Everest Kanto Cylinder Ltd is a leading manufacturer of high-pressure gas cylinders, catering to industries like oil and gas, automotive, and firefighting. EKC Share Price on NSE as of 19 September 2024 is 207.06 INR. On this page, you will find EKC Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as EKC News Today, EKC Share News Today, EKC Share Price Target Tomorrow, EKC Share Price Target 2030, and more Information.

Everest Kanto Cylinder Ltd Company Details

Everest Kanto Cylinder Ltd is a leading manufacturer of high-pressure gas cylinders, catering to industries like oil and gas, automotive, and firefighting. The company, based in India, specializes in producing cylinders used for storing compressed natural gas (CNG) and other industrial gases. With a strong global presence, Everest Kanto is known for its quality products and innovative solutions, helping industries with safe and efficient gas storage. Their commitment to safety standards and technological advancements has earned them a reputable position in the market.

| Official Website | everestkanto.com |

| Founded | 1978 |

| Headquarters | India |

| Number of employees | 659 (2024) |

| Subsidiaries | EKC International FZE, CP Industries Holdings, Inc. |

| Category | Share Price |

Current Market Overview EKC Share Price

- Open Price: ₹206.80

- High Price: ₹208.86

- Low Price: ₹205.42

- Market Capitalization: ₹2.33K Cr

- P/E Ratio: 22.06

- Dividend Yield: 0.34%

- 52-Week High: ₹217.43

- 52-Week Low: ₹108.35

- Current Share Price: ₹207.06

EKC Share Price Today Chart

Read Also:- Salasar Share Price Target 2024, 2025 To 2030 and More Details

EKC Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of EKC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | EKC Share Price Target Years | Share Price Target |

| 1 | EKC Share Price Target 2024 | ₹250 |

| 2 | EKC Share Price Target 2025 | ₹290 |

| 3 | EKC Share Price Target 2026 | ₹333 |

| 4 | EKC Share Price Target 2027 | ₹378 |

| 5 | EKC Share Price Target 2028 | ₹435 |

| 6 | EKC Share Price Target 2029 | ₹498 |

| 7 | EKC Share Price Target 2030 | ₹570 |

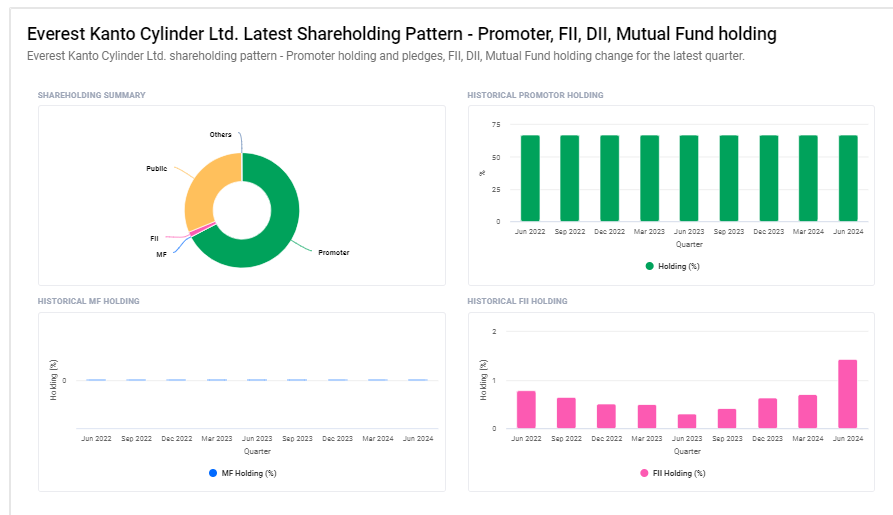

Everest Kanto Cylinder Ltd Shareholding Pattern

- Promoters: 67.39%

- Retail and Others: 31.10%

- Foreign Institutions: 1.43%

- Other Domestic Institutions: 0.08%

Key Factors Affecting EKC Share Price Growth

Here are six key factors that can affect Everest Kanto Cylinder (EKC) share price growth:

- Demand for Gas Cylinders: EKC’s share price is highly influenced by the demand for high-pressure gas cylinders, especially in sectors like automotive (for CNG vehicles) and industrial gas. Growing demand can positively impact its stock.

- Government Policies and Incentives: Supportive government policies for clean energy, such as CNG adoption and regulations on gas safety standards, can enhance EKC’s business, driving share price growth.

- Raw Material Costs: The cost of raw materials, such as steel, can significantly impact EKC’s profitability. Lower material costs help improve margins, which could lead to share price growth.

- Technological Advancements: EKC’s ability to innovate and introduce advanced cylinder technology, such as lightweight or more durable cylinders, can improve its competitive edge, positively influencing its stock performance.

- Expansion into New Markets: Expansion into new geographic or industrial markets can boost revenue streams. For instance, tapping into emerging markets for CNG infrastructure could fuel share price growth.

-

Economic Conditions: The overall economic health of the regions where EKC operates can impact its performance. A strong economy often leads to higher industrial activity, boosting demand for gas cylinders and potentially driving up the share price.

Read Also:-

- Infosys Share Price Target

- Tata Motors Share Price Target

- NCC Share Price Target

- Suzlon Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.