exide’s growth heavily relies on the demand for automotive batteries, as it is a key supplier to both original equipment manufacturers (OEMs) and the replacement market. A rise in vehicle sales, particularly in the electric vehicle (EV) segment, can boost demand for Exide’s products. As the automotive industry expands, Exide’s revenue increases, positively influencing its share price.

- Growth in Renewable Energy and Solar Storage: The increasing focus on renewable energy and the use of solar power systems drive demand for energy storage solutions. Exide, being a major player in the solar battery segment, stands to benefit from this trend. As more households and businesses adopt solar energy, Exide’s market share and revenue grow, which can lead to share price appreciation.

- Technological Advancements in Battery Solutions: Innovation in battery technology, such as developing more efficient, long-lasting, and eco-friendly batteries, plays a crucial role in Exide’s competitive edge. By investing in research and development, the company can offer advanced products that cater to changing consumer and industry needs. This technological progress can enhance Exide’s reputation, drive sales, and lead to higher investor confidence, thereby pushing the share price upward.

- Expansion into Electric Vehicle (EV) Batteries: As the global automotive industry shifts towards electric vehicles, Exide’s success in capturing a significant share of the EV battery market can be a game changer. The company’s ability to meet the growing demand for lithium-ion and other EV battery technologies could open new revenue streams. A successful expansion into this high-potential sector would likely boost long-term growth prospects, positively affecting the stock price.

-

Cost of Raw Materials and Input Prices: Exide’s profitability is influenced by the cost of raw materials like lead, which is a major component in battery production. Fluctuations in the price of lead or other essential materials can impact production costs and profit margins. If Exide manages to control costs effectively or find alternative materials, it could protect profitability, boosting the share price. On the other hand, a rise in raw material costs without corresponding price adjustments could challenge growth.

Read Also:-

- Infibeam Avenues Share Price Target

- Salasar Share Price Target

- Piramal Pharma Share Price Target

- Suzlon Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.